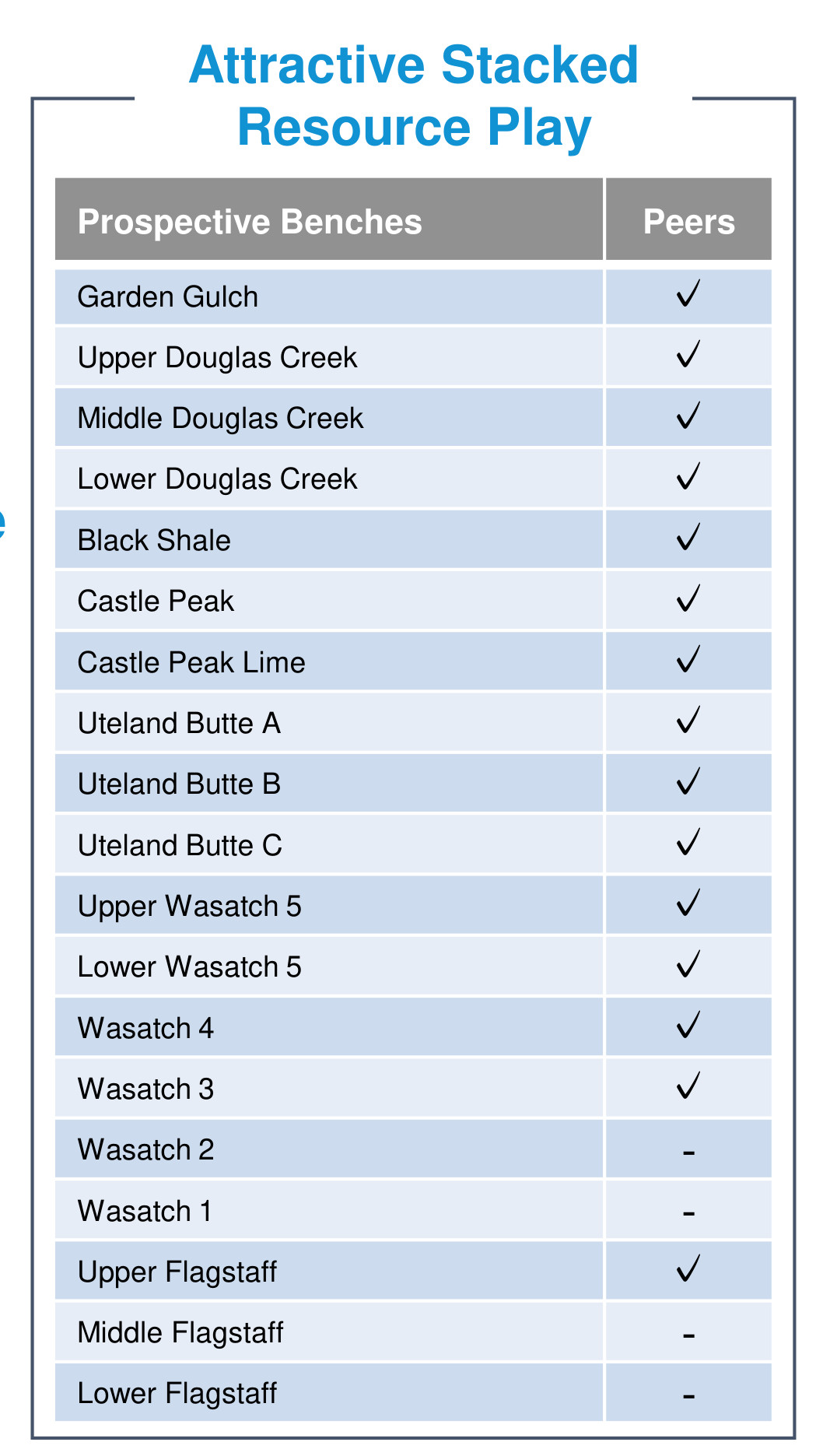

Uinta Basin operators SM Energy and Crescent Energy are landing laterals in new benches in the stacked, oily pay estimated to contain as many as 17 productive zones. (Source: Shutterstock)

Uinta Basin operators SM Energy and Crescent Energy are landing laterals in new benches in the stacked, oily pay estimated to contain as many as 17 productive zones.

SM put three wells in Douglas Creek. Crescent has allocated 26% of its $60 million Uinta capex plan so far this year to landing in benches other than the traditional Uteland Butte formation—initially Douglas Creek, Castle Peak and Wasatch.

“It is a lot bigger playground than I ever anticipated,” Herb Vogel, SM president and CEO, told investors in a call Nov. 1.

SM took over Uinta operations Oct. 2 from XCL Resources and Altamont Energy, totaling 63,300 net acres in a $2.6 billion deal that included non-op Northern Oil & Gas contributing $500 million for 20% of the total leasehold.

