ZeroSix’s chief commercial officer, Samantha Holroyd, spoke at SUPER DUG on the possibilities of blockchains and why E&Ps should abandon that well.

ZeroSix offers a solution to oil and gas producers looking to curb emissions with just one catch: the company has to give up its wells’ future production.

ZeroSix’s encourages E&Ps to plug up their highest polluting wells and collect carbon tax credits. Those credits can address a producer’s own emissions or sold on a voluntary market by the metric ton.

However, voluntary carbon markets have faced criticism over lax standards. And E&Ps may balk at the tradeoff: permanently sealing off a well.

ZeroSix says it addresses both concerns with digital verification technology — and a commonsense path for producers: plug the worst performing wells.

ZeroSix has developed projects in which wells plugged and abandoned (P&A) produce just 1 bbl/d to 10 bb/d, Samantha Holroyd, chief commercial officer for ZeroSix, told Nissa Darbonne, Hart Energy’s executive editor-at-large.

“The most polluting wells and are the least valuable because the company is spending great resources to maintain that wells production,” she said.

And any hit to daily production misses the bigger picture, Holroyd said.

“We have clients that want us to help them qualify their assets based on the daily production,” she said. “That's irrelevant. What I really want to talk about is the volume of reserves that you're going to recover from those wells between now and the future, not the daily production.”

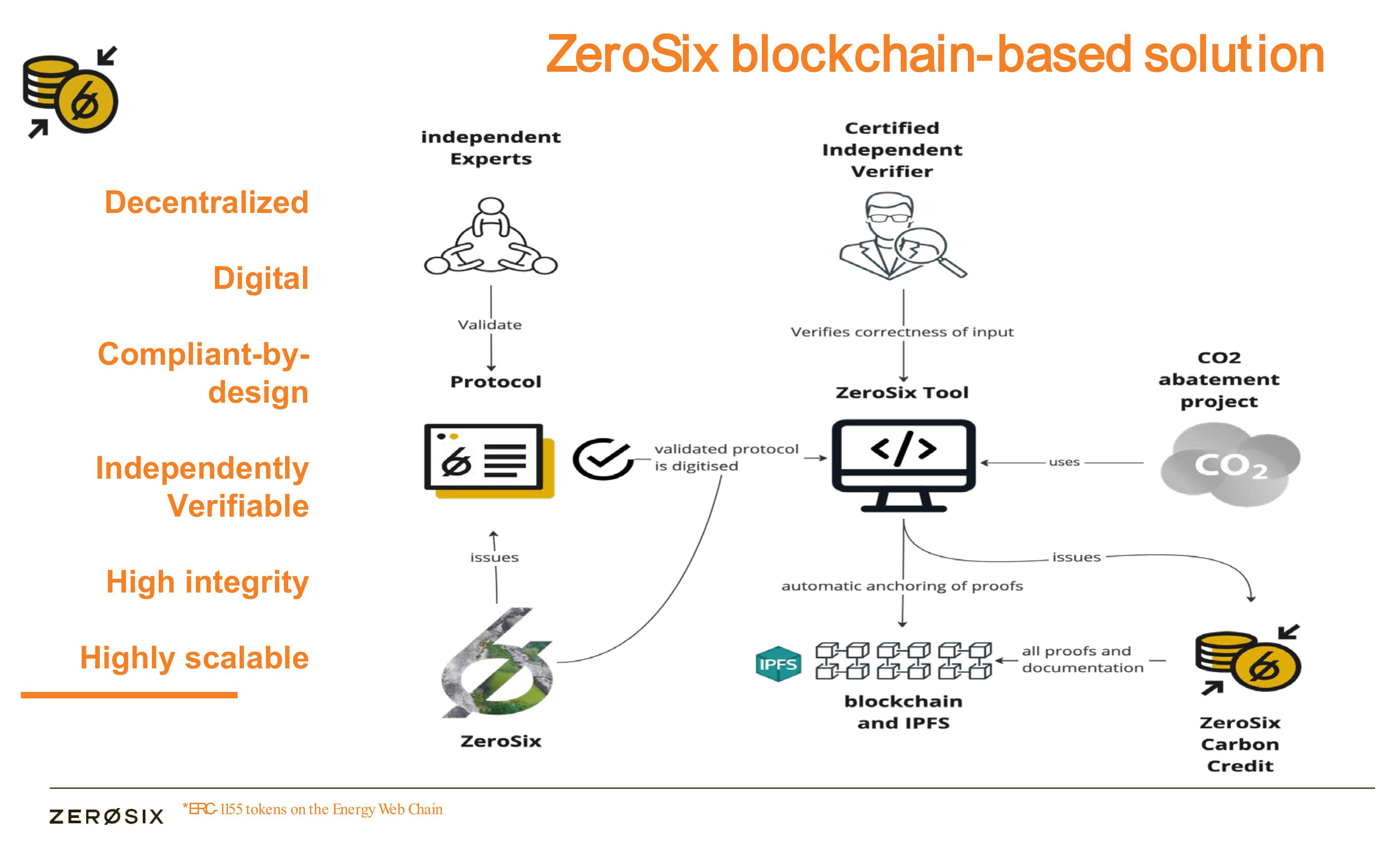

ZeroSix has also developed an answer to the weakness of other voluntary carbon markets: a digital tool to create a carbon credit protocol anchored to a digital ledger, or blockchain, Holroyd said in late May at Hart Energy’s SUPER DUG conference.

