Hedge fund giant Citadel acquired Haynesville E&P Paloma Natural Gas for $1.2 billion. (Source: Oil & Gas Investor)

Hedge fund giant Citadel has acquired Haynesville Shale E&P Paloma Natural Gas for $1.2 billion, Hart Energy has learned.

The transaction includes acreage, producing assets and approximately 60 undeveloped Haynesville locations, according to sources familiar with the transaction.

Paloma Natural Gas, backed by private equity firm EnCap Investments LP, said it sold to Citadel in February 2025.

Hart Energy has reached out to Citadel, EnCap and Paloma for more information.

Paloma Natural Gas LLC produced nearly 140 Bcf of natural gas in 2024, or about 382.25 MMcf/d, according to Louisiana state data.

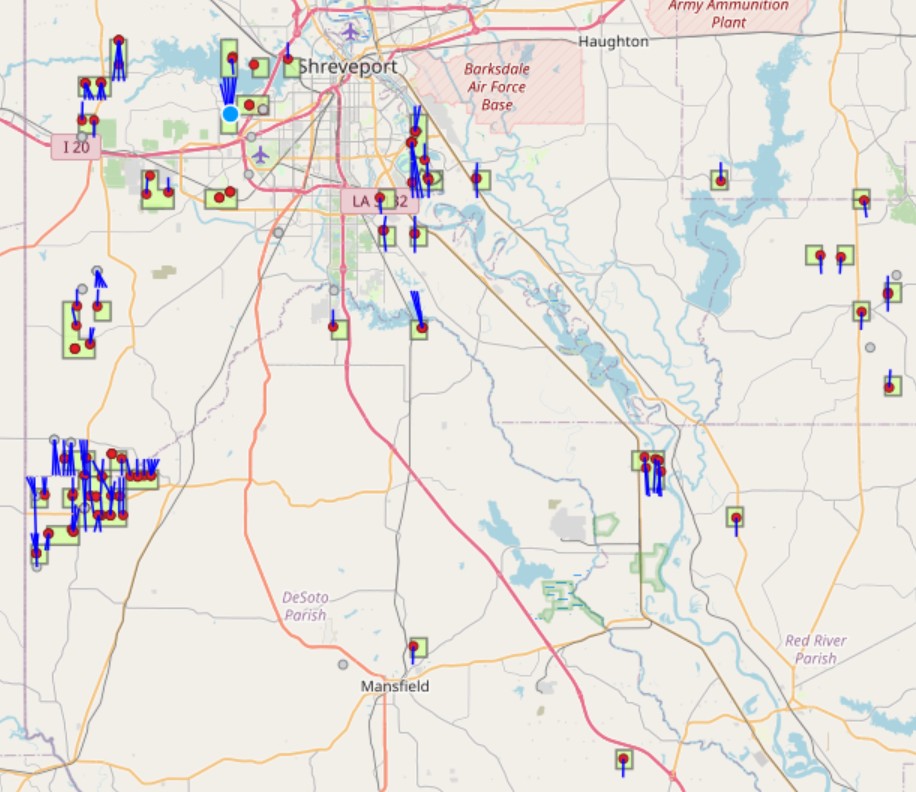

The company has assets across Caddo, De Soto, Bossier, Sabine, Red River, Webster and Bienville parishes, Louisiana, according to Rextag data.

Paloma acquired the Haynesville assets of Goodrich Petroleum Corp. for $480 million in cash in 2021.

Experts say buyers want Haynesville Shale exposure as U.S. natural gas prices rise and gas demand grows to fuel LNG exports, AI data centers and power generation.

After coming off record low prices seen last year, Henry Hub strip prices average about $4.58/Mcf over the next 12 months, according to CME Group data.

Miami-based Citadel, with about $65 billion in assets under management, has emerged as an unusual force in natural gas trading in a market dominated by merchants, energy producers and utilities.

Citadel’s commodities business generated around $4 billion of profit last year, driven by natural gas trading, Bloomberg reported.

RELATED

Aethon: Haynesville E&Ps Hesitate to Drill Without Sustained $5 NatGas Prices

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Four Weeks

2025-04-18 - The oil and gas rig count rose by two to 585 in the week to April 17. Despite this week's rig increase, Baker Hughes said the total count was still down 34 rigs, or 5% below this time last year.

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

US Oil Rig Count Rises to Highest Since June

2025-04-04 - Baker Hughes said oil rigs rose by five to 489 this week, their highest since June, while gas rigs fell by seven, the most in a week since May 2023, to 96, their lowest since September.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-03-07 - Baker Hughes said this week's decline puts the total rig count down 30, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.