There's probably some truth in the thought that a “fair” deal has to be one that leaves all parties smarting just a little, believing that they gave away too much at the negotiating table. But what if the parties’ interests are appropriately identified and aligned such that deal momentum can move forward, and at closing an acquirer purchases a “transformative” asset well above its weight class?

This likely understates some of the challenges faced by Sanchez Energy Corp. and its strategic 50:50 partner, Blackstone Energy Partners, in their $2.275-billion purchase of Eagle Ford assets from Anadarko Petroleum Corp. earlier this year. The transaction was highly complex, involved best-in-class capital providers, and was the largest all-cash Eagle Ford Shale asset deal since May 2014.

A bespoke solution was carefully crafted to close a deal that many investment banks thought was simply unfeasible—and, at first sight, with some reason. On Jan. 12, 2017, the day the deal was announced, Sanchez had an equity market capitalization of just $575 million. The company held a cash position approaching $500 million, but various note and convertible preferred issues weighed on the balance sheet, making up a little more than half of Sanchez’s total enterprise value (TEV) of $2.2 billion.

How could an E&P with a somewhat stretched balance sheet—and producing 49,500 barrels of oil equivalent per day (boe/d) in fourth-quarter 2016—get financing to buy a working interest in 318,000 gross operated acres, with production of about 67,000 boe/d, valued at nearly $2.3 billion?

“The prevailing opinion was that the Anadarko deal was too big for Sanchez to consider,” recalled Skip McGee, CEO and co-founder of Intrepid Partners, which served as sole financial advisor to Sanchez on the transaction. “Creativity was key in structuring this transformative deal for Sanchez.”

The deal

Perhaps even more surprising was that the parties to the deal were, in fact, poised to fund a still larger transaction in the event that Anadarko’s partner, Korea National Oil Corp. (KNOC), wanted to exercise its “tag-along” rights to sell its interest in the Eagle Ford property on comparable terms. The 30-day rights were not exercised, but—if they had been—the deal would have required funding of around $3.5 billion.

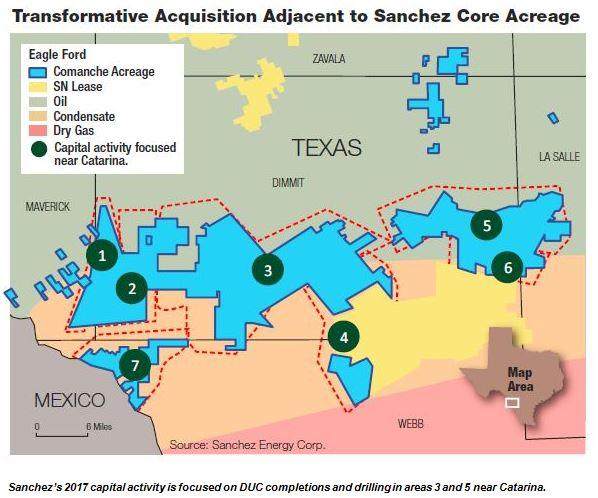

On a Jan. 12 conference call with investors, company CEO Tony Sanchez introduced the “Comanche Eagle Ford Asset” purchase to investors, which he described as “a transformative acquisition that is highly accretive and significantly deleveraging.” The $2.275-billion acquisition would be made through a strategic 50:50 partnership with Blackstone Energy Partners and funds it manages.

From a geographic and geologic perspective, the Comanche acreage is largely contiguous and, in several areas, adjacent to Sanchez’s existing Catarina position. The newly acquired 318,00 gross acres holds an inventory of over 4,000 “high rate of return” drilling locations, according to Sanchez, and the total resource potential, net to Sanchez, is 600 million barrels of oil equivalent (MMboe).

Offering a base valuation was the fact that roughly 80% of the purchase price was underpinned by the PV-10 (present value at a 10% discount factor) of the proved developed producing (PDP) properties and drilled but uncompleted (DUC) wells, assuming strip pricing. The PV-10 estimate of each partner’s 50% interest in the PDP assets ($767 million) and DUCs ($155 million) came to $922 million vs. a $1.1375 price tag paid by each of the buyers.

The acquired assets were able to generate free cash flow (net of funding costs) for the company at once under the current development plan. As a result, Sanchez expects its net debt-to-EBITDA multiple to come down by more than one turn over the next 12 to 18 months. Paving the way is an immediate start of completion work on 132 Lower Eagle Ford DUCs with estimated IRRs of over 100% at strip pricing.

