Private-equity sponsors are obviously alert to investors’ changing interests, and energy is no exception in terms of shift in sentiment. Current trends indicate the renewable-energy sector is capturing increasing air time with investors.

And it’s happening at a time when conventional energy has been roiled by high commodity-price volatility and steeply lower liquidity in A&D and public-capital markets.

But, as with many maturing markets, there are factors that have yet to unfold in a variety of areas, such as absolute returns, returns on a risk-adjusted basis and tax-related issues, to name just a few.

It’s clear that societal factors, including ESG (environmental, social and governance) considerations, also play a part. This may prompt some investors—depending on their mandates—to seek a more diversified energy portfolio that includes renewables.

In addition, renewables may meet some investors’ goals in terms of visibility of a more consistent stream of returns over an extended time horizon.

Other questions quickly arise. How large are financing requirements of the growing renewable sector? Should the sector be viewed as a competitor to conventional energy or as a complementary component in an energy portfolio? Are lower perceived levels of operating risk on the mark, and are rates of return in line on a risk spectrum? How long before projects generate initial returns?

Sentiment has shifted in favor of renewable investments, although this could partly reflect the low levels of capital returned to investors due to markedly fewer assets being monetized from earlier conventional energy investments, according to Jeff Eaton, a partner with global placement agent Eaton Partners LLC, which specializes in funding alternative investments.

“We’ve had more than a couple of renewable-focused energy funds that have been oversubscribed, one being a wind-focused fund and another being a water-focused fund,” Eaton said.

“We’re seeing much more demand for those types of investments than for more traditional oil and gas investments right now. The bid for traditional oil and gas investments is as low as I’ve seen it.”

By comparison, “our oil and gas funds have been very difficult to raise over the last couple of years. We’re seeing LP [limited partner] investors reduce their allocations to fossil-fuel investments—for environmental and other impact reasons—and reallocate some of the money to renewables and alternatives. So that is definitely happening.”

Those paring conventional oil and gas investments include “several of the European pension funds and sovereign-wealth funds as well as some of the U.S. university endowments, which are proactively making that shift,” he said.

“Additionally, I would say that there are other investors that will maintain their investments in traditional oil and gas. But they feel that they’re over-allocated, purely because they just haven’t seen a lot of distributions back to them since there haven’t been many exits,” that is, sales of portfolio companies by private-equity funds.

“We don’t think that the days of raising an oil and gas fund are gone forever,” he added. “We just think that the market is pretty fatigued—because there’s not a lot of liquidity that’s going back to investors in that space, and, so there’s not a lot of money to be reinvested.”

Return targets vary

Within an evolving energy industry, the renewable sector has a complementary role to play alongside conventional energy investments, according to David Finan, partner with EIV Capital LLC, which has included a renewable component in each of its energy funds.

“I don’t think investors view it as a binary ‘either/or’ investment decision; I believe investors view the two as complementary,” Finan said.

“Renewables form a meaningful part of the value chain now. Anyone who doesn’t have a specific mandate for just one part of the value chain will start to look at the renewable sector. It’s growing as a percent of the overall energy pie.”

Based in Houston, EIV targets private-equity-type returns for its investors across the energy value chain with a focus on growth-oriented opportunities associated with long-term offtake agreements. It runs a diverse energy portfolio that leans predominantly toward midstream investments.

“We don’t differentiate between a renewable return profile and a traditional midstream return profile,” Finan said. “The investment merits have to stand on their own.”

Renewables do provide diversification. “For example, the cyclicality of renewables is different than that of oil and natural gas. Our renewable business is creating more EBITDA today than it did at any time in the past based on higher end-market pricing versus traditional WTI or Henry Hub pricing.”

Returns in the renewable sector vary across the board. A segment of investors in the space are comfortable with targeting lower rates of return, he added.

“For the most part, they’ve structured long-term offtake agreements [e.g. power-purchase agreements, or PPAs] that have a 10- to 20-year time frame. Those agreements provide lower variability to the cash flow profile of the underlying asset, and that can be attractive to institutional investors.”

Renewable assets that carry a 10- to 20-year contract typically generate single-digit rates of return, according to Finan.

“If you’re willing to take construction risk, you can get a higher return, and, if you’re willing to take development risk, you can get a much higher return,” he observed. “Folks who are willing to ride the development cycle of renewables can get attractive returns vis-à-vis conventional energy investments.”

Rather than chasing these larger projects typically generating lower returns, EIV is focused on smaller potentially higher-return assets that fit its fund size. EIV typically looks for investments in the $20 to $80- million range, although it has the ability to pursue investments of up to $200 million. Each of the EIV funds usually has eight to 10 investments, including a renewable investment, with similar-target returns.

“We’re not changing our underwriting criteria just because it’s a renewable deal,” Finan said, adding that “we’re very upfront” with potential partners. People who are “entrepreneurial-minded” in the renewable space realize “it’s not just the cost of capital; it’s the experience of the investor and the ability to be nimble alongside the entrepreneur that tends to win the day.”

While return profiles are front and center in an investment, Finan acknowledges the need to recognize the growing importance assigned to the renewable sector when investors consider committing funds.

