Sempra Energy said April 5 it would sell a 20% stake in its new business platform, Sempra Infrastructure Partners, to investment firm KKR for $3.37 billion in cash.

The transaction is part of a strategy Sempra Energy originally unveiled in December to better position itself to capitalize on the growing global demand for cleaner fuels.

“Combining our resources with KKR improves our ability to capture new investment opportunities in cleaner forms of energy and the critical infrastructure that stores and transports it,” Jeffrey W. Martin, chairman and CEO of Sempra Energy, said in a statement.

“This transaction also sends a clear signal about the value and expected growth of our infrastructure portfolio,” Martin added.

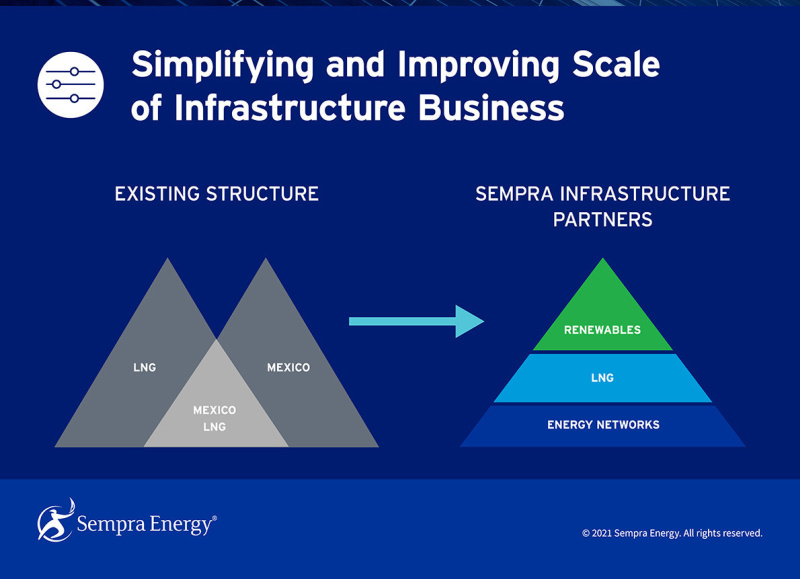

Late last year, Sempra agreed to buy the remaining stake in its Mexican unit Infraestructura Energética Nova SAB de CV (IEnova), which the company said it would combine with its North American LNG export infrastructure unit to create Sempra Infrastructure Partners.

With more than $66 billion in total assets at year-end 2020, San Diego-based Sempra Energy is the owner of one of the largest energy networks in North America, according to its company release.

The newly created Sempra Infrastructure Partners, according to Sempra Energy, will support the global energy transition by providing an improved platform for innovation and potential new investments in renewables, hydrogen, ammonia, energy storage and carbon sequestration.

In a statement commenting on KKR’s investment, Raj Agrawal, KKR partner and global head of infrastructure, said: “This infrastructure platform provides a strong foundation to expand cleaner energy resources across the continent. Backed by strong, contractually-supported, long-term cash flows, our investment is also consistent with KKR Infrastructure’s strategy to seek stable and predictable returns for our investors.”

Sempra Infrastructure Partners owns, among other assets:

- An LNG portfolio consisting of up to 45 million tonnes per annum of LNG export capacity in development, construction or operation on the North American Pacific and Gulf Coasts;

- A renewable portfolio consisting of up to 4 GW of renewable energy generation in development, construction or operation in Mexico and related electric transmission infrastructure; and

- A natural gas infrastructure portfolio consisting of distribution companies and certain cross-border and in-country pipelines, including those that export U.S. natural gas to Mexico and supply the Energía Costa Azul LNG facility.

The deal announced on April 5 values Sempra Infrastructure Partners at about $25.2 billion, including expected asset-related debt at closing of $8.37 billion, the company said in a statement.

Proceeds from the sale to KKR will be used to help fund growth across Sempra Energy’s $32 billion capital program, which is centered on its U.S. utilities, and to further strengthen its balance sheet. The sale, projected to close mid-2021, is also expected by Sempra to be accretive to earnings.

Goldman Sachs & Co. LLC is financial adviser and White & Case LLP is legal adviser to Sempra Energy on the transaction. Credit Suisse Securities (USA) LLC and Mizuho Securities USA LLC were financial advisers and Simpson Thacher & Bartlett LLP and Creel, García-Cuéllar, Aiza y Enríquez S.C. served as legal advisers to KKR.

Recommended Reading

How DeepSeek Made Jevons Trend Again

2025-03-21 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Trump Administration to Open More Alaska Acres for Oil, Gas Drilling

2025-03-20 - U.S. Interior Secretary Doug Burgum said the agency plans to reopen the 82% of Alaska's National Petroleum Reserve that is available for leasing for development.

Baker Hughes to Supply Multi-Fuel Gas Tech to TURBINE-X

2025-03-17 - Baker Hughes will provide TURBINE-X with its NovaLT gas turbine is capable of running on different fuels including natural gas, various blends of natural gas and hydrogen.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

AIQ, SLB Collaborate to Speed Up Autonomous Energy Operations

2025-03-16 - AIQ and SLB’s collaboration will use SLB’s suite of applications to facilitate autonomous upstream and downstream operations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.