On a combined basis, Noble's 14 working (15 total) dual BOP 7th generation drillships will comprise the “leading tier one drillship fleet” in the industry, Noble said. (Source: Noble Corp.)

Since late last year, E&P buyers have been jostling for upstream inventory with all the decorum of Black Friday shoppers waiting for a Walmart’s doors to slide open.

The latest deal—announced June 12—was a smaller-sized $1.9 billion Matador Resources for Delaware Basin assets. That comes after a first quarter in which upstream inventory hunger hit $51 billion.

As E&Ps have been burning through acquisition targets since 2023, the service sector’s consolidation have seemingly been on simmer. Service companies have taken a more subdued approach, at least until recently.

On June 10, Noble Corp. said it would buy Diamond Offshore Drilling for $1.6 billion. With offshore projects proliferating worldwide—particularly in Guyana, Brazil and the Gulf of Mexico (GoM)—the transaction was just the sort move some analysts have been expecting.

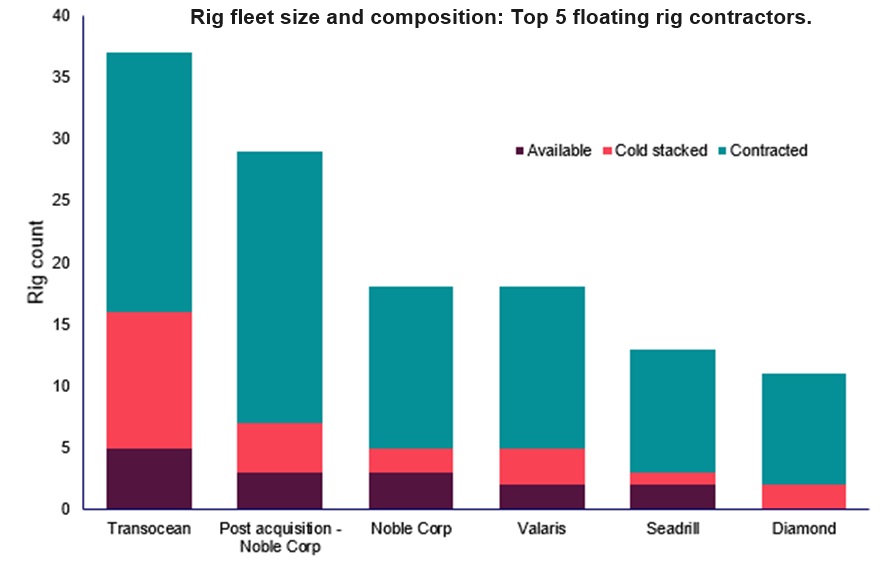

“We have been predicting offshore rig market consolidation for some time, and with little appetite from owners to add new rigs as rig demand is flattening out, we believed growth would be inorganic,” Leslie Cook, principal analyst of upstream supply chain for Wood Mackenzie, said in a June 12 report.

Cook said that Noble has grabbed first move advantage in the upstream service sector by melding the top two offshore rig contractors.

“It therefore comes as little surprise that the first major deal in the upstream service sector has been announced,” Cook said.

Including debt, Noble’s deal will cost about $2 billion.

On a combined basis, Noble's 14 working (15 total) dual BOP 7th generation drillships will comprise the “leading tier one drillship fleet” in the industry, Noble said.

Noble expects to realize annual pre-tax cost synergies of $100 million, with 75% expected to be realized within one year of closing.

“We believe Noble’s acquisition is highly strategic, and the addition of 12 offshore floaters is expected to strengthen the company’s revenue and cash flow visibility through the long-duration offshore upcycle,” Evercore ISI analysts said in a June 10 commentary.

Less dramatic, more substantial

Mark Chapman, principal analyst for oilfield services at Enverus Intelligence Research, said that while the Noble deal may be “less dramatic than upstream consolidation, services side M&A has also seen a substantial ramp in activity this year.”

Including Noble’s deal, global year-to-date service side consolidation stands at $14 billion—already topping the $11.5 billion transacted in 2023—and closing in on the $17 billion annual total from 2022. It’s only June.

Large deals already inked this year include SLB’s agreement to buy pay nearly $8 billion to acquire ChampionX and another SLB pickup of Aker Carbon Capture for $380 million.

While not on the same scale as, say, Diamondback Energy’s $26 billion buyout of Endeavor Energy Resources LP, deals like Noble are likely to continue.

The timing of Noble’s deal likely reflects the company’s bullishness about offshore activity levels globally, Chapman said.

“After years of underspending on global exploration and development, we see an uptick in activity to offset declines in Gulf of Mexico and generate ~3 MMbbl/d production growth in Brazil and Guyana by 2030,” Chapman said.

“This is a change for companies looking to replenish reserves, providing a longer-term tailwind as North America shale, which has been the backbone of global growth for the last decade, continues to mature.”

WoodMac’s Cook said the deal tightens floater market, with “more than 60% of total floater backlog … with four drilling contractors.”

“While we believe this will have little impact on day rates in the shorter term, we do believe that the consolidation of the market will afford rig contractors more control in the medium and long term, Cook said. “With day rates currently reaching US$500k/day, this will be an ongoing concern for operators adhering to capital discipline and planning for long-term drilling programmes.”

Noble’s deal also broadens its client footprint, improves access to U.K. and Australian markets and strengthens the company’s competitive position in the lucrative U.S. GoM market, Cook said.

The deal also diversifies the company’s portfolio without dilution of its assets’ marketability, WoodMac said.

Recommended Reading

Occidental Clears FTC Scrutiny to Close $12B CrownRock Deal

2024-07-18 - The waiting period for Occidental’s $12 billion acquisition of CrownRock LP under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 has expired, clearing the way for the deal to close next month.

New Wells Underway: Private E&Ps Pulled 40% of US Permits in May

2024-07-17 - Private E&Ps are keeping pace with public operators in taking permits for new-drill horizontals across the Lower 48, according to a research report.

NatGas A&D Warms Up as BKV Sells Marcellus Assets for $132MM

2024-07-12 - Natural gas M&A may be heating up as Barnett Shale-focused E&P BKV Corp. sold interests in gassy northeast Pennsylvania properties for nearly $132 million, according to regulatory filings.

Are 3-mile Laterals Worth the Extra Mile?

2024-07-12 - Every additional foot increases production, but it also increases costs.