The $7.85 billion project has dealt with multiple setbacks, protests and legal battles since construction began in 2018. (Source: Shutterstock)

Editor's note: This article was updated to correct the size of the MVP line.

After the years-long battle to build the Mountain Valley Pipeline (MVP), analysts say the Appalachian Basin’s natural gas industry will have to wait a while longer to reap the benefits.

On June 14, Equitrans Midstream, the line’s operator, said MVP had officially entered service, although Equitrans has not specified when gas on the 2 Bcf/d pipeline will begin to flow.

“This is an important and long-awaited day for our Nation and the millions of Americans who now have greater access to an abundant supply of domestic natural gas for use as an affordable, reliable, and cleaner energy resource,” said Diana Charletta, Equitrans president and CEO. “Natural gas is an essential fuel for modern life, and, as a critical infrastructure project, the Mountain Valley Pipeline will play an integral role in achieving a lower-carbon future while helping to ensure America’s energy and economic security for decades to come.”

Jim Crews, vice president of business development for MPLX and vice president of GO-WV, the Gas & Oil Association of West Virginia, said he was “Elated that MVP received FERC (Federal Energy Regulatory Commission) authority to put the pipe in service.”

The $7.85 billion project has dealt with multiple setbacks, protests and legal battles since construction began in 2018. In 2023, Congress wrote into law a provision directing agencies to grant the required environmental permits for completion. Nevertheless, MVP continued to face legal challenges, including a related Supreme Court case challenging FERC’s eminent domain authority.

“Obviously, we're discouraged about the time that it took to get it in service after so much support and such low prices that our producer members have experienced here in the Appalachian Basin,” Crews said.

Natural gas companies and power generators in the region hope to see better returns for their product.

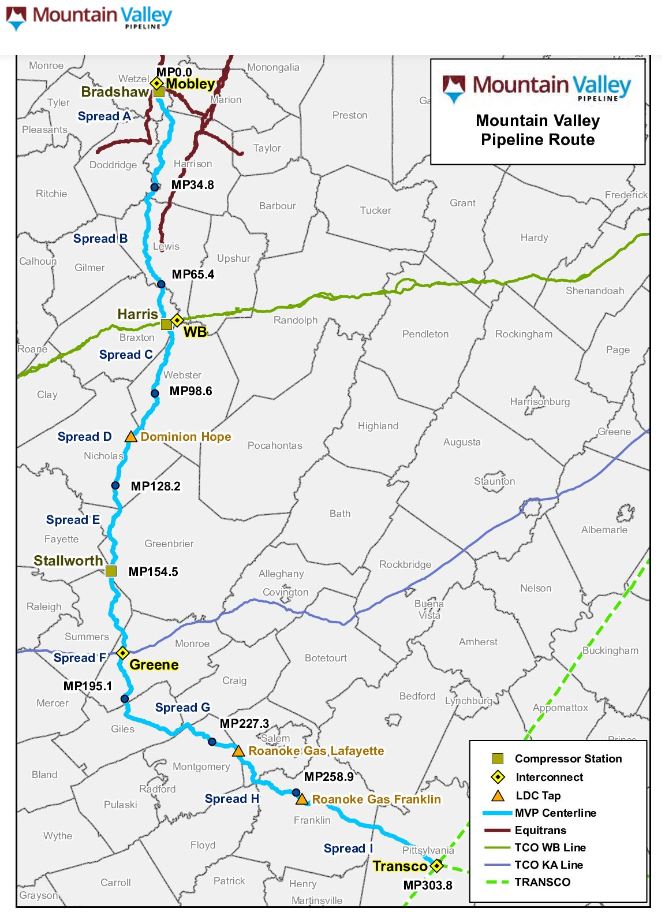

The 42-inch MVP line flows 303 miles from West Virigina’s Wetzel County to Pittsylvania County, on the southern border of Virginia, where it can access Williams Cos.’ Transcontinental Pipeline. The line stretches from Texas to Pennsylvania. Zone 5 includes Virginia, North Carolina and South Carolina.

Crews said the local price points for much of Appalachia often run $1 lower than the NYMEX rate, thanks to Appalachia region’s lack of takeaway capacity.

“We're hoping that our members can get some relief on the gas price once the MVP starts flowing and accessing the Transco Zone 5 market down in Virginia and North Carolina,” Crews said.

The pipeline will help meet natural gas demand in Southwest Virginia, which continues to grow, said Paul Nester, president and CEO of utility Roanoke Gas Co.

“The MVP and its natural gas supply are essential to meeting the needs of residents and businesses across the Roanoke Valley, now and for many years to come,” Nester said. “Further, MVP’s delivery points to Roanoke Gas in Franklin and Montgomery Counties are certain to provide direct, long-term economic benefits to our community and this region.”

After all the legal and regulatory paperwork, permits and lawsuits, FERC approved the startup of the MVP following a June 11 phone call. Analysts said ramping up the pipeline’s operations would take months and that it could be more than a year before the line is running at full capacity.

East Daley Analytics forecast that the new pipeline would have modest impacts in the near term, flowing at about 750 MMcf/d, or nearly 38% capacity, according to its report. The line is waiting for a debottlenecking project, the Transco Southeast Supply Enhancement expansion, which is expected to be completed in 2027.

RELATED

Mountain Valley Pipeline’s ‘Phantom Takeaway’ Problem

Equitrans is also developing the Southgate Expansion to extend the line into North Carolina. The project is expected to be completed in 2028. In March, Equitrans agreed to a $5.45 billion merger with gas producer EQT. In the merger agreement, EQT specified that the deal was contingent on FERC’s authorization for MVP to commence service.

Notably, EQT still owned Equitrans when MVP began construction in 2018.

Crews said Appalachian Basin E&Ps would probably wait to ramp up their production for the new takeaway capacity.

“Everyone's looking at the forward curve thinking that 2024 is probably a wash,” Crews said. “Once you ramp up to increase production, it's probably a year to two years before that production gets online. So, most of our member companies are looking at 2025 as opposed to this year.”

Recommended Reading

Artificial Lift Meets Artificial Intelligence, with Hit and Miss Results

2024-08-23 - Oxy and Chevron are among companies trying to find the sweet spot between data analytics and machine learning with human intervention to optimize production and predict failures before they happen.

What a Trump Win Would Mean for Oil Prices and Stocks

2024-08-23 - A second Trump administration might move the price needle on oil slightly, but OPEC would retain the upper hand in any outcome.

Trans Mountain Appoints New CEO, President

2024-08-23 - Trans Mountain appointed Mark Maki to CEO, succeeding Dawn Farrell who will now be chairman of the board.

Canada’s Train Strike Goes Off—Then Back On—the Rails

2024-08-23 - After the Canadian government stepped in to end the work stoppage, the Teamsters Union indicated that the strike would go forward.

Energy Transition in Motion (Week of Aug. 23, 2024)

2024-08-23 - Here is a look at some of this week’s renewable energy news, including a promising outlook for global offshore wind capacity.