Along with two mergers, Sitio’s $7.24 billion year of M&A includes the acquisitions of Foundation Minerals and Momentum Minerals. (Source: metamorworks/ Shutterstock.com)

Sitio Royalties Corp. closed its fourth and largest transaction of 2022 on Dec. 29, combining with Brigham Minerals Inc. in a match that brings the two companies’ Permian Basin royalty interests together.

The merger, valued by the companies at $4.8 billion, comes a day after Brigham’s stockholders voted in favor of closing the merger on Dec. 28. Brigham reported that more than 81.2% of the shares of Brigham common stock were represented, and more than 99.7% of the votes cast were in favor of the merger.

For Sitio, the deal caps off a year in which the company was formed through the merger of Desert Peak Minerals and Falcon Minerals Corp. in June. Along with its two mergers, Sitio’s $7.24 billion year of M&A includes the acquisitions of Foundation Minerals and Momentum Minerals. Sitio has accumulated about 260,000 net royalty acres through more than 185 acquisitions to date.

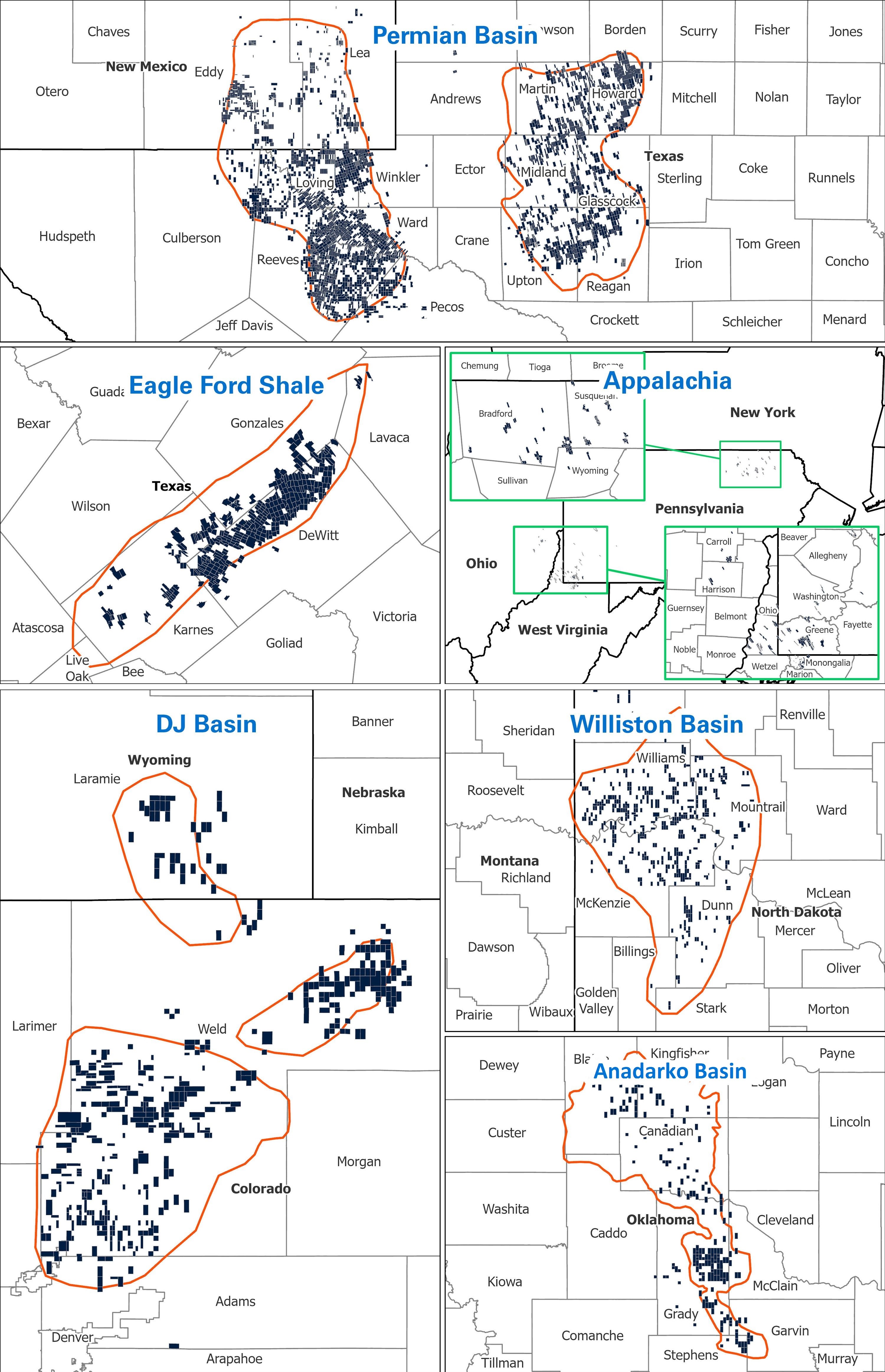

With the addition of Brigham, based in Austin, Sitio will consist of a total of 259,510 net royalty acres, as well as pro forma net production of 32.8 Mboe/d in the second quarter of 2022 and 50.3 net line-of-sight wells operated. Brigham's assets include positions in the Delaware and Midland basins in West Texas and New Mexico, the Anadarko Basin of Oklahoma, the Denver-Julesburg Basin in Colorado and Wyoming and the Williston Basin in North Dakota.

Sitio Royalties 2022 M&A |

||

|---|---|---|

| Announced | Seller | Value ($MM) |

| June 7 | Desert Peak Minerals; Falcon Minerals Corp. | $1,900 |

| June 27 | Foundation Minerals LLC; Quantum Energy Partners | $323 |

| June 27 | Momentum Minerals LLC; Apollo Global Management | $224 |

| Sept. 6 | Brigham Minerals Inc. | $4,800 |

Under the terms of the merger announced on Sept. 6, Brigham stockholders will receive 1.133 shares of Class A common stock of Snapper Merger Sub I Inc. (New Sitio) for each share of Brigham Class A common stock owned, and 1.133 shares of New Sitio Class C common stock for each share of Brigham Class B common stock owned.

Brigham Minerals Holdings LLC unitholders will receive 1.133 common units representing limited partnership interests in Sitio Royalties Operating Partnership, LP for each unit in Opco LLC owned.

In addition, in connection with the closing of the merger, Gayle Burleson, Jon-Al Duplantier, Richard Stoneburner and John ("J.R.") Sult will join the New Sitio board of directors. Each served on Brigham's board of directors.

Brigham Class A common stock is no longer listed for trading on the New York Stock Exchange.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.