As the second growth cycle of the resource-play era accelerates, equity analysts are taking note of small-cap producers that are applying best practices from the big shale plays to other areas. In several cases they have initiated coverage.

Analysts strongly favor producers of every size that have either proximity to refining and export outlets, or at least, firm and secure transportation. Differentials in areas that do not have adequate takeaway are starting to hit bottom lines. Most broadly, the emphasis is on leadership teams that can execute. In that, equity analysts sound not unlike managers in private equity.

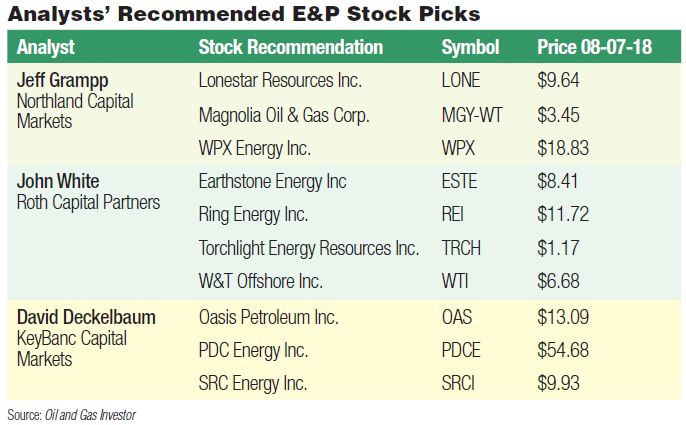

Northland Capital Markets initiated coverage early in July on a special-purpose acquisition company (SPAC) called TPG Pace Energy, but now going by the name Magnolia Oil & Gas Corp. “It has a healthy degree of cash flow from its position in the Eagle Ford,” said Jeff Grampp, managing director and senior research analyst.

First-quarter production for the company this year was 45,700 barrels of oil equivalent per day (boe/d). Grampp likes the Eagle Ford as compared to the Permian Basin, which gets much more attention. “It is a mature basin that is close to the Gulf Coast [for refining or export], and Magnolia has done a good job securing transportation.”

In his initial note, he wrote, “We believe [Magnolia’s] assets in South Texas near Gulf Coast oil demand centers, including export facilities, provide a significant advantage over peers in other geographies such as the Permian Basin, where wide basis differentials are currently negatively impacting operators.

“With most producers in the U.S. trying to find ways to get to the Gulf Coast, TPGE is geographically positioned well to maintain strong pricing realizations. We believe [near] Gulf Coast barrels such as TPGE’s will continue to garner a premium relative to landlocked U.S. basins (Permian, Williston, D-J, Stack, etc.), where we expect operators to continue to try paying their way to the Gulf, or face pricing their barrels at discounted WTI hubs.”

From that sound foundation, Grampp likes the technical advantages that Magnolia brings to its Austin Chalk position. He is not the least deterred that the Austin Chalk has been out of favor for some time.

“Magnolia is finding new ways to find oil in that formation,” he said. “The previous approach was to seek natural fractures. That was leading to wells with high initial production rates followed by quick depletion. Magnolia is introducing modern fracturing technology. It is taking its Eagle Ford success into the Austin Chalk.”

Even with good rocks and sound technology, “management is paramount,” said Grampp, “especially in a small company. As you go up cap there can be other factors, but in a small cap the management is very much the captain of ship. Even if the assets make all the sense in the world, that does not mean anything if management cannot execute.”

The evolution from SPAC to operating company is an obvious catalyst, but is not a common situation and so, not without its technical risks. “How do you value a company that does not, technically, have any assets?” Grampp asked rhetorically. That said, he and his colleagues are always alert to catalysts, including entry to a new basin, new management or a new situation on a producer’s balance sheet.

Bullish on oil

On the macro view, Grampp noted that his assumptions for West Texas Intermediate have gone from $55 to $60 per barrel (bbl). “We are constructive on oil demand. We have not reached a price that would deter demand growth, and we like that OPEC and its partners in Russia are addressing demand as well. We don’t want to see that sugar rush of oil prices rising too far too fast. We like that OPEC is playing ball.”

That said, there is concern about the number of potentially negative variables, including the accelerating deterioration of Venezuela, the geopolitical struggle over Iranian exports and the domestic stability of Libya. “Domestically we are concerned about Permian differentials in the near term,” said Grampp. “For that reason, we feel better about producers that have secured transportation.”

Staying in the Eagle Ford, Grampp also likes Lonestar Resources Inc., a pure-play producer there. “We think they are poised for a step change. They have good acreage that last year was masked by underperformance on production. However, that was mostly a matter of delays from service companies. Last year was a turn year for Lonestar. They made an acquisition that provided them with the scale to get the attention of the service companies. First-quarter numbers were very good, and second-quarter numbers are looking strong.”

Grampp notes that Lonestar has already had something of a rally because, “people are looking for oily names outside of the Permian.”

