Source: Anadarko Petroleum Corp.

[Editor’s note: This breaking news story was updated Sept.13.]

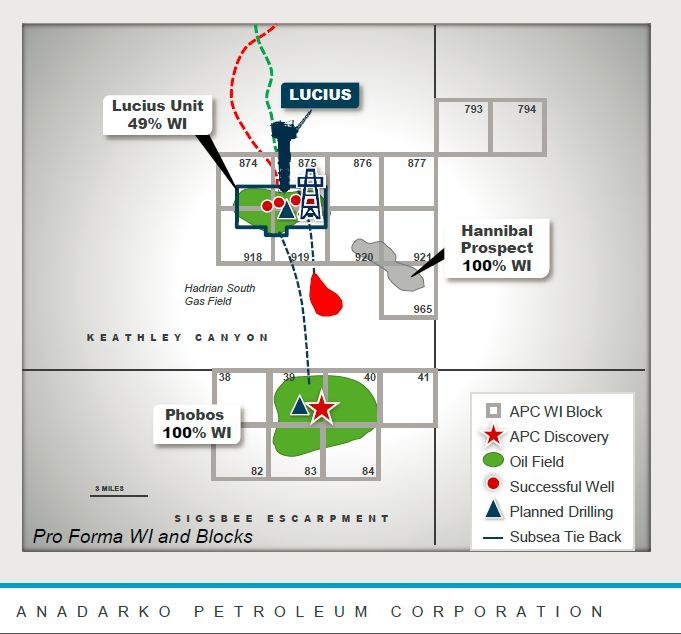

Anadarko Petroleum Corp. (NYSE: APC) said Sept. 12 it agreed to buy Freeport McMoRan Oil & Gas deepwater Gulf of Mexico (GoM) assets for $2 billion.

The deal doubles to about 49% Anadarko’s ownership in the Lucius development and adds production of 80,000 barrels of oil equivalent per day (boe/d), more than 80% oil. The company will partially fund the deal through an equity offering.

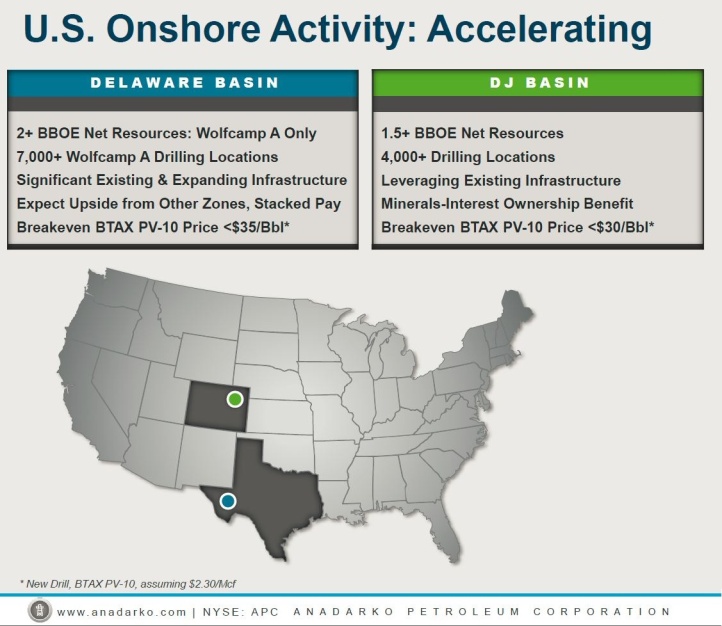

Anadarko said the acquisition will generate about $3 billion in incremental GoM free cash flow during the next five years at current strip prices. The deal will also allow the company to accelerate capital into the Delaware and Denver-Julesburg (D-J) basins.

Al Walker, Anadarko chairman, president and CEO, said Freeport aggressively drilled during the past two years and that most of those expenses are now complete.

“We don’t see much more than maintenance capex in front of us,” Walker said during a Sept. 13 conference call. “This extremely attractive bolt-on property transaction was accomplished by purchasing assets at a very attractive price from a motivated seller. “

Walker said the bolt-on transaction is a catalyst for the company's oil-growth objectives.

Anadarko also said Sept. 12 that it will offer about 35.3 million shares of its common stock. The company expects to grant the underwriter, J.P. Morgan Securities LLC, a 30-day option to purchase up to 5.3 additional shares of its common stock.

Anadarko will add two rigs in both the Delaware and D-J plays later this year and plans to further increase activity afterward.

"We expect these acquired assets to generate substantial free cash flow, enhancing our ability to increase U.S. onshore activity in the Delaware and D-J basins,” he said.

Capital One Securities analysts said in a Sept. 13 report that the deal “should pay out in just over 2 years at the current strip without doing anything upon closing.”

The deal and onshore activity acceleration will increase Anadarko’s net asset value by an estimated $5 to $73, Capital One said.

Detractors will point the dilution of U.S. shale exposure as deepwater GoM and international production mix increases to about 31% from 20%, the analysts said, as well as the “rationale of buying free cash flow generating GoM assets to ultimately accelerate US onshore (i.e., why not issue $2 billion in equity and directly accelerate?”

The deal is, overall, positive for Anadarko but it’s unclear how investors will digest the news. The unexpected transaction is an accretive GoM acquisition funded via equity.

By comparison, investor expectations were for “further asset divestitures leading to a U.S. onshore acquisition,” said Pearce Hammond, senior research analyst at Piper Jaffray & Co.

Walker said the company’s expectation is to more than double production to 600 Mboe/d from the two basins during the next five years.

“This increased activity would drive a company-wide 10% to 12% compounded annual growth rate in oil volumes over the same time horizon in a $50 to $60 oil-price environment, while investing within cash flows,” Walker said.

The company's GoM position, with the addition of the properties, will have net sales volumes of about 155 Mboe/d. The purchase expands Anadarko’s operated infrastructure in the GoM as well.

For Freeport the divestiture is its third following announced deals to sell net mineral acreage in the Permian and nonoperated interests in the Haynesville for a total of $189 million.

The transaction, effective Aug. 1, is expected to close prior to year-end. The transaction, effective Aug. 1, is expected to close prior to year-end. Latham & Watkins LLP advised Anadarko on the transaction with a Houston-based oil and gas team led by partner Michael P. Darden.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.