Shale wells are notoriously stingy about giving up their oil.

With current shale well fracturing and production procedures stranding the vast majority of a well’s oil, industry and researchers have focused extensive efforts to improve recovery of hydrocarbons. Today’s array of sensors and other data-gathering devices are flooding researchers with rich troves of data that could help improve frac procedures.

Among those with research advancements are petroleum departments at the University of Texas, Oklahoma State University, Colorado School of Mines and the University of Houston.

Tapered frac design

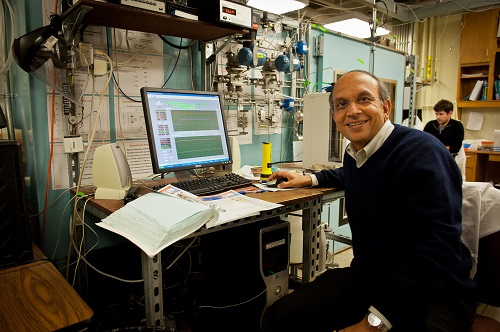

For the last decade, Mukul Sharma and associates at the petroleum and geosystems engineering department at the

University of Texas at Austin have researched the presence and the effects of induced, unpropped fractures in shale wells. In verifying their presence and identifying their causes, the goal has been to make a way to design frac clusters that properly engage the formation to maximize production. Sharma holds the W.A. “Tex” Moncrief Jr. Centennial Endowed Chair in petroleum engineering at the university.

UT’s efforts have yielded a software package called Multifrac-3D, which models the process of hydraulic fracturing and flowback. The program tells frac designers how to get uniform fractures to drain more of the reservoir. Modeling has improved production by an estimated 30% to 40%, Sharma said.

As hydraulic fracturing of horizontal shale wells ramped up around 2010, limited knowledge of how frac networks propagated gave producers uneven production results across a field. Sharma showed that fracking didn’t just create planar fractures. Often, there are fractures that are created but are too small to receive proppant.

Sharma’s team presented five pieces of evidence to demonstrate that this was happening, which were listed in a 2015 SPE paper, “The Role of Induced, Un-Propped (IU) Fractures in Oil and Gas Wells.” The five elements were: micro-seismic data, production history matching, tracer data, pressure communication between wells and calculations on the fate of the injected fracturing fluids.

“We’ve recently been studying what controls the geometry of the hydraulic fracture network in a naturally fractured reservoir,” Sharma told Hart Energy. “The well completion, the number and clusters and the number of perforations in each cluster, as well as the pumping schedule, are things that we can control and have a major impact on the geometry of the fracture network. Of course, the natural fracture network and the heterogeneity in the reservoir have a big influence as well.”

They observed that a geometric cluster design, in which all clusters contain the same number of perforations, often creates heel-dominated fractures. This can result in a loss of production from the other fractures. Adding more perforations to the toe, referred to as tapered completions, can provide more uniform proppant and fluid distribution.

Sharma’s research provides a quantitative method to design perforation clusters to provide the most uniform proppant and fluid placement in all clusters. The software has been extensively used in many applications, such as the growth of hydraulic fractures in naturally fractured rocks, geothermal wells and interference between parent-child wells.

He said this software has been tested in several wells with success and stressed that the team continues to learn from field results to make further updates as needed.

Frac count and spacing optimization

Unlocking more of the resource in shale wells have been a focus of petroleum engineering program professors at Oklahoma State University (OSU). Researchers have used artificial intelligence, or AI, and machine learning (ML) in analyzing surface drilling and core test data to improve frac methods.

Early results show the potential to increase production by up to 50% over existing frac methods.

A U.S. Department of Energy (DOE) grant includes Continental Resources, which is the principal partner in the project; Lawrence Berkeley National Laboratory; the Oklahoma Geological Survey and the University of Pittsburgh. They are nearing the end of the four-year, $19.9 million DOE project, with cost sharing from Continental Resources aimed at evaluating shale formations in the Caney Shale, a potential petroleum resource in southwestern Oklahoma.

Geir Hareland, a professor and Continental Resources Chair in petroleum engineering at OSU, described the work as a field laboratory site.

“The objective was to core through this formation and do a variety of core testing and modeling, and to fracture one horizontal well about two miles long,” he told Hart Energy.

The OSU frac team also includes Hunjoo Lee, assistant professor in the School of Chemical Engineering; Mohammed Al Dushaishi, Ward Fellow and an assistant professor in the petroleum engineering department; and other researchers.

During the process, they would gather extensive downhole data, analyzing each frac zone for rock hardness, ductility and other geomechanical properties. The research principles could then be applied toward analysis and improvement of frac designs in a variety of shale formations.

Three types of software were used for data analysis: Calgary, Alberta-based Rocsol Technologies’ D-WOB (Downhole Weight on Bit), which uses surface measurements and wellbore friction drag models to calculate the downhole weight on bit on horizontal intervals; D-ROCK, also from Rocsol, which cost-effectively uses inverted ROP models and core correlations to create a detailed geomechanical and reservoir property log; and Halliburton Co.’s GOHFER frac modeling software.

Unsurprisingly, they learned that maximizing exposure to the producing zone boosted production. But the specific mechanics were less obvious. More fracs, closer together, over longer laterals—and concentrated on the hardest and most brittle rock —were the keys.

They also made new discoveries on staging parent-child wells, using what Hareland called “wine-racking.” Alternating wells geared to produce higher and lower in the formation creates a kind of well cross-section waveform, he said, keeping larger distances between the wells and production from overlapping.

With about 18 months of production data in hand from the Caney horizontal well, the researchers have seen actual production match their pre-simulated model production in the formation.

