A carbon capture and sequestration facility. (Source: Shutterstock)

The South Dakota Supreme Court placed another roadblock on a hotly contested carbon capture pipeline when it refused to hear an appeal from Summit Carbon Solutions, the company behind the project.

Last March, the Supreme Court considered Summit’s arguments that CO2—captured and stored permanently underground—qualified as a commodity and that eminent domain could be used to transport the gas.

On Aug. 21, the court released its opinion that Summit’s arguments were not convincing and that the company had not done enough at the lower court level to show it was a “common carrier” for a commodity.

“It is thus premature to conclude that (Summit Carbon Solutions) is a common carrier, especially where the record before us suggests that CO2 is being shipped and sequestered underground with no apparent productive use,” the court wrote in its opinion.

Summit requested to argue against the Supreme Court’s ruling. The South Dakota justices refused the rehearing, South Dakota News Now reported Oct. 22. The case now heads back to a lower court for argument.

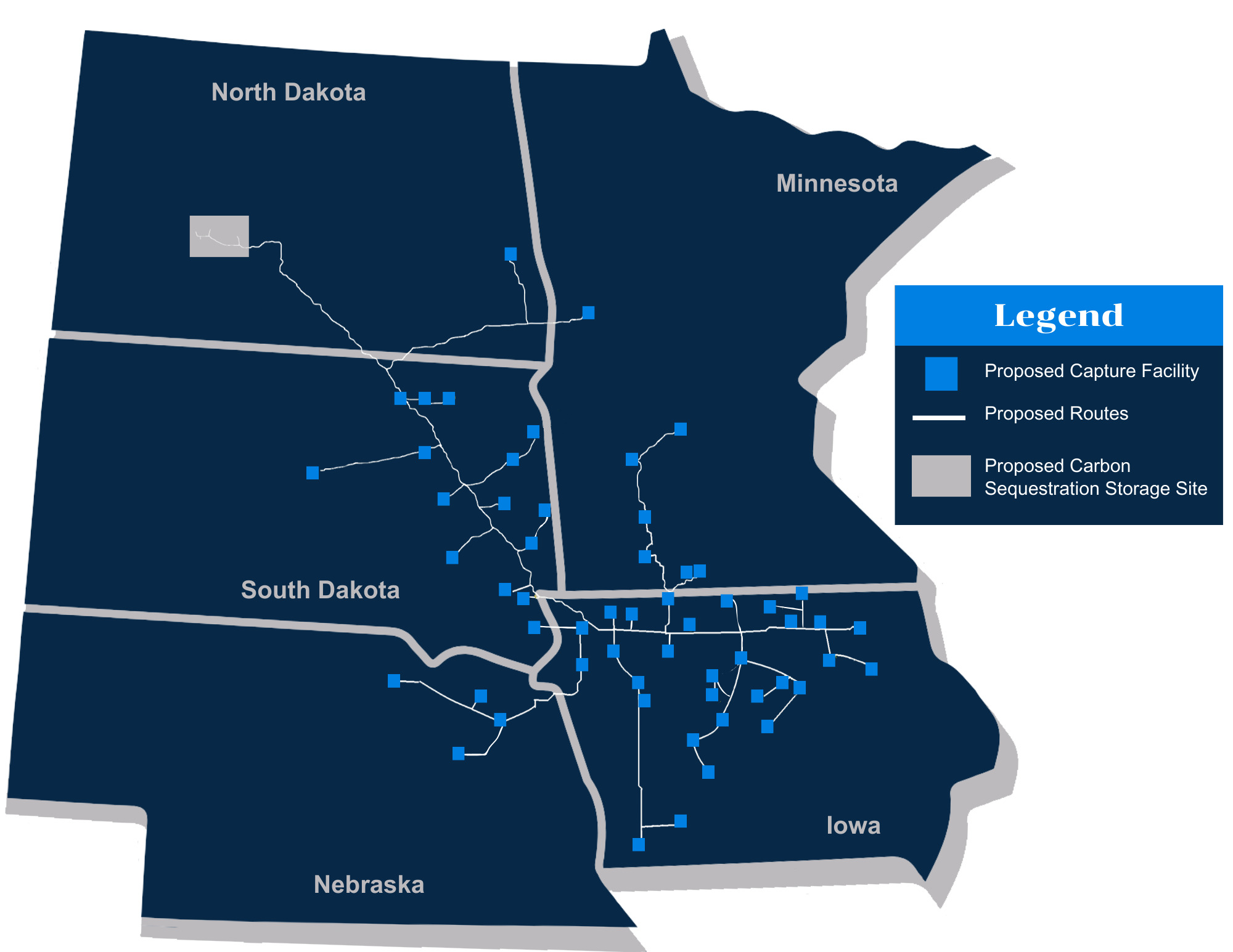

Summit Carbon Solutions plans to build a CO2 pipeline gathering system connected to ethanol plants in a five-state area. The greenhouse gas would be stored underground in North Dakota. The project has run into legal opposition in each state within the proposed network.

Recommended Reading

2025 Hamm Summit Goal: Make US NatGas ‘Hero’ for Powergen

2025-04-11 - Stepping up power for data centers “is a phenomenal opportunity here that our industry has to take advantage of. We have to get this right,” the Hamm Institute for American Energy’s executive director Ann Bluntzer Pullin said.

Trio Petroleum Deal Marks Entry into Canada’s Heavy Oil Region

2025-04-10 - California’s Trio Petroleum will acquire producing wells in the Lloydminster, Saskatchewan heavy oil region in a deal valued at roughly $1.38 million.

Prairie Operating Hedged D-J Production Ahead of Market Downturn

2025-04-10 - Approximately 85% of Prairie’s remaining 2025 daily production is locked in at $68.27/bbl WTI and $4.28/MMBtu Henry Hub as part of a strategic hedging program, the company said.

EIA: Tariff Chaos, OPEC Output Increases Spell $57/bbl WTI in 2026

2025-04-10 - Energy Information Administration price estimates for 2025 and 2026 are bad news for producers—if they come to pass—as breakeven prices for operators, even in the Permian Basin, require between $61/bbl and $62/bbl to remain profitable.

Oil Falls More Than 4% as Investors Reassess Trump's Tariff Flip

2025-04-10 - Oil prices fell by nearly $3/ bbl on April 10, wiping out the prior session's rally, as investors reassessed the details of a planned pause in sweeping U.S. tariffs and focus shifted to a deepening trade war between Washington and Beijing.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.