Editor’s note: This is part of an ongoing series of Oil and Gas Investor articles examining major shale play trends— from electrification to M&A to infrastructure needs— as E&Ps enter 2025.

Producers in Appalachia may see their loyalty to the northeastern part of the country rewarded in 2025.

They just need the promises of 2024 to come through and coalesce into a natural gas price rally and regulatory certainty.

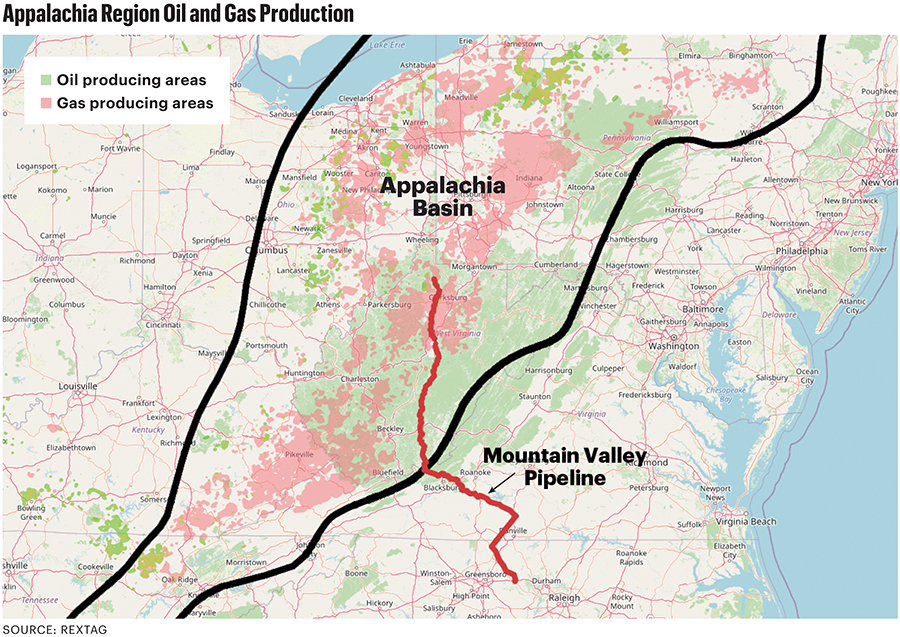

Ongoing protests have stymied or slowed pipeline construction projects in the prolific natural gas-producing region. The June 2024 start of service on the Mountain Valley Pipeline (MVP) was not a moment too soon in Appalachia.

But MVP came online only after a torturous, decadelong process blocked several times by lawsuits filed by environmentalists and residents along the pathway. The stalled pipeline was only completed after U.S. Sen. Joe Manchin (I-W.Va.) insisted a finished project was a condition of his vote for the congressional debt ceiling agreement in 2023.

An unpredictable regulatory environment is a key problem for the industry, said Tom Sharp, director of permitting intelligence at Arbo.

“When you have an environment where you have a lot of uncertainty with respect to what’s going to happen to any project—not just a midstream pipeline project, it’s infrastructure at large—then what you had resulted in chilling investment or caused fear of investment in large projects,” Sharp said.

Incoming President Donald Trump could ease this problem in the coming years. He campaigned in this part of the country largely on his pro-oil and gas stances, particularly in terms of loosening regulations and permitting.

Still, the primary mover for a new infrastructure project will be the market for the product it carries, said Amber McCullagh, Rystad’s senior vice president for onshore North America.

The driving force to build the next pipeline will be the same force behind the fight to build the MVP—commercial viability.

“It starts with demand, and the industry is pretty resilient,” said Greg Floerke, executive vice president and COO of MPLX, during Hart Energy’s DUG Appalachia Conference in November.

“I actually think the bigger challenge to Appalachian pipeline development is commercial,” McCullagh said.

The supply of natural gas in the U.S. was historically high for most of 2024, and Henry Hub prices remained well below $3/MMBtu for most of the year. Depressed prices mean potential builders tend to hold onto their money and wait for a better forecast.

“When you’re not confident that the commodity will be more than $3, even if your wealth at breakevens is sub-$2, it’s very hard to make that worth a 15-year commitment,” McCullagh said.

Analysts forecast that natural gas prices will increase—perhaps as oil prices struggle with oversupply—from growing demand from LNG exports and power generation for artificial intelligence data centers.