“ESG is top of mind today,” he said, “so it’s prudent to take into account the environmental impact of investing when renewables can be a component of that mindset.”

EIV predominantly has a growth-equity style of investing. In renewables, “the role we play in the market is in working with the entrepreneur to do the original development. Then we work to find a yield-oriented buyer suited to own the asset on a long-term basis.

“And then we’ll go on and do it again with the entrepreneur.”

One renewable investment was in Mas Georgia LFG LLC, a company formed to develop a landfill gas-to-energy project in the Atlanta metro area. The gas, which would have been flared, was cleaned so it could be used to produce energy under 20-year contracts. Three such units were built.

Another investment was in AMP Americas LLC. Based in Chicago, AMP operates CNG fueling stations for heavy-duty trucks, such as 18-wheel tractor-trailers used by large fleet operators, under a long-term take-or-pay contract.

Also, AMP takes methane from dairy farm cow manure, converting the gas to pipeline quality and sold as “renewable” across the country.

EcoVapor Recovery Systems LLC, also funded by EIV, uses advanced vapor-recovery units and oxygen-removal units positioned on tank batteries to upgrade gas, which would otherwise be flared, into pipeline-quality gas. This is especially helpful in environmentally sensitive areas. By eliminating flaring, E&Ps increase revenue, accelerate permitting and reduce their carbon footprint.

One interesting element of the renewable sector is that, in building a portfolio of investments, “it’s not only a question of diversity across basins and across hydrocarbon-mix,” Finan said. “You can also create diversity across end markets. Renewables provide a tool to generate a more diverse investment profile. We like that diversity.”

Power for data centers

In moving more meaningfully into the renewable sector, Quantum Energy Partners LLC is recognizing an extension of the energy value chain beyond the traditional upstream and midstream markets and into fast-growing end markets, according to managing director Sean O’Donnell.

“As an energy private-equity firm, one of our core competencies is finding, developing and delivering energy to the marketplace,” O’Donnell said. “The fact is that the points and methods of energy production and consumption are changing.

“We seek to partner with best-in-class management teams who are capable of identifying and executing on how to maximize as much of that economic value chain from the various points of production through to the point of consumption or sale.”

A number of factors have “unlocked the size and scale of the renewables market,” O’Donnell said. One is that, in addition to traditional utility buyers, there is increasing demand from corporate buyers, whose largest operating expense may be electricity. Typically in the technology sector, in some cases these buyers target sourcing 100% of their electricity requirements from renewable resources within the next decade or so.

“The biggest change on the demand side for U.S. renewable energy in the last several years has been the emergence of non-utility corporations becoming direct, dominant buyers of renewables,” O’Donnell said.

Well-known names on the list of renewable buyers include Google LLC owner Alphabet Inc., Apple Inc. and Facebook Inc. “The tech companies, in particular, have been the most aggressive buyers of renewable PPAs.”

As expansion of hyper-scale data centers continues, tech-sector companies are increasingly focused on the energy costs associated with operating these. The cost of electricity is the largest line item in their operating expenses, O’Donnell said, making for a priority of locating new centers based on where this cost can be minimized.

Additional factors driving development of the renewable sector include substantial capital available to fund projects; significant technology changes, particularly in storage, that are reducing costs and creating new revenue models for developers; and an evolving regulatory and incentive framework, he added.

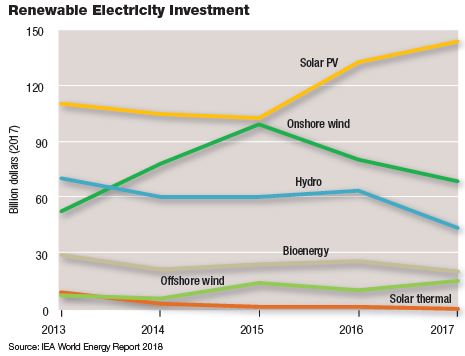

The renewable industry has invested $40- to $45 billion in project construction in the U.S. alone in each of 2014, 2015 and 2016, according to O’Donnell. “Going forward, even if it levels out at around that amount, it’s a massive business that competes on an aggregate size with much of what you’re seeing in the upstream space,” he commented.

A 5% share

Customers are far from confined to the technology sector and traditional utilities. For example, late last year, Exxon Mobil Corp. signed a 12-year deal to purchase 500 megawatts of wind and solar power in the Permian Basin from Denmark’s Orsted A/S. According to Bloomberg, the PPA is the largest ever renewable-power contract signed by an oil producer.

Quantum Energy Partners has been evaluating the renewable space for almost a decade, O’Donnell said. Its initial investments in wind and solar were made in its fifth fund. Last summer, it closed its seventh fund, Quantum Energy Partners VII LP, with equity commitments of about $5.6 billion.

Upstream projects are, as usual, expected to be allocated the largest portion of the fund at about 75%. Renewables—along with oilfield service, midstream and select downstream projects, including petrochemicals—are expected to make up the balance of the fund.

Renewables’ share of possibly 5% is “not a bad starting point,” O’Donnell said, but the project pipeline is in an early-development stage. “While the development dollars on an early-stage renewable are relatively small, if any of the projects secures a PPA, the dollars to develop and construct a utility-scale project get pretty large.”

