Thinking back to 2008, the world seemed like a very different place. Donald Trump was a businessman and host of a popular reality show, ExxonMobil Corp. was the largest company in the world based on market capital, and “American Idol” on Fox was the most popular show on television.

Today, Trump is, of course, the U.S. president, ExxonMobil has fallen behind tech heavyweights like Apple, and “American Idol” just returned to network television on ABC after being cancelled several years ago by Fox.

On the other hand, the world isn’t that different: The New England Patriots lost the Super Bowl in 2008 and 2018, the most popular movies at the box office in both 2008 and 2018 featured superheroes, and the iPhone has been the most popular gadget every year in this 10-year span.

The renaissance

More importantly to the oil and gas industry in general and the midstream in particular, 2008 marked the beginning of the U.S. energy renaissance. Though West Texas Intermediate crude prices hit a record $147 per barrel (bbl) that summer, the U.S. ended the year as the largest producer of natural gas.

Shortly thereafter, producers began using similar unconventional production techniques and technologies to replicate the success they were having with shale gas to unlock crude and liquids plays.

Clearly this strategy has paid off with the U.S. producing more crude oil than any other country for the past seven years—while breaking production records on a regular basis for the past four . This amount of production resulted in Congress lifting the domestic ban on crude exports at end of 2015.

The U.S. is now on track to become the largest exporter of crude in 2019.

Currently, the U.S. exports about 2 million barrels per day (MMbbl/d) of crude and condensate combined, but these levels are just the start of where production and export levels are going. At its peak, the U.S. will be a Top-Five exporter competing with OPEC member nations, Russia and Canada for market share.

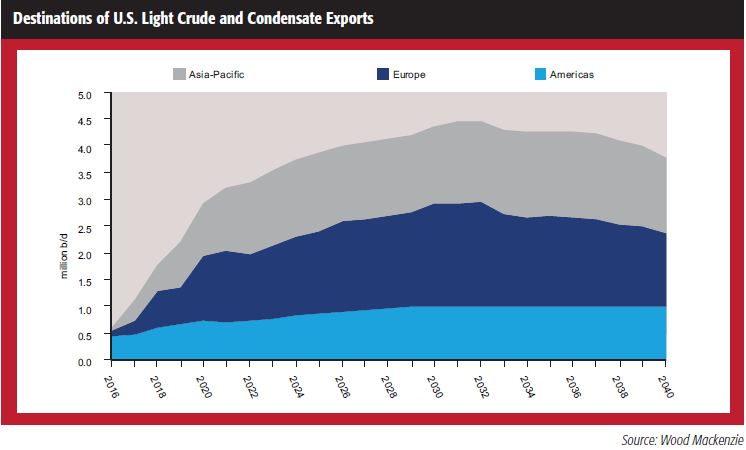

“Our forecast has U.S. crude exports peaking at 4.5 MMbbl/d (3.6 MMbbl/d of only crude, and 900,000 bbl/d of condensate) in 2032 with a slow decline from there. Exports will also peak at this time and have similarly slow decline,” John Coleman, senior analyst, North American crude markets, Wood Mackenzie, told Midstream Business.

Mega-growth

Exports are set to more than double over the next 15 years, but the most significant gains will be in the next five years or so as the U.S. goes into “mega-growth mode,” as one industry observer called it. A combination of high-quality inventory and a long runway of drilling locations are leading to this growth. The dominant barrel produced in the U.S. will be very light sweet crude, and according to Coleman, a great deal of this production will need to be placed into export markets.

“The light and ultra-light variety of crude that’s being produced in the U.S. is increasingly becoming saturated in a very complex domestic refining system. So as production continues to grow, it’s not a direct 1:1 relationship that every barrel produced has to be exported, but the majority of new production going forward is going to need to be exported,” Coleman said.

“We don’t have enough crude in the next 10 years to completely make Middle Eastern crude irrelevant for the whole world, but we have enough for the U.S. to not to care about it anymore,” Dan Lippe, managing partner, Petral Consulting, told Midstream Business.

According to Petral Consulting, since the majority of U.S. production needs to be exported, it can take a great deal of the global crude market share from Middle Eastern producers within the next decade.

