Enverus’ minerals expert Phil Dunning pulls back the curtain on generational changes and seismic shifts in the U.S. minerals market that make it challenging to for aggregators to achieve scale. (Source: Shutterstock.com)

Attractive yield and a seemingly unending flow of assets scattered across the nation mean oil and gas minerals are a market ripe for the picking. And aggregators of all sizes are quietly applying some cohesion to the largely fragmented domestic minerals market. Enverus’ Phil Dunning, director of product for minerals, breaks it down in this exclusive interview with Oil and Gas Investor.

Deon Daugherty, Oil and Gas Investor editor-in-chief: Let’s begin with your high-level assessment of minerals market dynamics.

Phil Dunning: The minerals market is interesting. It’s always existed, but most of the minerals world is private.

Unlike upstream oil and gas or operators where you have companies selling to each other [through] a business-to-business transaction, the mineral space historically has been more business-to-consumer. It’s almost like selling homes. Thousands of transactions are done. They [start] very small, then they’re aggregated, and then they’re sold upstream to bigger and bigger fish. It really wasn’t until a couple of these companies went public that news started coming out into the public that this is an asset class with a lot of free cash flow, and it’s actually very attractive from a yield perspective.

DD: Who are the small aggregators, and how do they grow?

PD: Ownership is fragmented over time. Let’s say grandparents owned a ranch in West Texas and they sold the surface, but they kept the minerals and they moved to Florida. If they had five kids when they passed away, then those assets are split five ways. And then if each one of those kids has five kids, then it’s split another five ways. So that 100% ownership, within two generations, is down to 5% ownership per person.

The problem in the mineral space from the ownership standpoint is that as more generations pass, the ownership percentage gets smaller and smaller. And when you’re a buyer, aggregating minerals is mainly either going to be landmen or private family offices, and people in the oil and gas space, like engineers, who know how to underwrite the acquisitions.

What gets hard for them today compared to in the past is that as each generation is coming of age and the assets are getting passed down, you’re having to aggregate more and more deals to make the same cash flow that you [could access] a generation prior. It’s becoming much more complex to acquire enough royalties that actually make a difference for someone else to buy. It’s a very saturated space now in terms of people trying to aggregate these small minerals.

So, you’re starting to see some interesting competition to find owners who want to sell. That’s everything from social media and buying Google ads through the most common one, which is just sending individual mailers. There’s not as many families and ranches and groups that still exist today that are making tens of millions of dollars a year as the family’s primary income. That’s just not as common anymore because of the fragmentation over time.

DD: What happens once these historically private assets go public?

PD: When a company is public, it has to maintain some rate of growth or payout. If you’re a growth company, you need to be maintaining growth of revenue and profit margin. If you’re a value company, you need to be maintaining dividends.

The problem in the mineral space is that as a mineral company, you don’t direct the bit. You don’t direct where wells are drilled and when they are drilled, unless you’re an offshoot class like Viper, which is a dropdown from Diamondback. But in the rest of the space, meaning 90% plus of the other public mineral companies that exist, they don’t control activity.

They have to be very careful on what they acquire to make sure that one, it is cash-flowing and two, it has a near-term upside. If for some reason they buy a bunch of acreage that just doesn’t have any near-term activity, they basically just bought something that’s dilutive.

DD: So, scale is critical, but it’s particularly difficult to achieve in an active minerals space.

PD: It’s becoming harder and harder over time because as these companies acquire other public or other private mineral companies, there’s only so many others at scale. In the mineral space, there are thousands of small aggregators that own [about] $10 million a year of cash flow. Then there’s a middle group of private equity-backed or private investor aggregate companies. And then it basically jumps up to public companies. If you don’t have enough of those middle companies for the public ones to buy, it’s really hard to maintain growth.

That’s the key question: is there a potential for stalling of growth at some point? Because all these public companies are basically going after the same very large acquisition-type deals, and there’s only so many of those to be had. And, is there a ceiling at any point in time or are we going to be able to continue to see the accretive deal flow?

DD: Would a stall mean that interest has peaked?

PD: I don’t think it’s peaked, that’s for sure. Every single time we think any M&A trend has peaked, it always seems to shock everyone. I think it’s in a transition period or starting a transition period to where a lot of the larger deals that existed—a lot of those consolidations and divestitures have occurred. There’s not that many players in it in terms of larger aggregation companies. I think the thing that needs to occur next, though, is someone needs to crack the nut on starting to get smaller aggregators to start selling up the food chain. And it’s just a different game. It’s just different than going after private equity-backed money. They know they need an exit, they’re comfortable at certain exits. It’s just different when you’re dealing with family offices and or family ranches.

DD: So the stall happens when families stop selling?

PD: I think it can be. There’s this old mantra—never sell your minerals—and it’s been really complex to work around. I think as you get to younger generations, though these assets change hands, it is an opportunity for some divestiture. I think the more interesting one is if we start to see an increase in operators starting to sell royalties and minerals, and again, non-operated working interest off as these consolidations occur, that can happen in a number of ways.

So if an operator owns minerals, they can sell them. If an operator owns royalties, they can sell them. Operators, though, can also sell overriding royalty interests on their own properties. And this has been done a number of times from different companies. The example would be: I’m an operator, I don’t own any minerals myself, but I operate 1,000 wells and I can basically sell off an overriding royalty interest to a royalty group from my ownership, and that will raise capital for me.