M&A in Appalachia

Gas-price instability caused a disconnect between what buyers were willing to pay for gassy assets and terms sellers were willing to accept. But with greater clarity on future gas demand, LNG export growth and increasing prices, gas deals have started to cross the finish line.

Appalachia, with its low-cost and bountiful gas supplies and unique infrastructure challenges, could also be a hotspot for gas-weighted M&A in the next two years, Dan Crowley, a managing director in Houlihan Lokey’s oil and gas group, told Oil and Gas Investor.

“In the conversations I have with some producers in Appalachia, people are very carefully watching that contango and sort of queueing up to come to the market at the right time,” Crowley said.

Since the advent of horizontal drilling and fracking techniques, Appalachia operators have largely targeted the gassy Marcellus Shale play. But the area has long been known for crude oil potential: The Drake Well, drilled by Edwin Drake near Titusville, Pennsylvania., in August 1859, kicked off a bonanza that effectively birthed the U.S. oil industry.

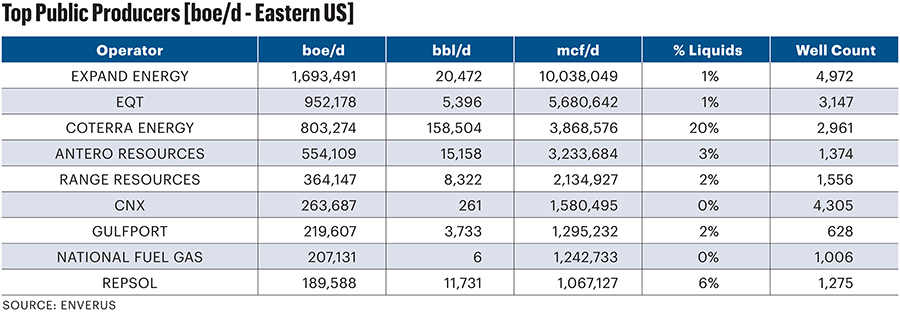

But gas is still king in Appalachia, and the basin is home to some of the nation’s largest natural gas producers. EQT Corp., second only to Expand Energy on a gas production basis, owns leasehold spread across Pennsylvania, West Virginia and Ohio.

Across the entire Appalachian Basin, Crowley has identified roughly two dozen companies that could be logical sellers or could potentially sell off non-core Appalachia asset packages over the next two years or so.

Private equity-backed E&Ps probably make up about half of that list, he said.

By private equity standards, several of the investments in E&Ps operating in the region are relatively mature—some sponsors have held onto their Appalachia investments for 10 years to 12 years at this point, Crowley said. PE firms may look to monetize their investments.

The third category of potential Appalachia dealmaking could focus on the small- to mid-cap publics generating a healthy amount of investor buzz.

“Some of the smaller public operators in Appalachia are logical candidates to be taken out or merged into somebody else,” Crowley said.

Most of the biggest M&A deals inked across Appalachia in recent years included some component of midstream capacity, Crowley said.

EQT paid $5.5 billion in stock to acquire Equitrans Midstream, the developer behind MVP.

Integrating midstream into M&A transactions in Appalachia isn’t as big of a hang-up as it can be in other basins. Some operators, such as Occidental Petroleum, are looking to divest midstream interests to pay down other debts.

But midstream access is a key consideration in Appalachian dealmaking.

“Appalachia is basically producing right on the brink of its takeaway capacity, so everybody’s competing for offtake,” Crowley said. “Having control of your midstream is important to protect yourself in that regard.”

Recommended Reading

Ovintiv Closes Montney Acquisition, Completing $4.3B in M&A

2025-02-02 - Ovintiv closed its $2.3 billion acquisition of Paramount Resource’s Montney Shale assets on Jan. 31 after divesting Unita Basin assets for $2 billion last week.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

Prairie Operating to Buy Bayswater D-J Basin Assets for $600MM

2025-02-07 - Prairie Operating Co. will purchase about 24,000 net acres from Bayswater Exploration & Production, which will still retain assets in Colorado and continue development of its northern Midland Basin assets.

Ring Energy Bolts On Lime Rock’s Central Basin Assets for $100MM

2025-02-26 - Ring Energy Inc. is bolting on Lime Rock Resources IV LP’s Central Basin Platform assets for $100 million.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.