In essence, the acquisition has left development plans for the company’s other key areas—Catarina, Maverick—largely unchanged. For the company as a whole, Sanchez has guided to a compound annual growth rate (CAGR) in production of more than 10% through 2019. With slightly higher capex companywide in 2018 and 2019, Sanchez aims to be cash flow neutral in 2018 and to generate free cash flow in 2019.

Introducing UnSub

But it was the deal structure—and how assets and funding were paired up—that was truly innovative.

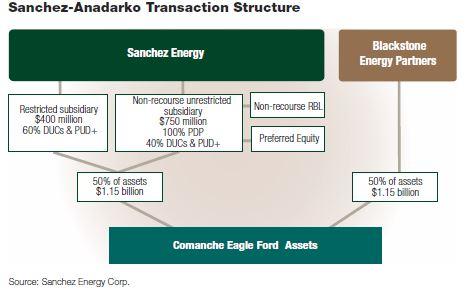

Accompanying news of the acquisition was a flow chart. Most notably, it included what Sanchez called a “non-recourse unrestricted subsidiary,” dubbed “UnSub.”

To recap: Sanchez, as operator, and Blackstone, as strategic partner, each pay approximately $1.15 billion for 50% of the assets. Of this amount, Sanchez pays $400 million from cash, while a further $750 million is financed through a newly formed UnSub. In turn, UnSub is funded by a reserve-based loan (RBL) and preferred equity issue of $330 million and $500 million, respectively.

The creation of the UnSub marked a key step in lowering Sanchez’s weighted average cost of capital, allowing the company to use a mix of bank financing and a preferred issue capped at 14%.

Capital providers to the UnSub were J.P. Morgan and Citibank, as the joint lead arrangers of the $330 million RBL, and GSO Capital Partners as regards the preferred equity issue. The latter issue carries a coupon of 10% and provides upside for GSO in that the issue can be redeemed only after it has provided an annual return of 14%. The RBL has grid pricing of Libor plus 275-375 basis points.

Whereas issuance of common equity capital would have come at a significantly higher cost, the major portion of funding for the UnSub is, in effect, expected to be no more than 14%.

“We set it up so that the UnSub will basically refinance itself through cash flows alone,” according to Sanchez, in announcing the Comanche acquisition. “The entity by itself, from day one, will generate a significant amount of free cash flow after servicing the debt and after paying a coupon on the preferred. It will pay off the RBL and be in a positon to redeem the preferred at a 14% ROR, depending on the pace of drilling, in anywhere from three to five years. We’ve effectively equitized the acquisition, but we’ve capped the return on the equity at 14%.”

A temporary arrangement

Noting that Sanchez-related ownership interests necessarily sum to 50% (with Blackstone holding the other 50%), the priority standing of the UnSub is reflected in its ownership of all the PDP properties and a smaller share of proved undeveloped properties (PUD) and proved non-producing (PDNP) properties. The UnSub also has a relatively smaller capex burden.

For example, in terms of the 50% interest in properties acquired by Sanchez, the UnSub has ownership of 50%, or all, of the PDP properties. As regards the PDNP and PUD properties, it owns a 20% interest, with an associated 20% capex burden (e.g. to com-plete DUCs or drill new wells). By contrast, the restricted subsidiary (with priority claims on Sanchez's legacy properties) owns none of the PDP properties, but has a 30% working interest in the PDNP and PUD properties, with a 30% capex commitment.

Sanchez projects that the UnSub ownership configuration will allow the RBL credit to be paid down in roughly two years and the preferred equity issue to be redeemed, as noted earlier, in three-to-five years.

“The clear implication here is that the UnSub should go away sometime in the next few years,” said Sanchez. “Basically, we’ll be in a position to consolidate the UnSub and roll all of it up (into the parent).”

How important was the UnSub’s role in bringing together—and to fruition—a deal of more than $2 billion?

“The UnSub was critically important,” recalled Intrepid’s McGee, “because it would have been extremely difficult for the existing bank group to reach a required unanimous agreement to do something in the restricted subsidiary. It would have required a massive amount of equity; it just wasn’t going to happen. And in the UnSub structure, J.P. Morgan and Citi had almost a clean sheet of paper in terms of looking at the assets and in not being burdened by historically high leverage rates carried by Sanchez.”

Use of an UnSub rather than massive equity issuance—if it were possible—was warmly welcomed by investors. Sanchez’s stock rose by more than 60% over the 10 days following the announcement of the Comanche acquisition, rising from $8.70 per share to $14.24.

Reputation precedes

McGee is quick to credit the strength of Sanchez’s reputation in the Eagle Ford as a pivotal factor in attracting interest among private equity sponsors and preferred equity investors.

