If shale operators are to maintain their competitive advantage in a changing policy, technology and price environment, they will need a more skilled and flexible workforce.

The shifts in shale production growth over the course of the post-2014 oil price “swoon” and subsequent recovery have demonstrated that operators can respond quickly to price alterations. Companies have relied on remote drilling and other digitally enabled technologies to increase worker productivity.

As they plan for a future where costs will need to be kept lower for longer, shale companies will increasingly turn to technological solutions to achieve this, while keeping productivity high. Digitalization also will allow companies to maintain headcount numbers below the level seen during the oil price peak even as the industry recovers. In a bid to become leaner, many shale operators shed employees in noncore areas and squeezed asset teams during the price downturn. However, the workers they employ in the future will need to be techsavvy and open to new ways of working.

Skills shortage

Shale operators face a looming skills shortage caused by two factors: one stemming from historical events and one that is just beginning to impact companies. The first is the retirement of a generation of talent recruited before the 1986 oil price collapse. Because of the low levels of hiring in the late ’80s, there likely will be insufficient skilled personnel in subsequent generations of workers to replace these individuals. The second is the need to recruit personnel with expertise in digital tools. This is made more difficult by the intense competition for graduates with such skills. The overlapping skills needed include higher level mathematics and computer science.

These challenges have prompted some shale operators to confront their human resources issues. Internal training programs are fostering more organizational learning and are facilitating knowledge transfer between generations. Companies are using programs to provide employees who already possess ample domain knowledge with digital expertise, similar to the training initiatives undertaken when desktop computers became commonplace. Combining domain expertise with mathematics and computer science skills can more easily allow companies to access needed fields such as data science, data processing and machine learning (Figure 1).

By providing more flexible work options, companies are encouraging older workers to stay on longer to minimize the industry’s skills gap—mirroring a trend in the wider U.S. economy where workers over 65 make an increasingly important contribution. They also are recruiting and training workers needed to perform essential tasks such as welding and driving trucks. Companies are investing in scholarships and college partnerships to encourage students majoring in science, technology, engineering and mathematics subjects to join the industry.

Keeping costs in check

Technological advances are already enabling shale operators to reduce the number of employees they need. For example, optimizing the choke settings on a gas-lift well used to take one engineer a day working across multiple system interfaces. However, by applying robotic process automation technologies, that time can be cut to a couple of hours. Similarly, technology startups are developing online tender platforms for oilfield services such as sand delivery. By accepting the lowest bid for a particular job, shale operators can keep costs in check.

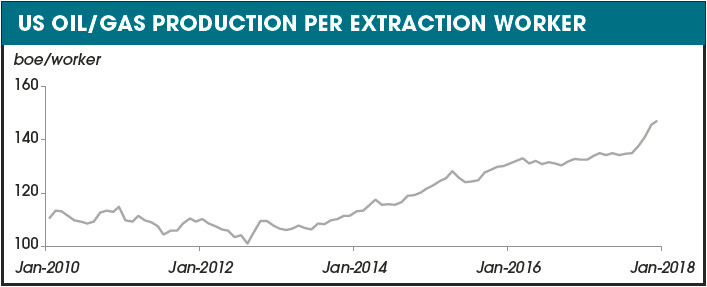

The employment picture for shale operators has changed significantly following the slide in the oil price. U.S. employment for oil and gas extraction fell from more than 200,000 in October 2014, before the drop, to a low of 145,000 in mid-2017. Since then, employment numbers have risen by only about 5,000 and remain near 2007 levels when the shale industry was in its infancy. Various factors have contributed to the relatively muted upturn in the headcount: in particular, technology has boosted employee productivity. One person can produce nearly 150 boe, up from 110 boe a decade ago (Figure 2). A renewed focus by shale operators on their core acreage, combined with the growth in robotics and remote drilling, also has reduced the technical workforce required to develop a well.

Wages will still need to increase if the shale industry is to draw in workers. The rise of the shale industry coincided with a period of growth following the Great Recession. Economic conditions are different this time around. Today’s U.S. labor market is far tighter, enabling workers in many sectors to demand pay hikes. However, while wages in the wider U.S. economy have risen by more than 5% since January 2017, when OPEC implemented its landmark supply-cutting deal, wages in oil and gas extraction have increased by less than 1%. Over the same period, oil prices have risen more than 20%. This mismatch is creating uncertainty about whether shale can compete with other industries to attract a stable supply of high-quality prospective employees.

Need for flexibility

Exacerbating the recruitment challenge for shale operators are their rapidly changing requirements. In the shale industry of the future, workers will need a far broader combination of skills than they possess today. Employees will require digitally driven skills in computer programming and new fields, such as advanced analytics, that can be deployed to solve complex engineering and technical problems on shale’s frontline. Domain expertise, such as in geology and geoengineering, will still be important to employers and act as a means of entry to the industry. However, possessing such specialist knowledge won’t be sufficient for workers to prosper.

In a data-driven world in which companies are aiming for greater organizational flexibility, employees also will need to work in new and more agile ways. They will need to adapt to industry trends including increased business unit autonomy, greater employee empowerment and accountability, factory-style execution and more cross-functional teams. Companies can address these challenges by adopting new approaches. For example, they can pair experienced staff with younger workers trained in emerging fields such as data science, and they can adopt continuous learning programs that allow existing workers to update their skill sets. Companies also will need to revamp the talent management and competency frameworks that define roles and govern skills development programs.

Competition between industries for candidates with these much sought-after digital skill sets is going to get fiercer. Before the oil price drop, petroleum engineering was the best paid career option for U.S. graduates and attracted the cream of the crop. Today a degree in data science is the ticket to a well-remunerated job right out of college. The difference is that graduates with strong data skills are needed in almost all industries as companies embrace the benefits of digitalization. Their skills are highly transferable, and graduates can pick and choose between competing offers.

With a shortage of data science graduates to meet the demand from U.S. companies, shale operators will have to spruce up their compensation programs and total remuneration packages, and tackle the industry’s slow career progression if they want to attract digital natives. They also will have to create a more compelling value proposition in other ways. Millennials want to live in cities. So part of a viable employment solution will involve using digital technologies and processes to transmit oil and gas data to employees located in urban centers, a shift from the old model of sending workers to remote outposts close to hydrocarbon deposits.

Have a story idea for Industry Pulse? This feature looks at big-picture trends that are likely to affect the upstream oil and gas industry. Submit story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.