The purchase of Haynesville assets give Tellurian a potential 1 Tcf of natural gas that it can produce at its own pace and at lower costs, the company said. (Source: Hart Energy)

The steady flow of A&D activity in the Haynesville continued in September but LNG underscored one deal more directly and deliberately than previous transactions.

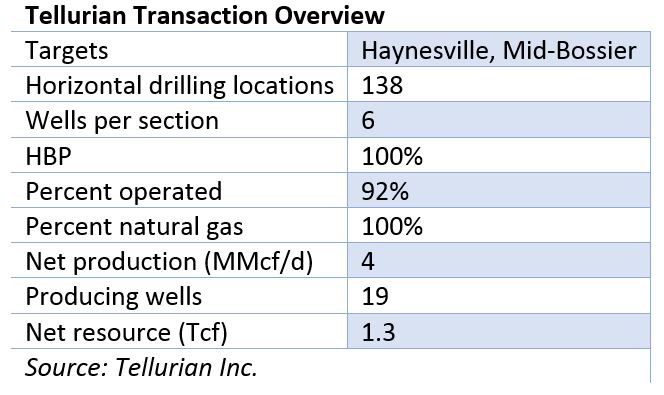

Exporter Tellurian Inc. (NASDAQ: TELL) said it plans to buy 9,200 net acres in Red River, DeSoto and Natchitoches parishes, La., for $85.1 million in a bid to undercut Henry Hub prices. The seller of the assets was undisclosed.

The deal marks a step forward for Tellurian’s LNG plans to export gas from a proposed 1,000-acre Driftwood terminal near Lake Charles, La.

Tellurian was co-founded in February 2016 by Charif Souki, the former CEO and co-founder of Cheniere Energy Inc. (NYSE: LNG) who left the company after disagreements with activist investor Carl Ichan. Tellurian’s other founder is Martin Houston, who is described by the Oil & Gas Council with being “the key architect of BG Group’s world-class LNG business.”

The Haynesville acquisition establishes a potential resource of 1.3 trillion cubic feet (Tcf) of natural gas for Tellurian. The leasehold includes 19 producing, operated wells with net current production of 4 MMcf/d.

The acquisition also includes associated natural gas gathering and processing facilities with “substantial additional capacity,” Tellurian said. Additionally, the Haynesville assets are 100% HBP and 92% operated, allowing the company to control the development pace of its multi-year drilling inventory.

Meg Gentle, Tellurian’s president and CEO, said the natural gas producing assets are integral to the company’s business.

“We expect our full cycle cost of production and transport to markets will be approximately $2.25 per MMBtu, which represents a significant savings to natural gas we will purchase at Henry Hub and other regional liquidity points,” she said. Gentle formerly served as executive vice president of marketing at Cheniere.

The company cited other markets, such as the Gulf of Mexico, where prices are as high as $5.67 per MMBTUs.

Tellurian plans to build a LNG facility with a capacity of 26 million tonnes annually as well as a 96-mile pipeline. The company said it expects to see regulatory approvals and construction begin by 2018 with its first LNG cargoes shipped in 2022.

In February, Tellurian merged with Magellan Petroleum to gain access to public equity markets. By June, the company completed engineering and design studies.

The Haynesville transaction is set to close by November, Tellurian said.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

FLNG Gimi Receives First Gas from BP’s FPSO in the GTA Field

2025-01-22 - Golar LNG’s Gimi FLNG vessel will support BP, which began flowing gas from wells at the Greater Tortue Ahmeyim Phase 1 LNG project in early January.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

Exclusive: LNG Takes Control in Meeting Data Center Reliability, Capacity Needs

2025-04-02 - William Seller, solutions architect at DartPoints, shares insight on the impact that data center power demand will have on the natural gas industry, in this Hart Energy Exclusive interview.

Winter Storm Snarls Gulf Coast LNG Traffic, Boosts NatGas Use

2025-01-22 - A winter storm along the Gulf Coast had ERCOT under strain and ports waiting out freezing temperatures before reopening.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.