“There was a lot of interest, and the interest traces back to the fact Sanchez is the low-cost operator in the Eagle Ford,” he said. “In a world where oil prices are basically flat, if someone can show you a path to making attractive unlevered rates of return at the wellhead, then adding a little leverage can make that pretty attractive for private equity.”

In an area in which leases often have a “hard consent” clause, by which changes to new operators are not automatically approved by leaseholders, Sanchez’s reputation as an active and efficient operator in the play was another factor in its favor. “That’s really the key to this: the credibility and capability of the company as an operator, and the efficiency it can bring to the field,” added McGee. “It’s drilling wells in six days and doing it for $3 million or less.”

Even so, given its limited market capitalization, Sanchez’s drive to expand through the acquisition of Anadarko’s neighboring acreage was by no means easy.

“From a transaction structuring and financing perspective, it was pretty daunting. The one thing on which Anadarko was crystal clear was that it would take zero financing risk. That was something we heard repeated multiple times,” said McGee. “It wouldn’t announce anything until all the money was lined up. And that was assuming ‘all the money’ was $3.5 billion, if KNOC opted to tag along. That was our quest—and it was a much heavier lift that wouldn’t have been possible without Sanchez’s top caliber capital markets team.”

To strengthen its position, Sanchez took several steps. One was to get ahead of a sale process by focusing on a potential price for the assets that would show Sanchez to be a serious bidder in line with a competitive process. Another was to offer a drilling commitment. Although Anadarko had itself done minimal drilling on the property in the last year, this would appeal to Anadarko as owner of the gathering and processing operations of its Western Gas Partners subsidiary.

But, assuming financing could be arranged, it was not hard to recognize Sanchez as the natural buyer.

“With the Anadarko acreage fence-lining Sanchez on three different sides, it’s pretty easy to see how this made strategic sense,” observed McGee.

Plans for attracting high quality capital providers were set in motion following a decision to “carve up” the Comanche assets, based on a 50:50 split between Sanchez, on one side, and a “side-car vehicle” backed by a private equity sponsor on the other. Providers of preferred equity were similarly invited to participate in the UnSub that was formed.

“It was a very intense and vigorous process,” recalled McGee. “We wanted to present a highly credible financing team to Anadarko, which we felt was very important because there were lots of moving pieces in our financing structure. The challenge was that, given so many different pieces, if you changed one item in one capital provider’s term sheet, there could be a ripple effect that risked unraveling other items and impacting the overall transaction.”

Forward applications

One outcome that was expected—but didn’t materialize—was that KNOC would elect to sell its interest alongside Anadarko, making the overall deal size as large as $3.5 billion. In fact, rather than increasing, the deal size was trimmed somewhat due to a purchase price adjustment, with the initial stated price tag of $2.275 billion coming down by roughly $200 million, shared 50:50 by Sanchez and Blackstone.

What, if any, are the implications for Sanchez of KNOC’s decision to hold on to its interest?

While a near-term period of integration is likely, the earlier plans for a larger deal size mean that “Sanchez has some dry powder to evaluate other acquisitions if there are interesting opportunities,” noted McGee. “The fact that KNOC is not ‘tagging’ (not exercising it rights to sell alongside Anadarko) speaks to the confidence it has in Sanchez as an operator going forward.”

The deal structure could have implications in other regions as well.

“We’ve had a number of inbounds from other E&Ps who want to understand the transaction and its potential applicability to their situation,” said McGee.

“You’re going to see continued consolidation in not just the Eagle Ford, but also the Bakken, the Rockies and the Haynesville. This structure, or maybe some hybrid versions of the structure, will certainly come into play in other regions. If you can pair up smart institutional capital with someone that could be viewed as the consolidator, the best-in-class operator, I think you could have a lot of running room.”

Recommended Reading

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Iveda Deploys New Liquid Storage Management Solution for Gulf Western Oil

2025-02-26 - IoT servicer Iveda’s LevelNOW system uses sensors to deliver real-time information about tank levels.

Halliburton, Nabors Collab to Deploy Drilling Automation in Oman

2025-04-15 - The companies integrated Halliburton’s Logix automation with Nabors Industries’ SmartROS rig operating system.

Diamondback in Talks to Build Permian NatGas Power for Data Centers

2025-02-26 - With ample gas production and surface acreage, Diamondback Energy is working to lure power producers and data center builders into the Permian Basin.

Exclusive: Halliburton's E-Fleets Lower Haynesville Completions Costs

2025-04-14 - Halliburton’s Neil Modeland, senior business technology development manager, shares insight into the company’s electrification services and efforts to minimize associated completions costs in the Haynesville Shale, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.