Refracturing could also benefit from this research, said Hareland, because fracs done 10 years ago had fewer stages, but they were larger and spaced further apart. Shale’s low permeability limits its oil’s ability to flow, so fracturing more stages with smaller fracs opens a well to more production.

Keeping casing liners in place

As producers and investors look to squeeze out more production from wells, they’re also searching for ways to lower costs and boost cash flow. To make that work, many producers look to refracturing wells that were first fractured in the early days of the shale revolution. Multistage wells are particular targets, as producers hope to reach producing zones that were missed or inadequately stimulated the first time.

One refrac method involves inserting an expandable casing liner into the existing casing. After sliding the liner into place the installer expands the liner to fit by pulling a tool along its length. The liner’s purpose is to keep the new frac from taking the path of least resistance through existing fissures without creating new ones. From there, the producer is starting anew because, at that point, it is essentially a brand new well that has not been perforated, said Jennifer Miskimins, F.H. Mick Merelli/Cimarex Energy Distinguished Department Head Chair at the Colorado School of Mines. Miskimins is also the founder and current director of the Fracturing, Acidizing, Stimulation Technology (FAST) Consortium.

Civitas Resources, an E&P operating in Colorado’s Denver-Julesburg Basin, used a liner made by Mohawk, but wanted to be sure it performed as advertised, Miskimins said.

After installing the liner, the new frac would involve creating half-inch-diameter fracs using “piston-like forces, which could potentially move the liner that’s sealed inside the casing,” she said. If those forces shifted the liner by a half inch or more, that would cover up the corresponding fracture in the original casing, “destroying your refracking potential.”

Civitas asked the school to conduct as close to a real-world test as possible in order to find out.

At the school’s Edgar Mine Testing Facility in Idaho Springs, Colorado, the research team prepared both anchored and unanchored patch components in a pipe. One type of each was perforated with a full-size perforating gun, with three shots in each section.

According to a paper published by the team, “Both the anchored and unanchored, perforated and unperforated, patch/casing sections were then push/pull-tested to determine friction factors and the impacts of the perforating on the patch/casing interface. These results were then incorporated into [finite element method] FEM modeling to determine the ability of the full-size, field-deployed patch to remain stationary and the impact such would have on perforation alignment during treatment conditions.”

FEM is a common method of mathematically solving engineering and math modeling equations.

The push/pull testing involved a lab machine that applied 50,000 psi of pressure to the lining, many times more than the normal frac pressures, Miskimins said.

As a result, “The takeaway was that these liners don’t move,” she told Hart Energy.

Formation structure analysis

The volume of water used in fracturing has surpassed 1 MMgal/well in tight shales, leading researchers to investigate alternative methods that don’t require water. Pulsed power plasma stimulation (PPPS), which is already common for rock removal in mining operations, is gaining interest among academics. Researchers are seeking private funding to expand these efforts into oil and gas, especially in tight reservoirs and shale plays.

But for the University of Houston’s (UH) Mohamed Y. Soliman, a particular subset of the method shows great potential for analysis as well as for fracturing. As PPPS fractures the rock, it also emits an electromagnetic field in a process called electromagnetic wave propagation (EWP). Soliman, chairman of the Petroleum Engineering Department, was awarded the Society of Petroleum Engineers SPE Legends of Hydraulic Fracturing Award in spring 2023.

He and his UH team believe that tracking the EWP field’s behavior as it navigates the rock could much more deeply and accurately analyze the character of the fracture and formation than current methods do. With that in mind, they want to design “a field tool that may be used for waterless stimulation for well format/fracture diagnostics and underground imaging,” according to a paper Soliman published with colleagues at sciencedirect.com in November 2022.

Soliman compared PPPS to releasing the power of two double-A batteries all at once into an area of the formation.

“You have two capacitors, each of which stores 10 kilojoules (kJ) of electricity. That’s a small amount of energy when you release the energy slowly, as in a flashlight,” he wrote. “But here, we are discharging those capacitors in 5-6 milliseconds.”

By hitting the rock so hard, “It fractures the rock. When you do that, you also create an electromagnetic field that produces a shock wave, or EWP, which propagates through the rock,” according to his research.

Proving the theory

The first step in proving their theory involved creating a small physical model with which to compare actual results against computer models. If proven sufficiently accurate, the testing could be expanded into a field-scale trial.

Their lab test samples were concrete cylinders 9 inches in diameter and 12 inches long, with a bore tube down the center. Into those samples they discharged the 10 kJ current and monitored its results. Soliman said, “We measured the electromagnetic field the shock wave produced, and we matched that experimentally and numerically.”

Soliman and his team say their results validated the procedure and justified large-scale field research, for which they are currently seeking funding. They concluded that creating a PPPS-based stimulation tool would indeed be a cost-effective alternative to “current low-accuracy microseismic applications.”

Recommended Reading

US NatGas Prices Hit 23-Month High on Increased LNG Feedgas, Heating Demand

2024-12-24 - U.S. natural gas futures hit a 23-month high on Dec. 24 in thin pre-holiday trading.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

US NatGas Prices Retreat From 2-Year Peak on Forecasts of Less Cold

2024-12-26 - U.S. natural gas futures fell more than 5% on Dec. 26 from a near two-year high in holiday-thinned trade.

Venture Global Plaquemines Plant on Track to Produce LNG

2024-12-13 - Venture Global LNG’s Plaquemines plant was on track to pull in about 0.16 Bcf/d of pipeline gas on Dec. 13, up from 0.10 Bcf/d on Dec. 12, according to LSEG data.

EIA: NatGas Storage Plunges, Prices Soar

2025-01-16 - Frigid weather and jumping LNG demand have pushed natural gas above $4/MMBtu.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.