Within that top hot basin, Grampp likes WPX Energy Inc. “They have a blocky, high-quality position,” he said. “They were a year or two ahead of a lot of people on some of their acquisitions, and they got some pushback on the prices that they paid at the time, but now they are looking pretty smart. WPX also has a legacy Williston Basin position that is another good source of oily development.”

Maintaining that eye on transportation, Grampp added that WPX “has its takeaway secured and built out midstream assets. They have monetized a portion of their midstream assets, and could do the same with others parts, perhaps next year. We like that security. We like the rock in the Permian too; we just don’t know about delivery in general from there.”

Small-cap vibes

In mid-June, John White, managing director and senior research analyst at Roth Capital Partners, initiated coverage of Torchlight Energy Inc. with a Buy rating. Torchlight is bringing horizontal development to the Orogrande Basin of far west Texas, west of the Delaware. White joined Roth in the middle of 2014, just a few months before the price of oil collapsed. “It was an easy decision then to focus exclusively on the Permian and on management teams with proven track records,” he recalls.

White, who follows small-cap upstream independents, is the only analyst following several of them. It is notable that for small-cap equities, some of the investment criteria are similar to those that private-equity managers use, especially the track record of the management team’s experience in the play.

An important differentiation as opposed to mid-size or large-cap independents is that there is less expectation that small caps will live within cash flow. In fact, it’s quite the opposite: the expectation for small caps is that they will have to invest beyond their immediate means.

“Small companies can’t grow without outspending cash flow,” said White. “The only way they are going to grow organically and through acquisition is to outspend cash flow.”

He notes another similarity between small caps and the private-equity world: the exit strategy.

“All of the companies we have worked with definitely have the aspiration to be mid-caps,” said White. “Management teams will entertain a sale of the entire company at any point, provided the terms are favorable. But they feel the need to grow to mid-size for the best valuation for a sale.” Even if there is not a sale, after achieving mid-size status, valuations are generally more favorable.

Small caps also have some advantages, White explained. “Large- and mid-cap producers have recently come under pressure from institutional investors to spend within cash flow, and to plan or focus on dividends or share repurchases. Small caps can respond quickly to any divestitures that come from those larger companies rationalizing their operations.”

Small caps can also adjust their own operations more quickly. “The bigger guys are running six or 10 or 15 rigs, but the smaller ones, just two or three. They can easily change direction, or even slow the drilling program if necessary.”

The most surprising name on White’s list? W&T Offshore Inc. “The company really stands out in terms of management. Founder, chairman and CEO Tracy Krohn is committed with shareholders because he owns 33% of the stock. We found that very unusual for any E&P firm to have one senior executive own a third of the company. The CFO and COO are also very strong.”

White noted that W&T showed focus and discipline during the downturn. “They have very strong all-in finding-and-development costs [F&D] over three years of $11.37. They have made sound decisions and have properties of quality. The only reason we rate the stock neutral is because there will be some refinancing late in the third quarter or early in the fourth. We want to see how those unfold and then we will revisit the rating and our targets.”

It is common for private equity to back an operating management team through development and sale, then re-up with the same team. White said that there is a similar pattern for Tim Rochford, founder of Ring Energy Inc., for which he has a Buy rating. “He previously founded Arena Energy, which was very successful in the Central Basin Platform of the Permian. With a small initial capital investment he sold Arena for $1.6 billion. It is a great story in value creation.”

Ring is also active on the Central Basin Platform. “The C-suite around Tim has expertise on the CBP, and also on acquisitions in the Permian,” said White. “The company conserved cash and protected its balance sheet during the downturn. In mid-2016, it started to get momentum bringing horizontal drilling to the San Andres Formation, which is not a shale, but a conventional dolomite reservoir with a long history of vertical production. Ring is the only public company drilling horizontally in the San Andres. It has a large acreage position and the development is going very well.”

Earthstone Energy Inc., another Buy, is active in the Midland Basin and also has a smaller presence in the Eagle Ford. “It started with the Bakken and Eagle Ford, and made small entries to the Midland leading up to the acquisition of Bold Energy last year. It sold its Bakken position and now focuses on the Midland Basin.”

White is drawn to Earthstone’s production growth rate. “From 2015 to today it increased production from 3,900 boe/d to the guidance for 2018 of 12,250 boe/d. That is an increase of 211%. That is why we like to focus on small caps. That is where you get that kind of growth. And 90% of its proven reserves are in the Midland Basin.”

Earthstone is also attractive on a relative value basis, White said. “On the metric of enterprise value over 2019 EBITDA, it currently trades at just 3.1x vs. the median of 6.2x of our Permian Basin peer group.”

Torchlight is an interesting operation on several levels, said White. Like Ring, it is bringing horizontal development to a basin that has only known vertical wells so far. The company is shining its torch light so far west in Texas that it is not even in the Permian any more. It is in the Orogrande Basin, which is separated from the Permian by the Diablo Platform. Torchlight has drilled two science wells into formations that were deposited at the same time as well-known Permian horizons.