SM received Federal Trade Commission (FTC) clearance to close the deal on Aug. 22, ending an imbroglio that began in 2022 when XCL tried to buy a fellow Uinta operator, EP Energy, whose property ended up being sold to Crescent Energy.

The FTC was already reviewing XCL’s plan this year to buy Altamont when SM stepped in to buy both, bringing in Northern to fund 20%.

“At that point, we were able to get full data from the operator,” Vogel said. “We were restricted before that.”

With XCL’s and Altamont’s D&C plans, permit and facility construction status and other details, “we've had about two months now to figure out how to optimize the forward plan,” Vogel said.

SM delayed spud on three XCL wells to extend these by one mile into three-mile laterals. By year-end, SM expects to have 13 new Uinta wells drilled and eight of these online.

Some will include the three delayed wells, which are now expected to go online in this quarter and in January.

‘Higher returns’

The XCL and Altamont property came with some 40,000 boe/d. SM also has operations in the Eagle Ford in South Texas and in the Permian Basin.

“It’s nice having three assets to compete against each other [for capital] because it drives those returns and [SM asset managers] know if you get higher returns, you get more capital the following year,” Vogel said.

The Uinta’s waxy crude is prized by refiners for its wax, low sulfur, low metals and low nitrogen.

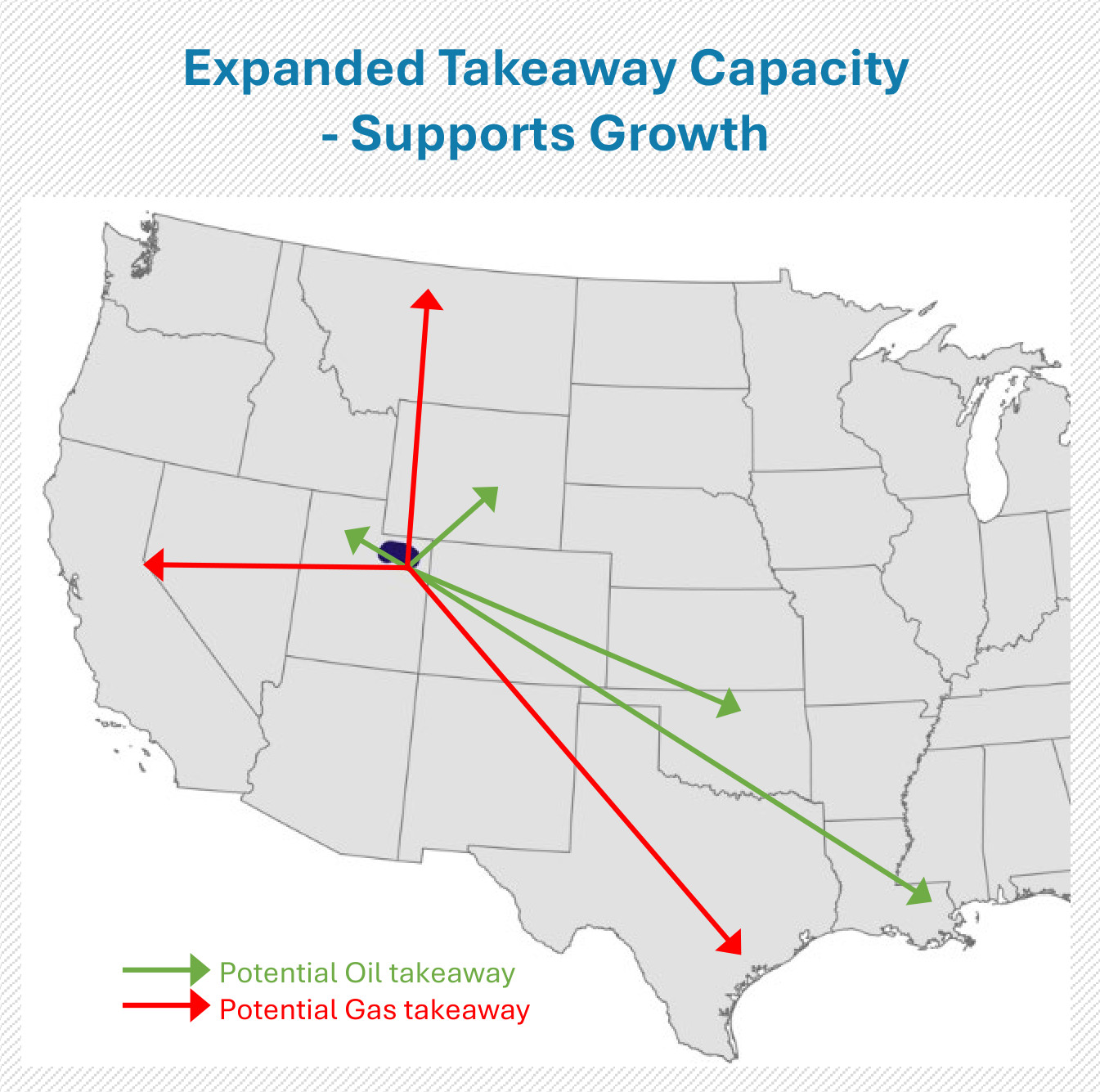

New rail takeaway out of the basin has the crude going to Wyoming, Oklahoma and the Gulf Coast—after total basin production of some 176,000 bbl/d first fills Salt Lake City refineries’ roughly 90,000 bbl/d waxy slates.

“A surprising thing is just how much more attractive the waxy crude is to the refiners, given what optimizes their product slate,” Vogel said.

The oily western side of the basin’s natural gas is used in-state; what is left goes west to the Pacific Coast, north and to the Gulf Coast.

SM is estimating LOE (lease operating expense) of $5/boe companywide.

GP&T (gas, processing and transportation) by rail is $16/bbl.

“Based on back-of-the-envelope math, to get to the midpoint of SM’s guide we would need to use [roughly] $13/boe GP&T, which compares to our prior assumption of SM’s Uinta barrels receiving a $12/bbl revenue deduct,” Zach Parham, a J.P. Morgan Securities analyst, reported.

