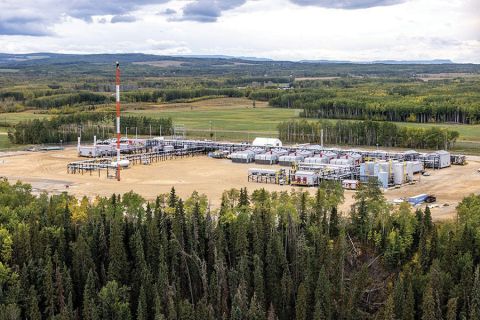

As U.S. shale companies use technology and better techniques to grow oil and gas production, improving economics remains an objective. (Source: Shutterstock.com)

HOUSTON—The U.S. shale industry gets an A-plus when it comes to growth, considering the rapid pace of barrels of oil being pumped from shale plays, but it fails in terms of returns of capital—something that frustrates investors.

That’s according to Bob Brackett, a senior analyst for Bernstein Research. Speaking in front of a standing-room-only crowd on opening day of the Unconventional Resources Technology Conference on July 23, Brackett gave the industry marks on a scorecard during an era dubbed the “Fracocene,” described as a time when oil and gas production in North America—characterized by long-lateral horizontal wells with massive hydraulic fractures—is strongly influencing the world’s energy economy.

“Growth is an A-plus. There is no asset on the planet growing oil faster. The U.S. is growing oil liquids year-over-year at a rate of 2 million barrels per day,” he said before handing out a grade of C-plus for discipline, which he said may be returning. Earlier he pointed out how the industry has emerged from a period of overinvestment. “We have behaved for the last six quarters. … This is a sector that lives within cash flow, gives some cash back to investors, earns a double-digit rate of return.”

But oil price continues to drive behavior with money typically not coming back to investors until after oil prices have risen, he added, noting some companies have fared better than others. The returns on capital are “fantastic” before costs such as D&A and taxes are factored into the equation.

Returns of capital may have received a failing grade on Brackett’s scorecard, but there are some benefits, according to Scott Tinker, director of the University of Texas at Austin’s Bureau of Economic Geology. He pointed out jobs created and how natural gas brought down electricity costs and led to a near 20% drop in CO2 emissions as its share of the power generation fuel mix grew to match that of coal.

“The production economics are poor but they come with benefits,” Tinker said.

Their words were spoken as oil and gas companies roll out second-quarter earnings reports following a market downturn that ushered in more efficient ways of operating, streamlined portfolios and a stronger focus on technology. Shale players have optimized completion designs, drilled laterals that surpass 15,000 ft, tweaked spacing and boosted proppant loads in an effort to get more from wells and add value.

Improving earnings remains at an objective for many.

Fellow panelist Vicki Hollub, president and CEO of Occidental Petroleum Corp. (NYSE: OXY), recalled a meeting during which someone called U.S. shale plays the equivalent of a Ponzi scheme for the oil and gas business. “He said that because he wasn’t seeing earnings coming from any of the shale companies,” Hollub said.

For Occidental, making shale plays economic goes back to successfully using R&D, according to Hollub. The company started its data analytics team a few years ago and initially tackled how to reduce the trial and error process involved with formulating frack and completion designs.

“If you can minimize the trial and error process to maximize your understanding of the data and which parameters really matter … that’s a great way to start to get ourselves on track to faster earnings. We created that dynamic with this team,” Hollub said.

Having transitioned from an exploration-focused company to M&A—chopping the number of countries in which it operates from 28 to about six, organic growth is where focus currently lies for Occidental. Technologies such as those involving data analytics and the economical sequestration of CO2 from both conventional and unconventional reservoirs are among the areas receiving attention.

“We have the capacity available to sequester significant volumes of CO2 going forward,” Hollub said. The move could not only help lower emissions but also increase the company’s production.

In June, Occidental announced a partnership with White Energy to study the economic feasibility of capturing CO2 to use in EOR operations as part of a carbon capture, utilization and storage project. The project would involve capturing CO2 from White Energy’s ethanol facilities in Hereford and Plainview, Texas, and taking it to the Permian Basin where Occidental would use it for EOR.

Occidental has already conducted four CO2 injection pilot projects on its unconventional acreage in the Permian Basin and deemed them technically successful, Hollub told conference attendees. Hopes are that it will help double recovery from the shale play.

The company also sees data analytics opportunities in essentially every task it does, she said. But key to it all is subsurface knowledge.

“If you don’t get the subsurface right you’re never going to get the chance to maximize what you have,” she said. “That’s where it all starts. We’re trying to optimize as we go.”

The company expects its Permian resources’ production to double that of last year’s level, enough to boost the company’s overall production by 10%.

But panelists and others seemed to agree that the industry’s recovery rate for shale plays needs a boost.

“Right now we are only getting 10% of the resource out of the ground in unconventional oil operations,” said Steve Winberg, assistant secretary for the U.S. Department of Energy’s Office of Fossil Energy. “If we could increase that to 20% by using big data and machine learning, that would be a huge win. It would be another shale oil and gas revolution.”

Improving recovery from unconventional reservoirs, big data and machine learning, improving well integrity, seismic imaging and understanding variables in shale reservoirs are among the projects the federal government is undertaking, he said.

Brackett gave the industry an “incomplete” for technology, saying “the most obvious, easy stuff” such as expanded lateral length and increased sand per foot has been done.

Looking at the Permian alone, he said the industry still has a lot of running room.

“The three-dimensional stacked pay of the Permian is fantastic but what is beyond the Permian?” he asked. “Will enhanced oil recovery get us another 10%? Will we find other emerging resource plays? Will we ever take this technology abroad?”

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

Sliding Oil Prices Could Prompt Permian E&Ps to Cut Capex

2024-12-03 - A reduction in the rig count would also slow the growth of natural gas output from the region, benefitting gassy Gulf Coast players, according to Enverus.

E&P Highlights: Dec. 2, 2024

2024-12-02 - Here’s a roundup of the latest E&P headlines, including production updates and major offshore contracts.

Exxon Plans Longest 20,000-Ft Wells on Pioneer’s Midland Asset

2024-11-04 - Exxon Mobil has already drilled some of the longest wells in the New Mexico Delaware Basin. Now, the Texas-based supermajor looks to go longer on Pioneer’s Midland Basin asset.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.