The first half of 2024 was a difficult time for natural gas producers.

The U.S. set records for monthly natural gas in storage. Breakdowns and construction delays at LNG export plants, and mild weather hurt demand in the U.S. and overseas. Prices crashed in January and stayed low into July.

It’s a difficult situation, but the bad news isn’t too much of a surprise to the companies most involved in the natural gas market and the analysts who track it.

If things go as planned, the summer of 2024 will be remembered as the natural gas industry’s nadir of the 2020s, before decades-long infrastructure projects came online and long-awaited markets finally opened.

Two unconnected projects expected to come online soon are both small parts of the massive infrastructure being built to turn things around.

Energy, energy everywhere

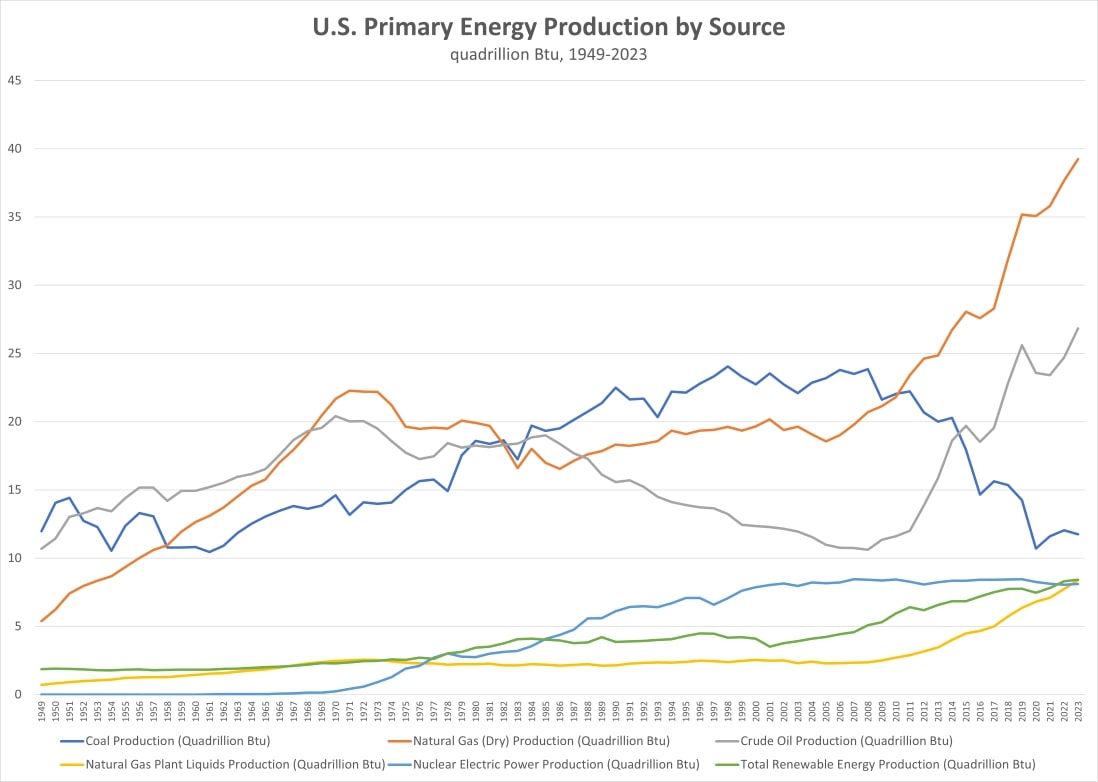

At the end of June, the U.S. Energy Administration (EIA) reported that the gap between the amount of energy produced in the U.S. had surpassed the amount of energy consumed by an all-time high in 2023.

The gap between production and consumption came to 9 quadrillion Btus (quads), the biggest gap since 1949—as far back that records go. Total energy produced amounted to 103 quads, while total consumption came in at 94 quads.

(The EIA uses Btus—British thermal units—as a means of comparison between the different ways of producing energy, such as coal, gas or solar. One Btu is the quantity of heat required to raise the temperature of a pound of water by 1 F.)

Natural gas is easily the biggest contributor to U.S. energy production, responsible for 39 quads in 2023; second place went to crude oil at 27 quads.

Production of both had grown significantly from 2022—gas by 4% and crude by 8%. The continued growth in oil production makes sense, considering that prices have remained relatively stable and profitable over the last few years. Producing more oil in a favorable market is what E&Ps do.

It’s not the same story for gas. Natural gas prices hit a high of $8.81/MMBtu at Henry Hub in August 2022, according to the EIA, and began a rapid drop soon after that. The high for 2023 was in January at $3.27/MMBtu. Prices have not reached that level since.

