Second-quarter 2024 financial results for 34 publicly traded U.S. oil E&Ps suggest increasing well productivity is helping these companies reduce production costs on a per barrel basis and freeing up cash for other uses, including shareholder returns. (Source: Shutterstock)

U.S. E&Ps, averaging a record 13.1 MMbbl/d through the first eight months of 2024, are on track to becoming the world’s top producing country for the seventh consecutive year, the U.S. Energy Information Administration (EIA) says.

But they’re setting records without spending more.

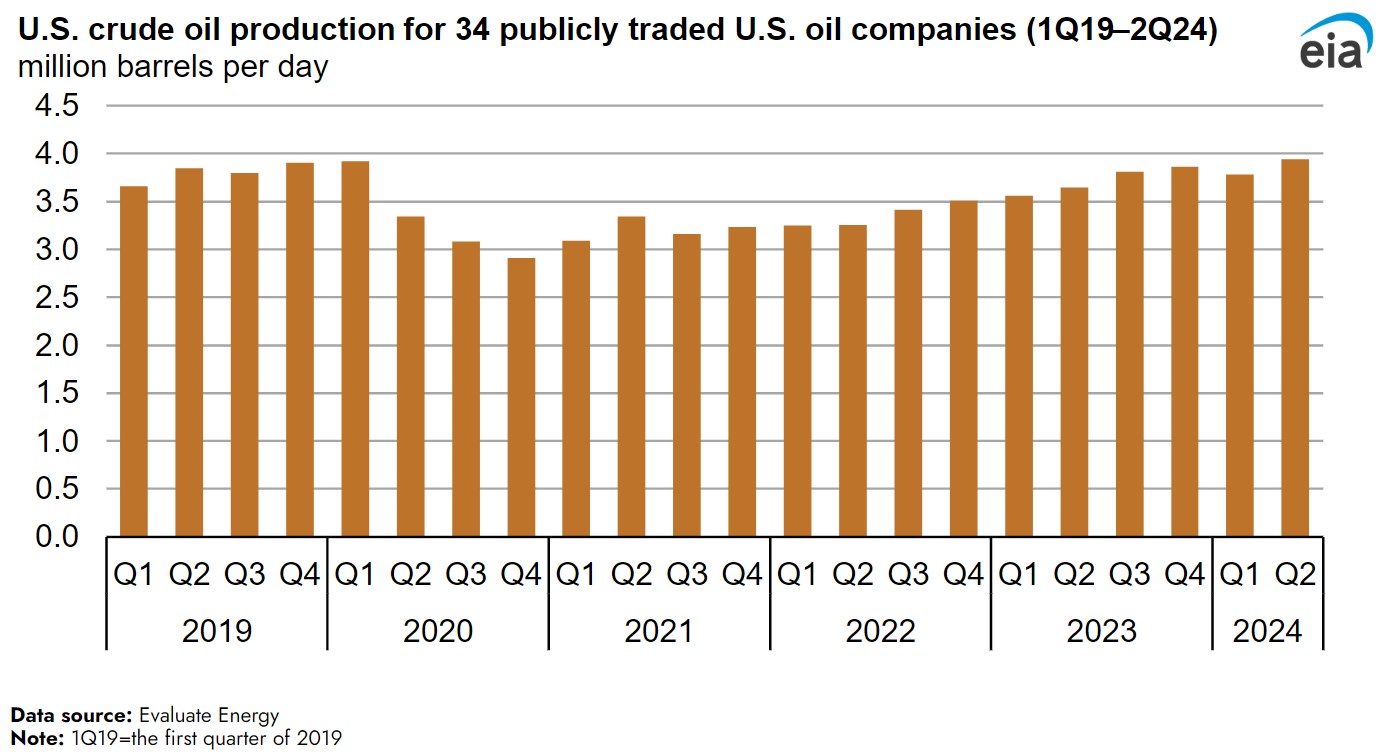

Over the past two years, publicly traded E&Ps have generally increased production, with oil volumes in second-quarter 2024 averaging 3.9 MMbbl/d— the most in the past five years.

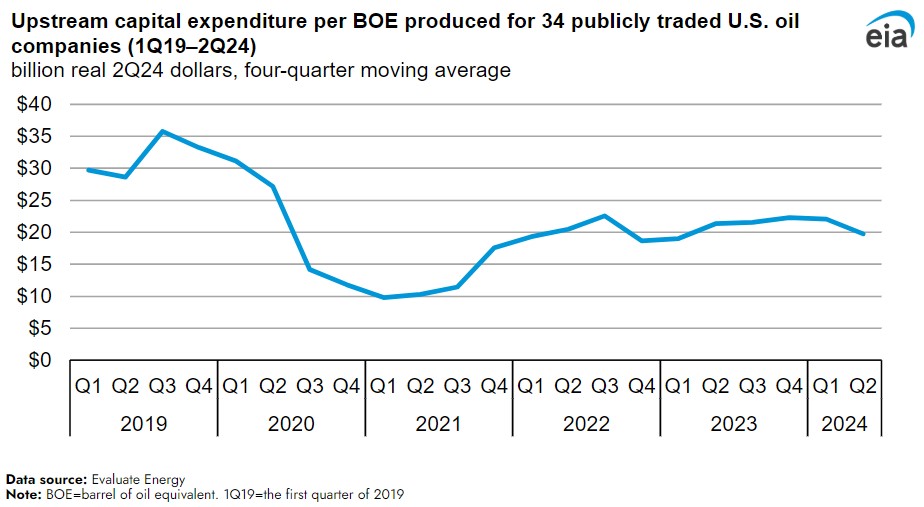

Even as production has increased, 34 public companies examined by EIA have kept costs flat. Upstream capex per boe has averaged around $21/boe in real terms since mid-2022 while oil increased by 21%. By comparison, in 2019, the E&Ps produced crude oil at an average cost of $32/boe.

