The agreement enables early information sharing, technology innovation and other collaborative benefits expected to make subsea projects more economically viable. (Source: Shutterstock)

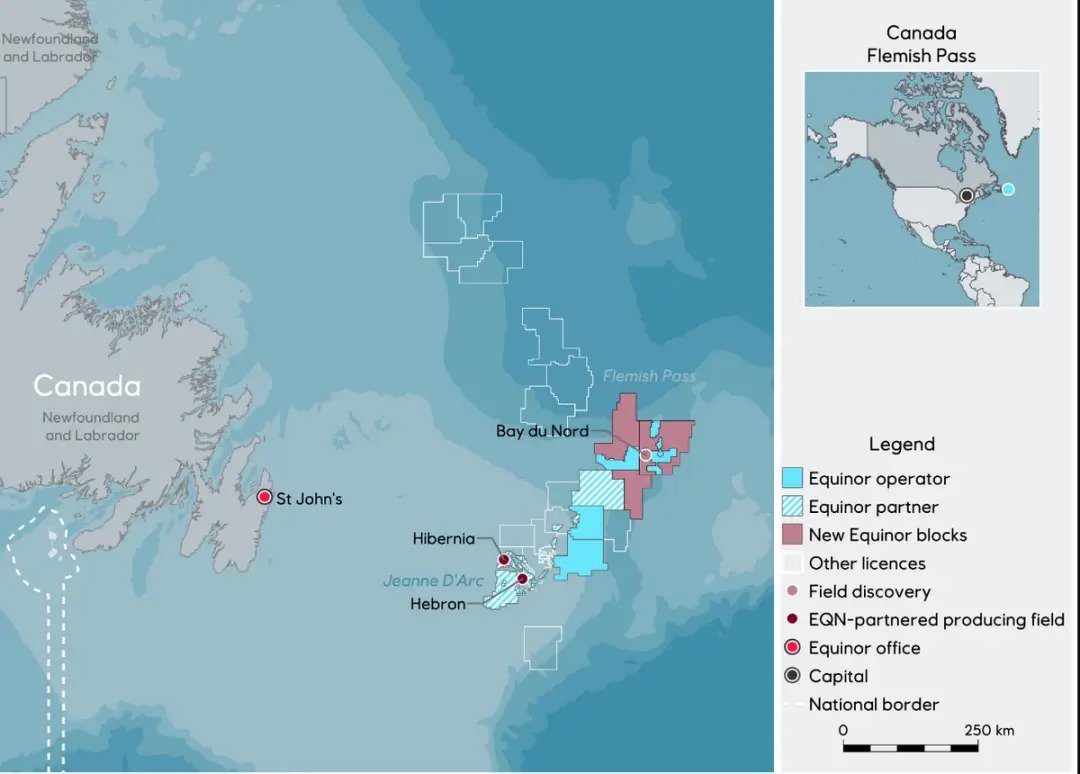

SLB and Subsea 7 announced May 2 that the Equinor ASA and the Subsea Integration Alliance, which comprises OneSubsea and Subsea7, signed a long-term strategic collaboration agreement that paves the way for exploratory work to begin on the Wisting Field offshore Norway and Bay Du Nord, offshore Newfoundland and Labrador, Canada.

The agreement enables early information sharing, technology innovation and other collaborative benefits expected to make subsea projects more economically viable, SLB and Subsea 7 said in separate press releases.

The agreement paves the way for collaboration to begin immediately on early, joint concept studies for two major projects. Under the same agreement, any resulting engineering, procurement, construction and installation work execution would be directly awarded to the alliance, if Equinor reaches final investment decision (FID) on the pair of projects.

Wisting is in the Barents Sea offshore Norway, and in November 2022, Equinor decided to hold off on the Arctic project due to ballooning project costs. Equinor operates the project with 35% interest on behalf of partners Aker BP with 35%, Petoro with 20% and INPEX Idemitsu with 10%.

Bay Du Nord is approximately 500 km northeast of St John’s, Newfoundland and Labrador, Canada, in 3,838 ft water depth. In May 2023, Equinor and partner BP decided to postpone FID on its $12 billion Bay Du Nord project for three years in an effort to lower project costs.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

EY: Three Themes That Will Drive Transformational M&A in 2025

2024-12-19 - Prices, consolidation and financial firepower will push deals forward, says EY.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.