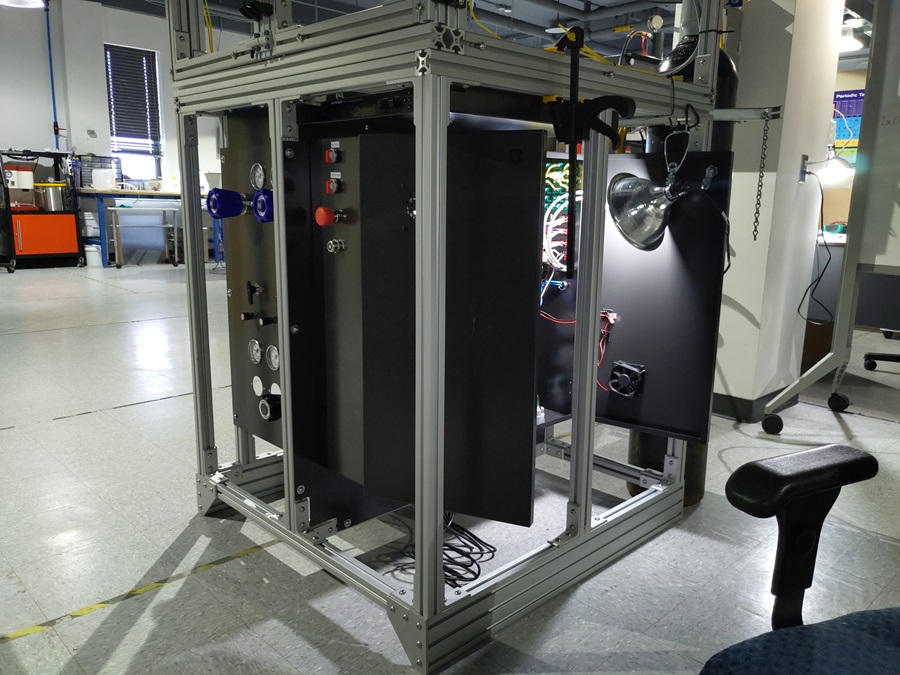

Shell plans to test this system to demonstrate the technology’s suitability and applicability for its renewable hydrogen needs and possibly for ammonia production. (Source: Shutterstock)

Oil giant Shell plans to test water vapor electrolyzer technology developed by Wisconsin-based Advanced Ionics, aiming to lower hydrogen production cost, the startup said Sept. 17.

Part of Shell’s GameChanger program, the pilot project is intended to help scale Advanced Ionics’ second-generation, 800 cm2 stack and move it toward commercialization. Shell plans to test this system to demonstrate the technology’s suitability and applicability for its renewable hydrogen needs and possibly for ammonia production, Advanced Ionics said in a news release.

“We’re excited to support Advanced Ionics through the Shell GameChanger program,” said Ed Holgate, principal for Shell GameChanger. “Their innovative intermediate temperature technology, which utilizes available steam to reduce electricity consumption, promises to potentially enhance efficiency and sustainability in the petrochemical sector. Shell GameChanger is the perfect program to validate, de-risk, and nurture such groundbreaking solutions, providing the resources and expertise needed to bring them to market.”

Advanced Ionics’ new class of electrolyzers uses process or waste heat already present at industrial facilities to help bring down costs. The water vapor electrolyzer, called Symbion, is made using materials and steel that are widely available.

The company says its technology enables the production of green hydrogen for less than $1 per kilogram. By using process or waste heat, Advanced Ionics said it can produce hydrogen for 35 kWh/kg, up to 40% less electricity per kilogram of hydrogen produced than alkaline and proton exchange membrane electrolysis technologies.

“The petrochemical industry will struggle to decarbonize without an economic path to producing and selling green hydrogen and derivatives such as green ammonia,” said Advanced Ionics CEO Chad Mason. “Through our partnership with Shell GameChanger, we’re proving a new way to decrease the cost of green hydrogen through more efficient, symbiotic operations.”

RELATED

Recommended Reading

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.