The investment will allow Slant III to pursue acquisition and development opportunities in the Permian Basin, the company said. (Source: Slant Energy)

Newly formed Slant Energy III LLC has secured an equity commitment from Dallas-based private equity firm Pearl Energy Investments, the upstream E&P said Feb. 25.

The investment will allow Slant III to pursue acquisition and development opportunities in the Permian Basin, the company said.

Slant III was co-founded by Stewart Stover and Jeff Etienne. The Slant management team has had a successful track record in acquiring and then optimizing upstream assets in various onshore basins.

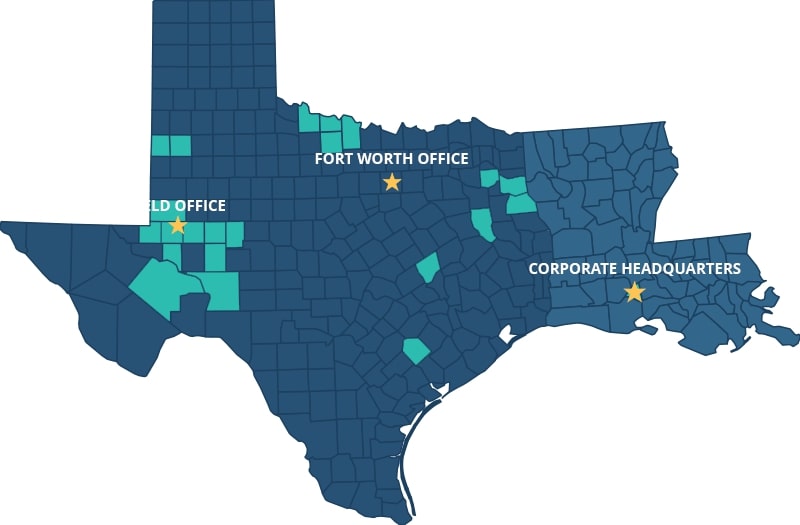

Slant I was formed in 2016 and secured a $30 million equity commitment from Pearl. The E&P scooped up assets in North Texas, East Texas and the Eastern Shelf before divesting in 2023.

Slant II secured a $90 million commitment from Pearl in 2022 and is currently operating and growing assets in the Permian’s Midland Basin, according to Slant Energy’s website.

“Pearl is excited to continue our long-standing, successful partnership with the Slant team,” said Billy Quinn, managing partner of Pearl. “Since 2016, Slant has created value across multiple basins and through various operating strategies. We expect the market to provide unique opportunities for Slant to capitalize in their focus areas.”

Kirkland & Ellis LLP served as legal adviser to Slant III and Willkie Farr & Gallagher LLP served as legal adviser to Pearl in connection with the formation of Slant III.

Recommended Reading

Voyager Midstream Closes on Panola Pipeline Interest Deal

2025-03-19 - Pearl Energy Investments portfolio company Voyager Midstream Holdings has closed on its deal with Phillips 66 for its non-op interest in the Panola Pipeline.

Howard Energy Partners Closes on Deal to Buy Midship Interests

2025-02-13 - The Midship Pipeline takes natural gas from the SCOOP/STACK plays to the Gulf Coast to feed demand in the Southeast.

Summit Acquires Moonrise Midstream Assets to Alleviate D-J Constraints

2025-03-10 - A Summit Midstream Corp. (SMC) subsidiary will acquire Moonrise Midstream from Fundare Resources Co. in a cash-and-stock deal valued at $90 million.

Phillips 66 Buys EPIC’s Permian NGL Midstream Assets for $2.2B

2025-01-07 - Phillips 66 will buy EPIC’s NGL assets, including a 175,000 bbl/d pipeline that links production supplies in the Delaware and Midland basins and the Eagle Ford Shale to Gulf Coast fractionation complexes.

LS Power Completes Acquisition of Algonquin Power’s Renewables Unit

2025-01-09 - With the transaction’s closure on Jan. 8, LS Power formed Clearlight Energy to manage the acquired renewable energy assets.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.