Yet gas production continued rising all through 2023. As the Henry Hub price languished at $2.52/MMbtu average over December 2023, natural gas monthly gross withdrawals hit an all-time high of 3.99 Tcf, according to the EIA.

Anyone familiar with the situation knows why production went up while prices cratered.

In the U.S., most gas producers don’t have much of a choice over how much they produce, because most of them don’t consider themselves gas producers in the first place. More than one-third of U.S. natural gas production comes from wells in which crude is the primary focus, according to the EIA.

The growth in associated gas has been a byproduct of the shale revolution, which naturally produces gas, along with other products. In 2010, none of the primary U.S. shale oil basins produced more than 1 Bcf/d of associated natural gas. By 2022, the Bakken, Eagle Ford and Niobrara all did. The Permian Basin produced more than 16 Bcf/d and is expected to hit 22 Bcf/d by the end of 2024.

Natural gas lines in the Permian have been running near capacity for almost a year. According to the EIA, prices at the regional Waha Gas Hub dipped as low as negative $4.60/MMbtu over the summer.

Of course, producers have been well aware of the situation and have invested billions to turn things around.

Matterhorn’s climb

The first two of many pieces for a much more profitable natural gas market are coming close to fruition.

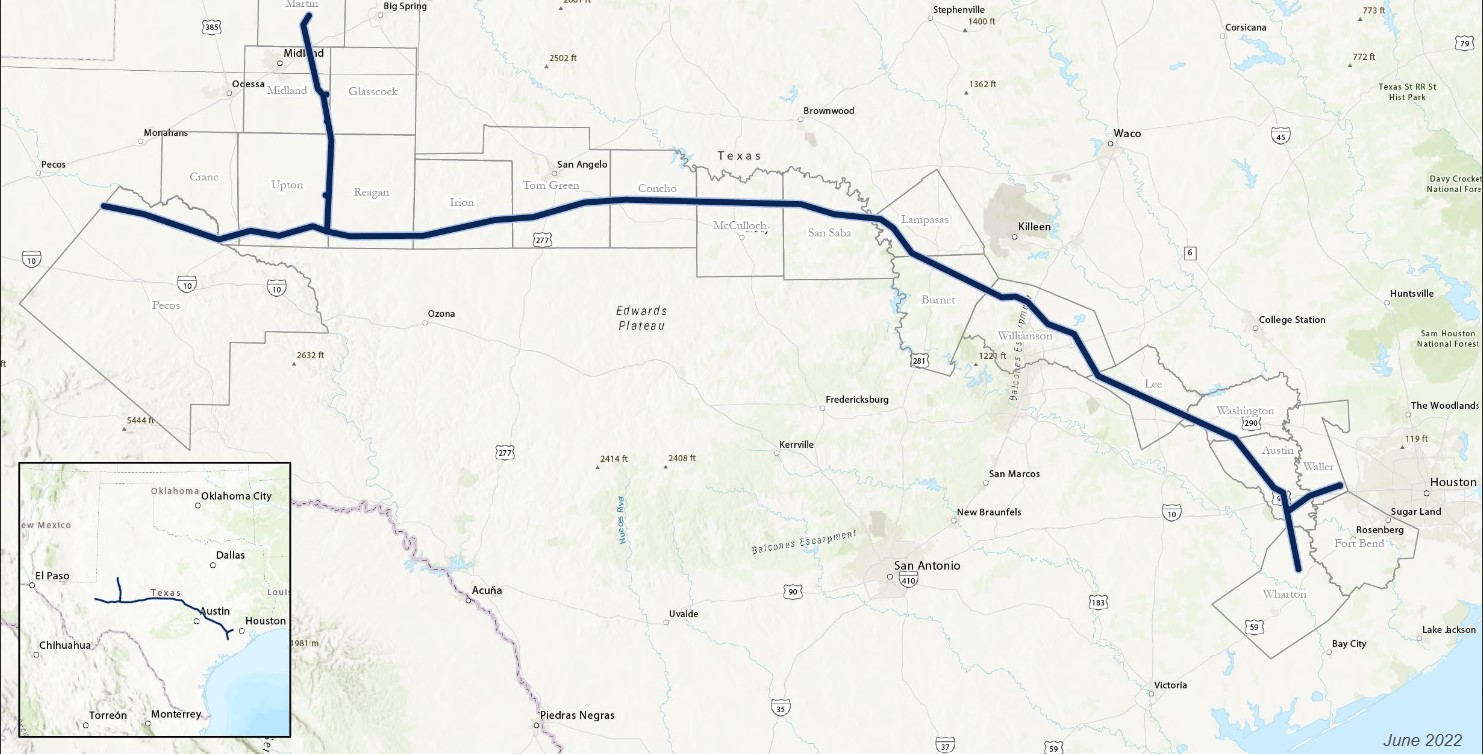

With a 42-inch diameter, the 580-mile Matterhorn Express Pipeline is designed to take up to 2.5 Bcf/d of natural gas out of the Permian Basin. According to one analytical firm, the line could start doing so as soon as September.