O’Donnell is quick to emphasize that projects are evaluated on a risk-adjusted basis, especially given the markedly different profiles of renewable and traditional oil and gas investments. After one to two years of permitting and two to three years of construction, initial cash-flow-based returns may not come for three to five years in contrast to payback in as few as one to three years in most oil and gas plays.

“Renewables tend to be more complicated on the front end,” he said. “But once a project is up and running, it typically generates a far more ‘steady-state’ stream of revenues under a PPA, which is what the lenders and infrastructure-owners like.

“They love to see a 10- or 20-year revenue profile with an investment-grade utility or a technology firm on the other side. Capital will flock to that project and create an interesting monetization opportunity for the developer, sometimes before project construction or operations begin.”

Compared with historical private-equity returns, “it’s a lower absolute return—no doubt about it. But we focus on risk-adjusted metrics in our fund’s portfolio construction,” O’Donnell said.

“If you have a management team with the expertise and capability to take the highest-risk, early-stage portion of the project—the permitting, construction, development—and you believe you can control those risks to get to a 20-year PPA, there is value to be created by private equity in that part of the capital-formation cycle in renewables.

“There is a large universe of infrastructure funds, sovereign-wealth funds and even utilities that aren’t well suited to take on the higher permitting, construction and development risks. But they love the economic profile of those assets when they are operating.

“We’ve made returns in renewables that compete with our upstream business when we’ve taken projects through the development and construction cycle before divesting them.”

The skillset developed by private equity elsewhere in energy can also apply to the renewables sector, according to O’Donnell. “As I mentioned earlier, our core competency in energy is to ‘find, develop, deliver,’” he said.

“What we are also skilled at is moving rapidly to de-risk and deploy technical advances. Just look at the upstream space in terms of the unconventional revolution: identifying a concept, de-risking it and converting it into development by companies at scale with technology adaptions. It’s changed the landscape of U.S. energy.”

A key factor that needs to be added to a renewable strategy is a sharp focus on the customer, he said. “In addition to utilities, there are new, large, direct customers emerging in the form of corporate buyers,” he added.

“Who the buyers are matters. Renewable power is different from sending oil to a hub, where you don’t need customers to commit to buy all your barrels. You need to make sure you find your reliable, long-term customer in renewables—because you need that signed PPA for the third-party capital formation and value-maximization process.”

O’Donnell described the renewables sector as having more diversified avenues to growth in revenues, reflecting, in part, rapid changes in technology.

The trend is real

Quantum was the lead investor in raising $240 million for ChargePoint Inc., which manufactures electric-vehicle charging stations along with associated hardware and software solutions. Quantum supported the company in assembling an investor consortium that included a sovereign-wealth fund, major oil producers and a vehicle manufacturer to take part in a “pure-play electric-vehicle-growth trend,” said O’Donnell.

“ChargePoint has, by far, the best management in the space,” he said. “It manufactures the charging station that goes on the wall of your garage, at the curbside in a campus or a retail parking lot, or in a vehicle-fleet depot. It is the U.S. market leader in terms of installed hardware, and it has a unique, networked, software solution, which is a powerful tool for customer- and energy-management application.”

The software tells the station’s owner who is using the system, what type of customer and energy consumer the user is, where the customer is located, and how to optimize electricity cost while providing the charging service, he explained.

O’Donnell acknowledged that a tension may exist between striving for returns and meeting ESG goals. “You have to have an ongoing dialog with your LPs across a variety of investment and portfolio considerations, including ESG,” he said.

“We designed an ESG policy and framework that matches their values with what we believe we’re capable of executing. Principally, it’s about risk-adjusted returns.

“But, secondly, as the energy space is broadly transitioning, you need to be investigating—if not investing in—each of the different asset classes that, over time, will become part of the new points of energy production and consumption.”

He added, “There’s no doubt that the secular trend to do more renewables—rather than less—is real. It’s a trend that is not going away, so we need to pay close attention to it and invest where our skill and capital position us to earn competitive risk-adjusted returns.”

On a risk-adjusted basis, “the rapid change in the buyer universe of renewables and the pace of technology advances do create the opportunity for above-average returns. The key is developing a strategy to pair leading and commercial solutions with the most active buyers in the market. And that is our current focus.”

Recommended Reading

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Trinity Gas Storage Adds Texas Greenfield Gas Storage Complex

2025-01-20 - Trinity Gas Storage has opened a 24-Bcf gas storage facility in Anderson County, Texas, to support the state’s power grid.

ONEOK, Enterprise Renew Agreements with Houston’s Intercontinental Exchange

2025-01-29 - ONEOK and Enterprise Product Partners chose to continue their agreements to transfer and price crude oil with Houston-based Intercontinental Exchange.

Tidewater Sells Canadian Roadway Network for CA$24MM

2025-03-06 - Canadian midstream company Tidewater Midstream and Infrastructure plans to use proceeds to pay down debt.

WaterBridge Starts Open Season for Produced Water Pipeline

2025-04-01 - Water midstream company WaterBridge plans to develop transport capacity out of the Delaware Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.