Alternus Clean Energy Vincent Browne, center, rang NASDAQ’s closing bell on Jan. 10 after the company’s listing in late December. Browne says the listing gives the company access to the global investment community. (Source: NASDAQ)

Ireland-born Alternus Energy Group is no stranger to the U.S., having crossed the Atlantic to develop and operate solar farms.

The company’s recent merger with special purpose acquisition company Clean Earth Acquisitions Corp., creating U.S.-based Alternus Clean Energy, has positioned the combined company for further growth through project development, tax credits and M&A.

Incentivized in part by the Inflation Reduction Act (IRA), Alternus—an independent power producer (IPP) focused on solar energy—is among the foreign developers with plans to expand their footprints and ramp up activity in the land of opportunity. About 280 clean energy projects were announced during the IRA’s first year, representing about $282 billion worth of investment, according to Goldman Sachs Asset Management.

Alternus, one of the newest additions to NASDAQ, aims to grow its operating assets to 3 gigawatts (GW) within the next five years. The U.S. is a key part of the plan, company executives say. Cash generated on the European side of the business from operations in Italy, the Netherlands and Romania enables the company to be more flexible. The company is divesting non-core assets in Poland.

“On an equity dollar perspective, it [the U.S.] is now by far a very attractive market,” Alternus Clean Energy CEO Vincent Browne told Hart Energy. He added that the market comes with “a whole load of challenges” including the supply chain and other “nebulous” things.

“Having said that, I think [the IRA] has been a huge catalyst and understood very easily in both the global investor markets and renewable markets as being a big boom and a huge commitment to renewables across the U.S., which will attract capital, certainly from our perspective out of Europe, into the U.S. market.”

Spurring growth

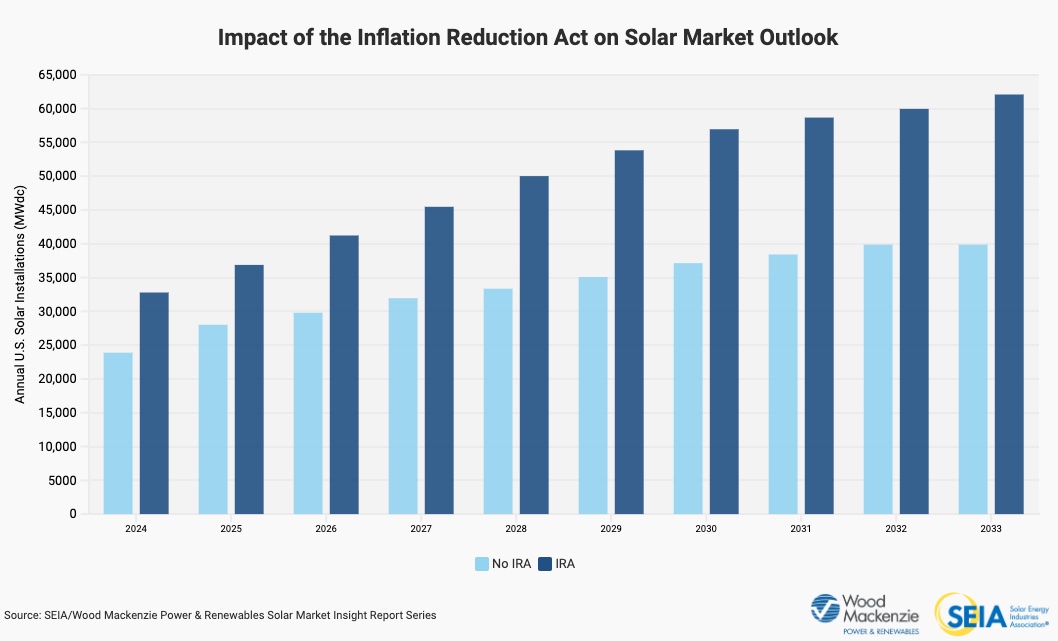

The IRA could lead to 48% more solar deployment than would otherwise be expected without the law, according to the Solar Energy Industries Association. The group forecasts the IRA, which offers production and investment tax credits, will drive an additional 160 GW of solar during the next 10 years and lead to more than $565 billion in new investment.

The IRA has been a “huge driver” for Alternus’ growth strategy, Browne said.

Alternus’ merger with U.S.-based Clean Earth Acquisition, a $575 million deal that closed in December, added about 168 megawatts (MW) of operating assets to the company’s portfolio. The combined company has another 98 MW under construction, more than 300 MW in various stages of development and an acquisition pipeline of more than 1 GW.