Gabe Daoud, an analyst with TD Cowen, reported, however, “We stress this has no impact to our model as we were previously deducting the [roughly] $16/bbl from our Uinta oil realization.”

XCL personnel continue to work the Uinta asset under a transition-services agreement through year-end. Vogel said 100% of XCL’s field staff has signed up to join SM on Jan. 1.

“So that's a pretty smooth transition over there.”

Douglas Creek

The most popular oil target for Uinta laterals is the Uteland Butte. XCL put three wells in the Douglas Creek prior to closing.

KeyBanc Capital Markets analyst Tim Rezvan reported before the SM call, “This zone has not been frequently drilled by active Uinta operators in recent years.

“Operators have instead focused on the deeper Castle Peak, Uteland Butte and Wasatch formations, making the Douglas Creek results more insightful.”

The Douglas Creek wells’ 30-day IPs tested 870 boe/d on average, 94% oil, SM reported, from an average of 10,316-ft laterals.

These—as well as two SM wells in Dawson County, Texas—are not “eye-popping from a boe perspective,” KeyBanc Capital Markets analyst Tim Rezvan reported.

But “they are eye-popping from an oil-cut perspective.”

He added, “While encouraging as delineation tests, decline rates will tell if productivity is comparable to XCL results drilled into these other zones, which had [90-day IP] rates with similar productivity and oil skews.”

Sand, e-frac

Vogel said SM’s 2025 D&C plan will be “a blend of known intervals [and] known spacing … and then we'll have a mix that have been partly delineated and we'll have some completely new tests.”

XCL had a sand mine next to an e-frac spread, run off in-basin-produced natural gas and completing wells as far as two and three miles away.

“So the frac spread doesn't need to move,” Vogel said. “This is … probably the most efficient operation I've ever seen.

“And by having a lot of wells on a pad, that helps on those efficiencies.”

SM is paring the total rig count among those XCL and Altamont had in the Uinta, reported Gabriele Sorbara, analyst for Siebert Williams Shank.

“We also believe the company is coming out conservative to ensure execution following its recent entry into the Uinta Basin,” Daoud added. “This original plan looked to right-size its rig-to-completion-crew ratio for the combined program.”

The target is to pare Uinta rigs to between six and seven in 2025 and to run three frac crews.

Crescent CEO David Rockecharlie told investors in a Nov. 5 call, “The Uinta is at an exciting stage of its evolution.”