In late July, Torchlight said it had made a discovery in the Orogrande Basin in far west Texas at its University Founders A25 #1 well. The 1,000-foot, proof-of-concept lateral was completed with a six-stage fracture in Pennsylvanian source rock. Sustained gas production ranged from 1 to 1.4 MMcf/d depending on choke size. Further testing and delineation will be necessary, but this could be the beginning of a new shale play west of the Delaware Basin, and a new future for the company.

While KeyBanc Capital Markets is a bottoms-up shop, David Deckelbaum, director of oil and gas equity research, was willing to provide a bit of macro perspective. Overall, the view is based on differing trends counter-balancing each other for a net consistent effect. “U.S. producers are outpacing expectations, but demand is running about 400,000 barrels a day ahead of most models. On the international level, OPEC has an accord to reduce their previous cutbacks.”

Taken together that sounds like additional supply ratcheting higher to keep pace with higher demand. But it’s not quite that simple. “When the U.S. is asking Saudi Arabia to tap into spare capacity, investors will start to question the availability of that spare capacity—at least any further spare capacity,” Deckelbaum noted dryly. “We have our own doubts about how much spare capacity there is, and how quickly that can be brought onto the market. The U.S. can now be considered a swing producer, but cannot be considered a swing rebalancer.”

Rockies names

Deckelbaum and his team take a bottoms-up approach, evaluating each name on its fundamentals with the idea that a clean balance sheet, strong leadership and good rock will survive in almost any business climate, and thrive in a high-demand situation.

In what might be something of a surprise, the first name from Deckelbaum is not a Permian producer, or even one in the Eagle Ford or Scoop-Stack. Rather it is SRC Energy Inc., formerly Synergy Resources, a pure play operating in Wattenberg Field in Colorado.

“Over the second half of this year the Wattenberg will get debottlenecked actively,” he noted. “Names that have been constrained by gathering, processing or transportation are going to be generally free of those limitations.”

Producers have had to manage around high line pressures, he explained, but now several processors are coming into the basin, including some private-equity-backed ones. He noted Discovery Midstream, Rimrock and Western Gas, among those entering or expanding.

SRC “has an immaculate balance sheet,” he added, “and is going to be able to generate free cash. Their compound annual growth rate out to 2019 is better than 30%. That ability to generate free cash and growth creates a dynamic case.”

Late last year, SRC closed a deal on the undeveloped leasehold and nonoperated producing properties related to the previously announced Greeley Crescent II Acquisition from Noble Energy Inc. Closing on some further Noble-operated production and related assets is expected later this year. The deal represents a double down for SRC, having acquired Greeley Crescent I from Noble in 2016.

Among widely known names, Deckelbaum likes Oasis Petroleum Inc., a major player in the Williston Basin. “As you look across the mid-cap E&P field, Oasis stands out for its 20% production growth, as well as for free cash flow. They should be able to achieve those hurdles through 2020.”

It also does not hurt that the company has a MLP, Oasis Midstream Partners. “They can build infrastructure and could accrete some value to OAS,” said Deckelbaum. “There is plenty of cash flow that can be dropped into the MLP from the parent company.”

At the same time, Oasis is reducing debt by selling noncore assets. “They are roughly $280 million through a $500-million plan,” said Deckelbaum, “so there will be further divestiture. Then a clean balance sheet will add to growth potential. I don’t think all that is fully understood by the Street. Neither is the recent acquisition in the Delaware Basin.”

While Oasis is well established in the Bakken and new in the Permian, PDC Energy Inc. is well established in the Wattenberg, like SRC, and new-ish in the Permian. It made a Delaware Basin acquisition a few years ago and has been delineating its northern and eastern positions, as well as securing transportation capacity at a favorable rate, Deckelbaum reported.

“Similar to SRC, PDC will benefit from the Wattenberg debottlenecking,” said Deckelbaum. “They have some high-rate gas assets in the Kersey area that will benefit more so than most from new midstream capacity. Overall PDC has been outperforming their type curves. That should get The Street to run a better net asset valuation.”

Recommended Reading

WTI Prices Fall as Trump Agrees to Pause Tariffs on Mexico, Canada

2025-02-04 - Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum said they had agreed to bolster border enforcement efforts in response to Trump's demand to crack down on immigration and drug smuggling.

Russia Declares Federal Emergency Over Black Sea Oil Spill

2024-12-26 - Russia declared a federal emergency on Dec. 26 over an oil spill in the Black Sea.

VanLoh: US Energy Security Needs ‘Manhattan Project’ Intensity

2025-02-06 - Quantum Capital Group Founder and CEO Wil VanLoh says oil and gas investment, a modernized electric grid and critical minerals are needed to meet an all of the above energy strategy.

Oil Industry Veteran Beyer Appointed to Key Interior Department Post

2025-02-05 - Energy industry veteran Leslie Beyer has been appointed to assistant secretary of land and minerals management at the U.S. Interior Department, where she will oversee key agencies including the Bureau of Land Management and Bureau of Ocean Energy Management.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.