“We’ve already doubled capacity and we have the capability to double again. It’s the inevitability of the situation that astounds me,” Lippe said.

Key destinations

Some destinations that look favorable for U.S. crude, for different reasons, are the European and Asian markets, according to Wood Mackenzie. Ideally, both markets will see significant uptake in volumes in the coming years as the U.S. competes with existing light crudes in both markets. Refining capacity in China is ideally suited to take a great deal of these volumes, and the Chinese market makes up about 20% to 25% of total U.S. exports.

Asian markets will also be important in absorbing U.S. condensate exports due to the large number of condensate splitters and crude-to-chemicals facilities in the region.

“There's going to be a tightening in global condensate availability into the 2020s with the U.S. being one of the largest suppliers of condensate, as well as one of the few with growing volumes,” Coleman said.

However, any long-term trade tariffs on U.S. crude will not have a material impact, he said. “Should any tariff scenario play out where the Chinese market gets shut off to U.S. crude exporters, we don't think it puts the overall export story at risk, but it can reshuffle and reshape global crude trade flows based on that.”

In such a scenario, Wood Mackenzie anticipates that U.S. volumes flowing to China will be redirected to the next-best available market with China pulling volumes from other markets. Ultimately, the export story will remain intact, albeit in a slightly less efficient way.

“Today those barrels are largely flowing to where producers can get the highest prices possible. If that market is shut off, crude flows are going to have to redirect and producers will have to sell into the next-best available market. This means slightly worse price realizations going forward. Now what is the magnitude of that? It’s probably not going to be hugely significant, but it would result in a wider discount in U.S. crude relative to international benchmarks,” Coleman said.

Besides Asian markets, European markets are expected to be focal points for U.S. crude exports, specifically in northwestern Europe and the Mediterranean. The refineries in these regions are less complex than in other parts of the world, which makes U.S. light sweet crude attractive since it has less sulfur and requires less processing than other, heavier types of crude.

This isn’t to say that OPEC’s importance will cease in the coming decades. It may be on the decline as far as importance to domestic markets, but OPEC will remain the marginal swing producer for the foreseeable future, according to Wood Mackenzie.

“Going forward, we expect OPEC to retain this role by having the capacity available to add supply when needed and make informed market decisions if supply needs to be removed. The U.S. is going to be much more economically driven, so for the U.S. to remove supply or greatly ramp up supply, there would need to be a price response first to incentivize producers. OPEC makes decisions largely on its views of where the market is going,” Coleman said.

Midstream infrastructure

Midstream operators have been key in helping U.S. crude producers make such remarkable gains in production and export market share in the past decade and will continue to play an important going forward.

“Mont Belvieu, Texas, will continue to be the focal point of midstream activity because of its proximity to West Texas and access to waterways. All of the pipeline interconnections point to this region with the largest liquids storage capacity in the country. Mont Belvieu will be the price-setting mechanism for NGL and petrochemical products,” Lippe said.

Despite a consistent buildout and expansion of pipelines for much of this century, such is the size of U.S. production that more pipeline capacity is still needed. Not surprisingly, much of this is needed to transport production out of high-growth areas like the Permian Basin to the Gulf Coast for export.

“The big story over the next three to four years will be infrastructure really catching up to where production is going,” Coleman said.

However, there are two concerns related to midstream and exports: short-term bottlenecks and long-term over-capacity. There is a mismatch between when new pipeline capacity comes online in the booming Permian Basin and when marine export terminals under construction come online.

“If these pipelines begin to deliver crude for export and there’s not enough dock space, storage, or marine terminal capacity available, you could have a situation where crude is getting bottlenecked in coastal markets,” Coleman said.

Building offshore

Many companies have been announcing new terminals with very large crude carrier (VLCC) capability in order to maximize efficiency by being able to carry far more volumes for export. Because inland waters aren’t deep enough to handle these vessels, they need to build docks offshore. There is the potential for overbuild and over-capacity should too many move forward, however.