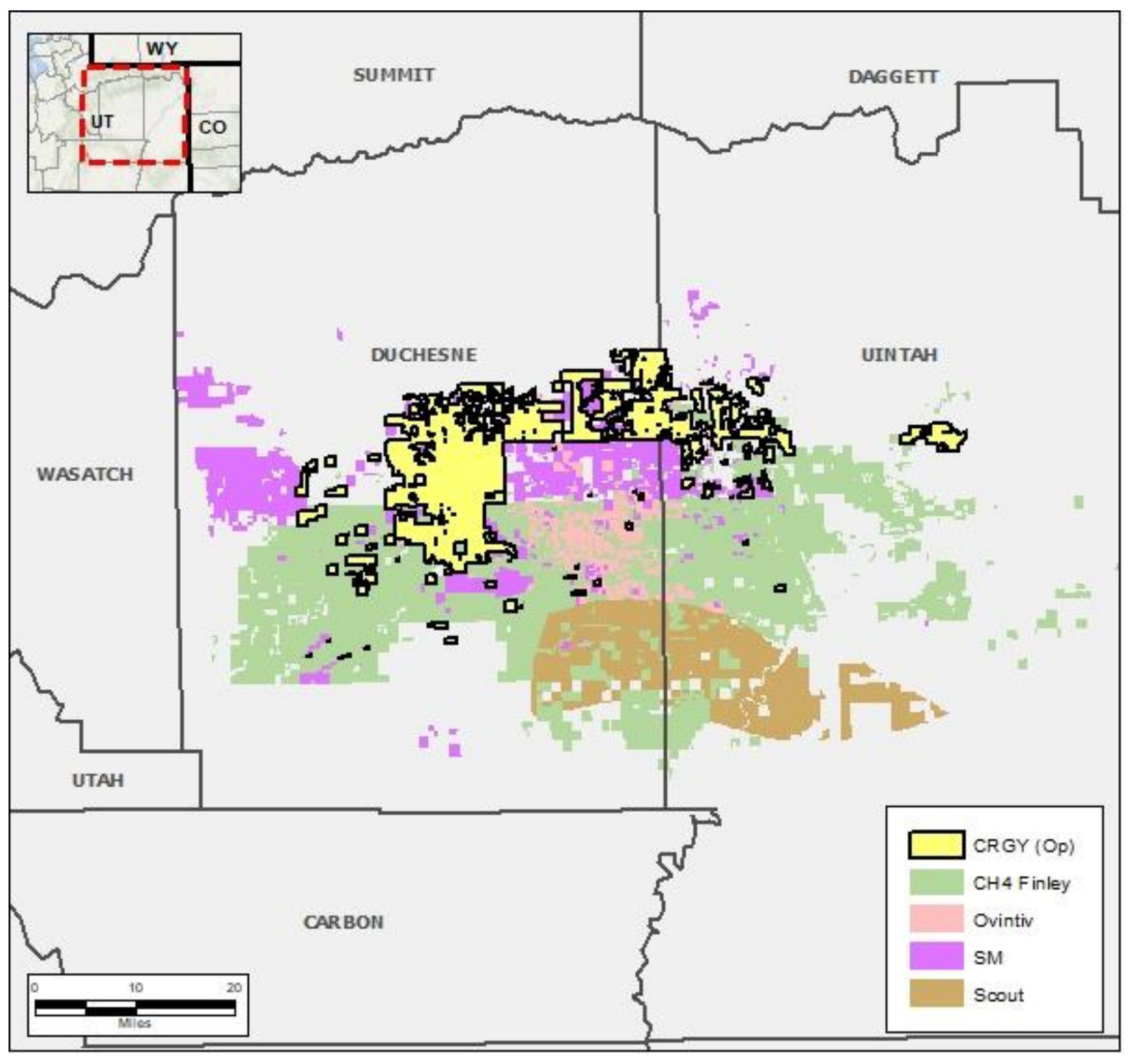

Crescent produces some 24,000 boe/d net, 62% oil, from its 145,000 net Uinta acres, all in the western oil fairway in Duchesne County and western Uintah County. Average working interest is 85%.

It has one rig drilling. It turned online 10 wells in the third quarter.

Rockecharlie added that it is “pleased to see” SM’s entry “and recognition of the impressive resource potential and advantaged economics in the basin.”

When Crescent picked up the EP Energy property in 2022, it paid $690 million, which Rockecharlie said was a discount to PDP value, thus “any development potential generating incremental returns.”

Crescent remains focused on the Uteland Butte, but “we have begun to allocate prudent capital to incremental horizons” like other operators have been “to delineate and further prove the impressive potential across the play.”

The tests have consisted of three wells. Evaluation is ongoing but “our initial results have been encouraging,” he said.

Crescent recently entered a joint venture with an operator to drill some of its easternmost leasehold to derisk it in a deal that doesn’t require an upfront Crescent capital contribution.

Crescent didn’t identify the operator.

Future development inventory is some 650 locations, roughly 80% oil. Of these, some 250 are in the low-risk Uteland Butte B and C. The others include preliminary Douglas Creek, Castle Peak and Wasatch wells.

DC&F (drilling, completion and facilities) cost is some $950 per lateral foot, Crescent reported. The 2024 average lateral length is 10,000 ft.

Recommended Reading

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

E&P Seller Beware: The Buyer May be Armed with AI Intel

2025-02-18 - Go AI or leave money on the table, warned panelists in a NAPE program.

Electron Gold Rush: ‘White Hot’ Power Market Shifts into High Gear

2025-03-06 - Tech companies are scrambling for electrons as AI infrastructure comes online and gas and midstream companies need to be ready, Energy Exemplar CEO says.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.