At the same time, E&Ps continue to send cash back to shareholders through dividends and stock buybacks, according to an EIA analysis released on Dec. 11.

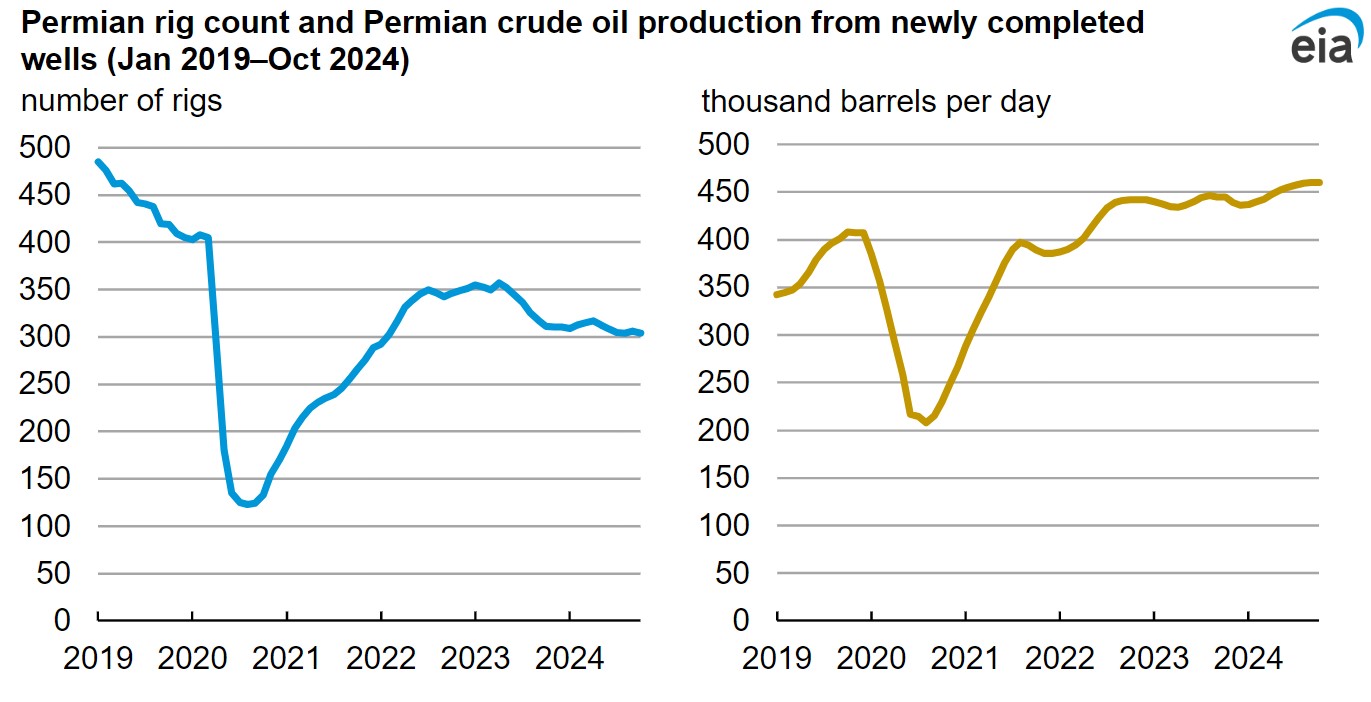

“Increasing well productivity, primarily due to advances in horizontal drilling and hydraulic fracturing technologies, has been a key driver in U.S. crude oil production growth, enabling U.S. producers to extract more crude oil from new wells drilled while maintaining production volumes from legacy wells drilled previously,” EIA said in a Dec. 12 report.

Second-quarter 2024 financial results for 34 publicly traded U.S. oil E&Ps suggest increasing well productivity is helping these companies reduce production costs on a per barrel basis and freeing up cash for other uses, including shareholder returns.

In the Permian Basin, the largest source of crude oil production growth in the EIA’s November Short-Term Energy Outlook forecast, output from newly completed wells has steadily increased over the last two years even as the number of active drilling rigs has declined.

Many publicly traded E&Ps have also been slower to return to pre-pandemic production volumes compared with private companies. Instead, publics have prioritized increasing shareholder returns and debt reduction while limiting production growth in response to post-pandemic supply chain issues and cost inflation.

EIA’s analysis doesn’t represent the entire sector, since private companies weren’t included. EIA excluded private E&Ps because they do not publish financial reports.

The included 34 publicly traded companies accounted for 30% of U.S. crude oil produced in second-quarter 2024.

Recommended Reading

Surge Closes on Divestment of Alberta Non-Core Gas Assets

2024-12-20 - Surge Energy said it has focused on developing its core Sparky and southeast Saskatchewan crude oil assets, leaving the Alberta non-core assets undercapitalized.

Gevo Completes $210MM Red Trail Assets Deal for Ethanol Plant

2025-02-05 - Gevo has renamed an ethanol production plant and CCS assets acquired from Red Trail Energy as “Net-Zero North.”

ConocoPhillips to Sell Interests in GoM Assets to Shell for $735MM

2025-02-21 - ConocoPhillips is selling to Shell its interests in the offshore Ursa and Europa fields in the Gulf of Mexico for $735 million.

US Energy Corp. Closes Divestiture of East Texas Assets

2025-01-07 - U.S. Energy Corp. said proceeds from the divestiture will be used to fund the company’s industrial gas project in Montana.

Eni, PETRONAS Form Gas Development JV in Indonesia, Malaysia

2025-02-27 - Eni and PETRONAS believe the joint venture will lead to synergies that create a leading LNG player in the region.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.