“The core growth strategy is to essentially grow in the target stage through acquiring direct project ownership, building assets out and then look at either a strategic partnership or a sell down, effectively for minority shareholding of some of those larger projects,” Browne said. That “gives us an equity cushion back into the group and saves us from having all the time to keep issuing shares of the parent, which is clearly not what we’d want to be doing.”

Strategic acquisitions are also in play.

As an IPP, Browne said Alternus’ role as long-term operator is part of the company’s core DNA.

“We’re an operator by nature. We’re not a fund. That’s a key point. So, we’re not looking for just yield and return and ease. We’re looking at putting roots into the various areas we plan,” Browne said. “We don’t just put in one park, fire and forget. We want to have long-term plans for every state or geography that we would enter.”

Fully integrated

The company utilizes a fully integrated operating model, which allows it to step into a project at various stages depending on the pricing, added Aaron Ratner, executive director for Alternus and former CEO of Clean Earth.

“Right now, because of the way the world is, there’s a lot of developers who are looking to sell at construction, ready to build [RTB] because their cost of capital is a little higher than it used to be,” Ratner said. “Interest rates are a little higher, and there’s some issues in place. So, they’re looking to sell right now, and we’re able to buy a lot of those projects as they’re ready to break ground, which is really great for us because we’re a lot closer to cash flowing.”

At other times, the market is more competitive and the cost of capital is lower. Developers have more power in the market, so “we want to move down the supply chain closer to actual development so that we have more control over our pipeline,” Ratner said. “Being able to slide up and down is really advantageous.”

He compared it to institutional financing and venture capital.

Venture capitalists have moved from Series A and Series B financing to more seed-stage deals. “They want to get there earlier and have more control over their deal pipeline,” Ratner said.

Alternus already has its eyes set on a pool of portfolio projects that could rapidly set up the company in seven or eight states—mainly in the Southeast—with 80 MW of projects, Browne said.

The company recently started construction of its 32-MW Dancing Horse solar PV project in Tennessee, which is expected to begin operations in first-quarter 2025 and generate about $2.3 million in annual revenue when fully operational.

Alternus Energy announced it acquired the project, part of a three-project Sunrise development, in August 2023.

Alternus is keen on Texas, but Browne called it a competitive market and pointed out that the “everything is bigger in Texas” cliche holds true. The company prefers multiple parks that are less than 20 MW, but it has acquisition targets in the Lone Star State.

“Texas would fare big if those ones work out,” he said. “Then, that will become the biggest state for us overnight, purely because the parks are so much bigger there.”

Looking ahead

However, like others, the company is not blinded by the opportunities. Alternus executives acknowledged the challenges ahead for the solar sector. Ratner’s concerns include weather and interconnections.

“There are projects in certain geographies where the weather’s changing a little bit. So, solar needs to become much more adaptable to things like hail in Texas,” Ratner said. “Certainly, the storage component is going to become increasingly important. The U.S. grid in particular is constrained.”

Though efforts are underway to expand and improve grids, that will take time. Meanwhile, the queues to connect to the grids remain long—more than a year in areas such as the PJM energy market, he said.

Lingering supply chain and social issues related to China are also a factor for the company.

“The Chinese government is supporting Chinese manufacturers to make panels over in China,” Ratner said.

The high carbon footprint of building a solar panel in China—and how long a project needs to operate to offset its supply chain carbon footprint—is an open question.

“There’s a slave labor component to some of these solar panels, which needs to be paid attention to,” he said.

In the U.S., the IRA has provided clarity on tax credits, Ratner said. The IRA credit scheme has helped companies avoid rushing an investment or breaking ground by year’s end to avoid losing the opportunity for credits.

Ratner said the pre-IRA days were “a pretty scary thing for developers.” Now, with firmer regulatory footing, other pieces need to fall into place.

“It makes it very hard to get your project financed at the development capital level and the construction level if you’re still worrying about your interconnect time, and that’s a key issue.”

Recommended Reading

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

USA Compression Names Chris Wauson as COO

2025-03-07 - Chris Wauson, currently the leader of natural gas compression company USA Compression Partners’ Permian office, has been chosen as the company’s new COO.

Devon Energy’s John Krenicki to Retire from Board

2025-03-05 - Krenicki plans to focus on his full-time responsibilities as vice chairman at private equity firm CD&R, Devon Energy said

Chord Announces $750MM Notes Offering to Reduce Debt

2025-03-05 - Chord Energy said it will use part of the funds to reduce its credit facility borrowings. The company is also looking to sell its Marcellus non-operated gas interests.

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.