“You've seen a smattering of these large-scale offshore terminal projects in the past few months and they can get quite expensive. They need an underwater pipeline connecting onshore tankage to this offshore platform and that can get very costly very quickly. If you have a situation where there’s going to be a substantial amount of competition in the area, you could see a lot of these projects fall by the wayside from the economics of a potential overbuild coming into play,” Coleman said.

However, it’s possible that integrated crude midstream companies would be able to repurpose or multipurpose some of these facilities and assets.

“You can interchange terminals to export other refined projects or NGL or other energy products. If there is an overbuild on the crude side, you can rationalize some of that capacity for other hydrocarbons to still put it to use,” he added.

One of the companies that is planning a large offshore terminal capable of handling VLCC vessels is Enterprise Products Partners LP, which has been one of the most important midstream companies when it comes to adding capacity to increase various hydrocarbons, including crude and LPG. Enterprise is ranked No. 5 on the Midstream Business Midstream 50 list.

“The trend with exports has been to break new records almost monthly, with the biggest advances led by crude. … For at least the last three years, we have been very open about our long-term outlook for U.S. crude oil exports and we don’t see these trends changing,” Jim Teague, CEO of Enterprise Products, said during a conference call to discuss the firm’s second-quarter earnings.

This new terminal would be capable of loading and exporting crude oil at about 85,000 barrels (Mbbl) per hour. “What makes this project a natural for Enterprise is the fact that our Houston area systems can aggregate more than 4 MMbbl/d of crude oil, a terminal without supply aggregation really isn’t a terminal,” Teague said.

The company also recently announced it is further expanding its Enterprise Hydrocarbon Terminal (EHT) on the Houston Ship Channel by purchasing an additional 65 acres. This acreage is adjacent to the marine terminal and includes two existing docks and land that will help the company greatly expand its terminaling capabilities, which will include the construction of at least two deepwater docks that can accommodate Suezmax vessels.

Enterprise’s network of Gulf Coast marine terminals includes 18 ship docks and eight barge docks. The company also has access to about 125 pipelines, 400 MMbbl of storage and every refinery in the region.

In order to maximize its returns, Enterprise started a vessel bunkering service along the Houston Ship Channel to refuel tanks, which not only adds to the company’s bottom line but also helps save time by fueling and loading at one location.

Gasoline demand

Ironically, the crude oil production renaissance in the U.S. has occurred at a time when domestic gasoline demand is decreasing as automobiles become more fuel efficient, public transportation becomes more widespread, and workers shorten their daily commute by either moving closer to work or working remotely. Most importantly, the automotive industry is beginning to switch from the internal combustion engine to electric motors.

“We’re in the early twilight of oil demand as global auto manufacturers turn to electric vehicles. The future of automobiles is all-electric, and the biggest single end-use market for crude oil is as a fuel for automobiles. I realize this perspective is not the consensus view, but anyone who denies the threat of all-electric vehicles out of hand is whistling past the cemetery. The majority of global oil demand is from transportation fuel. We’re talking the beginning of the end of oil as the dominant transportation fuel,” Lippe said.

At this time, the conversion to electric vehicles is primarily concentrated in developed nations including the U.S., Germany and England. However, global demand for crude oil is actually increasing as emerging markets grow and global demand isn’t expected to decline for several decades.

“Most of the crude demand growth will be coming from developing markets over the next two decades. Developed markets are very much in a plateauing phase. In our view, the demand for gasoline in this country either peaked last year or will peak this year and will start to slowly decline. Similar stories are starting to play out in the developed European market,” Coleman said.

Wood Mackenzie anticipates that the impact of electric vehicles won’t truly be felt on a global basis until sometime in the 2030s. Most importantly, the trend to electric vehicles will occur when global crude oil demand is higher than it is today.

In 10 years when we look back at 2018, it’s very likely that many things will be different in 2028. However, it’s certain that the biggest industry story will revolve around the perpetual growth of U.S. energy exports.

LNG’s growth

Although the U.S. energy renaissance began with gas, the year 2019 is poised to be perhaps the biggest yet for the LNG industry as domestic export capacity is set to nearly double to 10 billion cubic feet per day (Bcf/d). However, there is the risk that a lack of new LNG facilities after this next expansion will result in a supply gap over the next decade.