In early July, East Daley Analytics noted that the pipeline, owned by a joint venture and operated by Whitewater Midstream, could start taking line-fill service before August, “ramping up to the full 2.5 Bcf/d in September.”

The Matterhorn Express is a crucial part of decreasing the natural gas bottleneck regional producers face. It’s the first major natural gas pipeline to come out of the Permian since WhiteWater Midstream and MPLX’s Whistler Pipeline began service in 2021.

The line will end near Katy, Texas, in an area close to Houston for processing and, potentially, LNG export.

Meanwhile, in Louisiana

The next state over, Venture Global’s Plaquemines LNG is expected to start a long-awaited commissioning process, an analytical firm reported July 1.

The liquefication and export facility is in Plaquemines Parish on the Mississippi River, near the Louisiana Gulf Coast. At capacity, the plant will export up to 20 million tonnes per annum of LNG, adding about 3.4 Bcf/d of new natural gas demand in the region.

The massive plant will be the largest addition to U.S. LNG export capacity since Sabine Pass opened in 2019.

TPH & Co. noted in July that several pipelines that will serve the Plaquemines facility were gearing up into supply mode. In June, Enbridge’s Gator Express Pipeline flows indicated that the plant had received a small amount of natural gas, indicating that commissioning had potentially started.

The news matched an earlier forecast from Venture Global that LNG production at Plaquemines would start before the end of the summer. According to a July 3 study by analytical firm RBN, the facility is expected to be fully online in 2026.

The study was headlined, “Big Wave—A Tsunami Of New LNG Export Capacity Is Coming, With Broad Implications For Gas Markets.”

The Pipelines and the plants

Both projects showcase the primary movement within the natural gas industry since the 2010s to transform U.S. natural gas into an international commodity through LNG trade, thereby boosting the value of gas that has been so cheap that producers sometimes had to pay people to take it away.

“The new LNG export capacity coming online in North America over the next few years is sure to have a significant impact on gas products on gas flows and gas prices—in both the U.S. and Canada,” RBN analyst Housley Carr wrote.

“Given that all the U.S.’ incremental export capacity is located along the Gulf Coast, gas produced at crude oil-focused wells in the Permian—often selling at negative prices at the Waha Hub lately—will have new outlets, which should have a positive effect on gas prices there,” Carr said.

The Matterhorn Express is just the largest current pipeline project slated to bring natural gas to the Gulf Coast. The Louisiana Energy Gateway project by Williams Cos. is a gathering and pipeline system expected to bring an extra 1.8 Bcf/d of natural gas to Southern Louisiana.

Besides Plaquemines, one other LNG export terminal is expected to begin production by the end of 2025.

Cheniere Energy’s Corpus Christi Stage 3 project will add 1.4 Bcf/d capacity for liquefication. Cheniere executives said in June that overall construction is 60% complete and ahead of schedule and that LNG production may begin before the end of 2024, according to RBN.

East or west?

The future markets for the growing LNG export capacity aren’t set in stone.

Europe saw a surge in demand following Russia’s invasion of Ukraine in 2022. However, the European Union’s Agency for the Cooperation of Energy Regulators reported in April that LNG demand would likely peak in 2024, as EU member nations focus on installing solar and wind energy.

Analysts say Asia, however, will see an increasing need for LNG. China is currently beefing up its LNG regasification capacity and expects LNG imports to rise 8.2% in 2024.

Considering all of the factors, it’s difficult to predict the future. But, years-long efforts to provide a market for a glut of natural gas could begin to pay off, as 2024 starts winding down.

Recommended Reading

Iron Oak Energy Expands in Permian with High Roller Sand Deal

2025-04-08 - Proppant supplier Iron Oak Energy Solutions LLC is expanding in the Permian Basin with the acquisition of High Roller Sand for an undisclosed price.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Energy Trader Vitol Eyes $3B Sale of US Shale Producer, Sources Say

2025-03-27 - Global commodities trader Vitol is exploring a sale of its VTX Energy Partners business, in a deal that could value the U.S. shale oil and gas producer at as much as $3 billion, including debt, people familiar with the matter said.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.