The tool—the Production Reserves Carbon Offset Protocol—is the first blockchain-native carbon credit in the world, according to ZeroSix’s website, and creates a new standard for carbon credits using the blockchain tool in tandem with a qualification process to exchange physical assets for carbon credits that can be traded on a voluntary market.

The protocol moves “P&A liabilities and the reserves that [they] leave in the ground into carbon credit assets [to] trade or sell or hold out into the voluntary carbon market,” she told conference attendees in Fort Worth, Texas.

Holroyd said ZeroSix’s qualification process creates a consistent standard for oil and gas companies by adhering to the Integrity Council for Voluntary Carbon Markets’ Core Carbon Principles. The company uses Securities and Exchange Commission reserve reports to get accurate climate impact data.

Bottom of the barrel

“It's important to recognize that 80% of CO2 emissions are actually related to the burning of fossil fuels,” Holroyd said, referencing a December 2022 Energy Information Administration (EIA) report.

But emissions from wells remain problematic. Holroyd cited an EIA report that found about 900,000 operating wells in the U.S. Of those, the bottom-performing 25% produce less than 1 bbl/d.

Yet those poor performers generate a disproportionate 11% of the methane emissions in the industry.

ZeroSix’s process involves identifying the dirtiest wells — the bottom 25%— and after making all necessary agreements with the owners and operators, applying the ZeroSix protocol. The well, and all connected wells in the system, are then permanently plugged and the shut-in reserves are converted to carbon credits. Those credits can then be traded on the carbon market.

The process also enforces a principle of “additionality,” meaning that if it weren’t for ZeroSix’s encouragement to prematurely abandon their wells, those wells would be actively releasing greenhouse gases (GHG). Owners are required to give up mineral rights in the area, in addition to plugging the well.

“We’re checking all the boxes that the voluntary carbon market is demanding today,” Holroyd said.

Scrupulous market?

The voluntary carbon market has faced recent scrutiny, with the validity of carbon credits difficult to pin down and claims that major corporations are purchasing carbon credits in order to “greenwash” operations.

A January report by British media outlet The Guardian found that nearly 90% of rainforest offset credits issued by the world’s leading carbon standard, Verra, were likely “phantom credits” and didn’t represent genuine carbon reductions.

Despite the shortcomings that have developed in the carbon markets due to a lack of standardization and confusion regarding regulations, carbon credits are critical for corporations across the world in all industries that have set net zero commitments but still need a way to meet them.

“We have an obligation, we have an opportunity, to be part of the solution of what's happening in the carbon markets,” she said.

ZeroSix intends to be part of that solution.

The blockchain solution

Up until this point, the voluntary carbon market has relied on third parties to confirm validity—a method that has been called into question. ZeroSix’s blockchains allow for independent verification without having to go through a third party.

“Blockchain technology is the key to delivering quality and transparency on our credits,” Holroyd said.

ZeroSix uses the Energy Web Chain, a blockchain specific to energy, to anchor the validation and tracking information gathered during the qualification and development stage of the projects to a non-fungible and unique digital sequence which, together with the validation information, form a blockchain token. Each token represents the equivalent of 1 mt of CO2. These tokens are the carbon credits that can be traded or sold through the voluntary carbon market.

Carbon credit cash

While bad actors threaten the integrity of the voluntary carbon market, interest in investing in high quality carbon credits is on the rise. In November of 2022, 250,000 carbon credits from Pakistan’s Delta Blue Carbon project were auctioned for $27.80/mt. According to the global exchange Climate Impact X (CIX), who along with Respira oversaw the auction, 30% of the bid volume was prices at $35 per tonne or more, 27% above the auction reserve price, “signaling the premium at which some buyers were willing to pay for high-quality and unique credit types.”

"Despite a backdrop of high inflation and global macro uncertainty weighing on the whole carbon market, this represents a strong signal of support for premium credits of high integrity," CIX said.

Holroyd explained that the voluntary carbon market is expected to surge in the next several years and that her team is seeing evidence that it was already happening.

“For most of the projects we screen, to date we’re seeing that the necessary breakeven of the current credit price is somewhere between $15 and $25 a tonne,” she said. “That is really right where the market is trading today, with indications that it is rapidly expanding into … [an $80 plus per tonne market] over the next five to seven years.”

And there’s the added benefit of finding value in older, underproducing wells that often have issues with fugitive emissions. P&A can be expensive, and many producers continue operating these wells to avoid the cost, ultimately declaring bankruptcy for those wells. This leaves the mitigation responsibility in the hands of state and local governments, all at the expense of taxpayers. Meanwhile, those low-rate wells do continue producing fossil fuels that are ultimately burned, typically leaking fugitive methane, a potent GHG, in the process.

“If you’ve got an emission on a well and you haven’t quite gotten on to fixing it, this is an opportunity to say, ‘instead of driving out there and mobilizing an operation that again increases the carbon footprint of [my] business, let’s think of this as a candidate for premature abandonment,” Holroyd said.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.