Current LNG export capacity from the U.S. comes from Cheniere Energy Inc.’s Sabine Pass terminal in Cameron Parish, La., and Dominion Energy’s Cove Point terminal in Calvert County, Md. Capacity is set to grow significantly next year as a result of several new facilities coming online along the Gulf Coast and Atlantic Coast. These facilities include Freeport LNG’s terminal in Texas; Kinder Morgan Inc.’s Elba Island, Ga., terminal; Cheniere Energy Inc.’s Corpus Christi, Texas, terminal; and Sempra LNG’s Cameron, La., terminal.

Despite this growth, forecasts anticipate far more export capacity will be required to handle increased domestic production and global LNG demand. Cheniere officials reported that nearly 16.5 billion cubic feet per day (Bcf/d) of additional LNG will be required by meet global demand by 2030.

Multiple companies have proposed new LNG plants and terminals, but they have not received enough support via long-term commitments from buyers necessary to justify the large expenses involved in building these facilities.

Should these projects be pushed back or canceled, it’s likely that more midstream capacity will be added to help fill the supply gap, according to a recent Alerian report titled, “U.S. LNG Export Growth and the Benefits to Midstream.”

“Without the ability to export natural gas on tankers as LNG and via pipelines to Mexico and Canada…the natural gas supply in the U.S. would overwhelm domestic demand. This would have negative implications for natural gas prices and limit production growth,” the report said.

The lack of new LNG terminals will likely result in an increased need for new or expanded gathering pipelines and natural gas processing plants to move and process the increased production to existing export terminals. Expansion projects are cheaper and faster to complete than newbuild projects. The permitting process is easier and expansions aren’t as dependent on long-term contracts to move forward.

“Production growth benefits midstream companies as volume-driven businesses. More natural gas means more volumes to gather, process and transport, and that requires more infrastructure,” according to the Alerian report.

Though the bulk of U.S. LNG export facilities are located in Texas and Louisiana, they will utilize production from around the country. This will require both new and expanded pipelines to transport volumes from all of the major plays in the U.S., including basins as far apart as the Appalachian and the Permian.

Because there’s such a high level of interconnectedness between natural gas pipelines in the U.S., facilities like the Sabine Pass terminal have access to every producing region in the Lower 48 states east of the Rockies, the report said.

Much of these supplies will be used to meet the still-growing demand for LNG in Asia. Japan is the largest importer of LNG, but China has been leading the way in terms of demand growth. In 2017, China was responsible for 44% of the global uptick in LNG imports.

A potential trade war with China would negatively impact the U.S. LNG industry and create another headwind for projects that have not yet secured a final investment decision (FID).

However, the Alerian report noted that China was one of 40 countries that imported LNG in 2017 and the U.S. exported it to 25 of those countries. A customer base without China wouldn’t be ideal, but other customers could help bridge that loss. The use of spot markets and short-term contracts is a way to quickly develop new trade partners.

“While China is a major player in the LNG market, it's not the only customer. … Europe is clearly a market for U.S. LNG exports as countries look to diversify their gas supply from Russia,” the report added.

Additionally, the Trump administration may be in the midst of a trade spat with China, but the administration is negotiating trade agreements with European countries that could benefit the U.S. LNG industry. Still, Europe’s LNG demand is dwarfed by that of China’s, and while the threat of a trade war is still imminent, it's likely that FIDs for new LNG terminals will remain tough to secure.

Frank Nieto is a freelance writer based in Washington, D.C., who focuses on transportation and energy issues.

Sidebar:

Changing Cycles

Market cycles for U.S. crude, liquids and gas will change in the coming years as the country becomes more involved in global markets.

The U.S. oil and gas industry is about to get even bigger in the next decade with the country continuing to grow in its role as a global energy superpower. Domestic producers have been exporting natural gas, NGL, crude oil and petrochemicals—and these volumes will keep growing.

What impact will this have on prices?

At first glance, it would be easy to predict they’ll go up as the U.S. gains market share in various regions. However, other countries are also increasing their export volumes, demand dynamics are changing and there are important geopolitical considerations that will impact short-term and long-term pricing.

