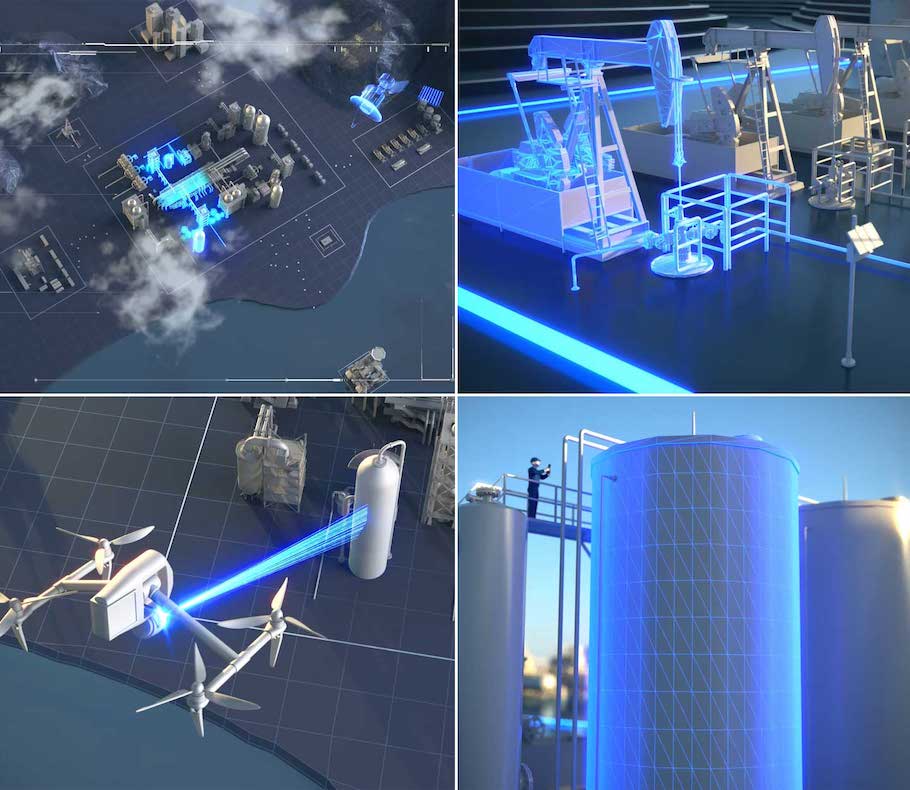

Continuous methane monitoring at a gas processing plant. (Source: Schlumberger)

Schlumberger announced March 8 the launch of Schlumberger End-to-end Emissions Solutions (SEES). The business offers a comprehensive set of services and cutting-edge technologies designed to give operators a robust and scalable solution for measuring, monitoring, reporting and ultimately, eliminating methane and routine flare emissions from their operations.

According to Schlumberger, SEES delivers a holistic approach to enable operators to develop a successful methane emissions elimination strategy from the outset. The approach builds on three pillars—plan, measure, and act—that are all underpinned by the industry’s first methane emissions digital platform, accessible in the DELFI cognitive E&P environment, to provide a comprehensive and differentiated path for operators to achieve their decarbonization objectives:

- Plan: Schlumberger screens a wide array of measurement and abatement solutions to identify the most cost-effective technology mix for any operator’s specific assets.

- Measure: Schlumberger uniquely provides operators access to the full range of curated, best-in-class third party and in-house solutions, after rigorous evaluation of 97 methane measurement technologies.

- Act: Though other service providers can inform an operator where emissions are occurring, Schlumberger—through its end-to-end offering—first finds the emissions and then takes remedial action to eliminate them.

In addition, robust data and a digital foundation will enable customers to have a secure, reliable single place for integrating multi-source emissions data with advice, plans and insights.

Schlumberger Chief Technology Officer Demos Pafitis commented: “We have created SEES specifically to help our customers deal with one of the most pressing issues of climate change: the urgent need to cut methane emissions. Due to its potency as a GHG and its major share of the industry’s overall operational emissions, tackling methane emissions will make a significant impact.”

SEES combines Schlumberger’s measurement and planning experience with the ability to assess and implement emerging technology, foundational data, AI and digital capabilities, and the means to scale and deploy anywhere in the world.

Recommended Reading

ChampionX Completes Improvements to Odessa Chemical Hub

2024-11-18 - The Odessa chemical manufacturing facility in the Permian Basin will increase ChampionX’s capacity by almost 10%, or 10 million kilograms annually.

E&P Highlights: Nov. 11, 2024

2024-11-11 - Here’s a roundup of the latest E&P headlines, including Equinor’s acquisition of a stake in a major project and a collaboration between oilfield service companies.

Delivering Dividends Through Digital Technology

2024-12-30 - Increasing automation is creating a step change across the oil and gas life cycle.

E&P Highlights: Nov. 18, 2024

2024-11-18 - Here’s a roundup of the latest E&P headlines, including new discoveries in the North Sea and governmental appointments.

Water Management Called ‘Massive Headwind’ for Permian Operators

2024-11-21 - Amanda Brock, CEO of Aris Water Solutions, says multiple answers will be needed to solve the growing amounts of produced water generated by fracking.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.