“We'll start to see shorter cycles in the crude oil market. So instead of 15-year cycles, we’re going to see three- to four-year cycles," Dan Lippe, managing partner, Petral Consulting, told Midstream Business.

That may sound like the market will become less orderly, but that's far from the case. In many ways, the global crude market is about to become both more competitive and more efficient. And the biggest driver of this change will be production out of West Texas, according to Lippe.

“West Texas is the only place that matters. Production in the region has increased so much that all of the pipelines are full. Fortunately, we're building new pipeline like mad and should have at least an additional 1 million barrels per day (MMbbl/d) of additional crude pipeline capacity by the middle of next year. That will start to alleviate the current constraints, which have slowed down the growth rate in West Texas crude production,” he said.

What’s most impressive about West Texas is that even with this slowdown, the annualized growth rate in the second quarter of 2018 was still an impressive 1.5 MMbbl/d per year.

The Iran sanctions

While West Texas is the most important crude play in the world right now, the most important story in the short term is the restoration of economic sanctions against Iran in the coming months. These sanctions will effectively force countries that are currently buying Iranian crude to choose between doing business with Iran or the U.S.

“Very few buyers are going to choose Iran over the U.S. because we have the ability to make up the loss of Iranian crude [from the world market] by ourselves,” Lippe said.

While the U.S. will likely gain market share from Iran’s departure, so will other countries like Russia, Iraq and Saudi Arabia. Domestic crude demand will not absorb U.S. production growth, which means most of these new volumes will have to be exported. This could have a negative impact on prices in the next 18 months with global production outpacing demand. The prices at which U.S. producers would be willing to sell before pulling back production levels will be very influential.. According to Lippe, this figure is likely between $52/bbl and $55/bbl.

The NGL cycle

The NGL market is also nearing the end of an upcycle, but this trend is a result of capacity restraints rather than geopolitical events. However, the NGL market will be just as focused on exports as crude.

“We have to build more raw-mix pipeline and fractionation capacity. We also need to start expanding NGL export terminals because there's nothing that the domestic markets can do to absorb all of the new liquids production,” Lippe said.

Most of the raw-mix, or Y grade, pipeline capacity that has been built since 2010 is expandable, which will limit the number of newbuild requirements. However, a great deal of fractionation capacity will be needed to handle all of the liquids and about 300,000 barrels per day of NGL export capacity will be needed in the U.S. by 2022. Over the next three to five years, Lippe expects midstream operators in the NGL space to be as active as they were in the booming 2004 to 2014 period.

“Mont Belvieu [Texas] will be the focal point of much of this construction because of its proximity to West Texas. In 10 years, Mont Belvieu will encompass the entire Gulf Coast from Corpus Christi [Texas] to New Orleans. The liquids storage in the region is by far the largest in the country,” Lippe said.

Cycles are shortening in the crude and NGL markets, but if anything, the natural gas cycle is lengthening. Unlike crude and liquids prices, the long-term outlook for gas prices is not positive, according to Lippe.

“Natural gas prices are either going sideways or down. There is almost no possibility of [benchmark] Henry Hub gas prices going above $3 per million British thermal units (MMBtu)for any significant period of time in the next 15 years,” he said.

Indeed, the resource base is so large, and the gas exploration companies have made so many advancements in unconventional production, that it is virtually impossible that the U.S. will have gas supply problems for decades.

At the same time, the global LNG market is filled up, so there’s not enough demand to support a price increase for any real length of time. One positive is that the market is fairly rigid. Lippe does not expect Henry Hub prices to trade between $2.50/MMBtu and $3/MMBtu and no lower than $2.25/MMBtu for any length of time.

“Natural gas has become hyperabundant and there is no upside on a global basis for natural gas unless there are several extremely cold winters in a row. Even then, that would only cause a price spike for a year or two,” he said.—Frank Nieto

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

NOV Appoints Former Denbury CEO Chris Kendall to Board

2024-12-16 - NOV Inc. appointed former Denbury CEO Chris Kendall to its board, which has expanded to 11 directors.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.