There is kind of this weird market that has existed over time, again, where interest rates are and things. It can be attractive to some companies that basically selling off ownership rights as overrides in their own properties to be able to raise money. So royalties, minerals, overrides anywhere where private equity and investment banking lives. I think as many of us know from working in that industry or even just covering it, they are very good at creating new financial products and new ways in order to make money shapeshift when markets seem closed to create a new space. And so, even if there is a little bit of a stalling on the smaller end of the market, again, they’re going to find a new way in order to either create these kinds of synthetic overrides or to be able to find something else attractive in this space.

DD: Does this drive up valuations given that the market is so fragmented?

PD: Yes and no. It drives it up from the standpoint that there are less middle and larger accretive deals. A [company such as] Kimbell Royalty Partners will tell you that they really only focus on deals of $1 million or more. There’s a lot of people going after those deals, a lot of private equity money.

And there’s also public companies that are going after deals on the smaller side. There is still a lot of people going after them, but the money isn’t as crazy, meaning valuations haven’t jumped to unreasonable levels.

I think where we’re seeing the breaking point of where people are spending more is really in that middle deal space where more and more people are fighting for [fewer available] deals.

If aggregators aren’t able to aggregate enough deals to make themselves attractive to the next company up the value chain, then you have a break in [assets] that are for sale and the larger the company that can be found to buy. There’s fewer and fewer of those, which means that there’s a lot more competition whenever somebody wants to sell.

DD: What is driving this activity at this moment?

PD: Right now, I think the main reason is that prices are a little bit depressed—meaning gas is definitely still depressed, oil is still in a good range, but it wasn’t what it was a couple years ago.

And I think a lot of people are starting to see that on the horizon, there is a crunch in terms of commodities. We have all the LNG terminals coming online in ’25, which should reduce the bottleneck, at least, in the Permian, in south Texas and Louisiana.

In order to fill those purchase requirements, you’re going to have to drill more wells. So there is an easy understanding that activity is going to have to increase in certain parts of the U.S. to meet the demands and the obligations that are set forth specifically for gas, natural gas and associated liquids. And then you also just have the reality that people are trying to find yield anywhere that they can.

If you want to be invested in the energy space, it’s harder and harder now to actually invest in public operators. There are seven big ones now, and getting less and less. That’s a little different than a mineral company, which is pretty much all yield. They yield a lot more than most public companies do.

But again, as more people are interested in investing in these companies, it becomes a problem for them just to maintain scaling and maintain those payouts. I think people are kind of coming in seeing that, “Hey, we know in the next 24, 36 months, things are going to get substantially better in commodity prices.” They are trying to get in today because you buy low and maintain those yields going forward.

As people are searching for yield all over the place, especially with an anticipation of interest rates dropping at some point in time, royalties are pretty attractive compared to a REIT, commercial real estate or any type of real estate type of platform. MLPs aren’t super attractive anymore either. So, it’s kind of one of the last places for high yield type of investments, at least in the public space.

DD: And minerals have this tremendous yield because they don’t have the expense of paying for the drilling and everything that goes along with it. Is that a fair assessment or why do minerals have a better yield than other sectors in the space?

PD: It is pure free-cash flow outside of general administrative costs and outside of acquisitions, because to the point you just made, once you’ve invested the money, you don’t owe anything else on top of it. It’s a royalty off the top.

Now that also means you have to put a little bit more money in upfront. All of your costs are in the acquisition itself, and then the hope is that it’s the gravy train as it continues to pay out. So that obviously will move forward value compared to things like non-op working interests or working interests specifically. The thing that people have to remember about minerals is that again, you don’t control anything. While you don’t have any costs on the back end, the teams that are able to determine where assets will be drilled next are the ones that are going to be most attractive.

If you’re buying a bunch of acreage that maybe is producing today but doesn’t have upside in terms of the new wells being drilled in the future, you’re going to run into the problem of royalties being a declining asset. It’s a declining asset base. If all your properties are declining and you don’t have new production coming online, you’re not going to be able to maintain those free cash-flow yields. There’s a little bit of an art and a science behind it.

I think people are more investing in the teams that they believe do the best at determining what property will have the most activity in the future more than just those that are buying whatever they can in this space.

DD: Why don’t producer companies generally own the mineral rights as well as the surface interests for their operations?

PD: If you go back to the ’70s and ’80s, Exxon Mobil originally was kind of this purveyor of owning the minerals and the operations. That’s why they own so many minerals in coalbed methane out in Wyoming and Colorado. And it was seen as attractive, meaning there’s a large cost to maintaining having to pay out individual royalty owners dealing with individual leases and obligations. If you own the majority or 100% of the minerals underneath your operations, the only person you answer to is to yourself. It’s actually very attractive from an operational standpoint.

The issue was that companies moved away from it because any company has cost centers, and if you’re putting billions of dollars into operational expenses, you’re not going to put as much money into minerals. You have to choose where you’re going to invest your money.

A lot of companies just don’t have the capital to be able to be investing in both at the same time. What you’ve seen is that while some companies acquire when the opportunity exists, they’re not actively out there acquiring, but they’ll do it if it makes sense. We have seen a lot more companies starting to either create subsidiaries or do partnerships.

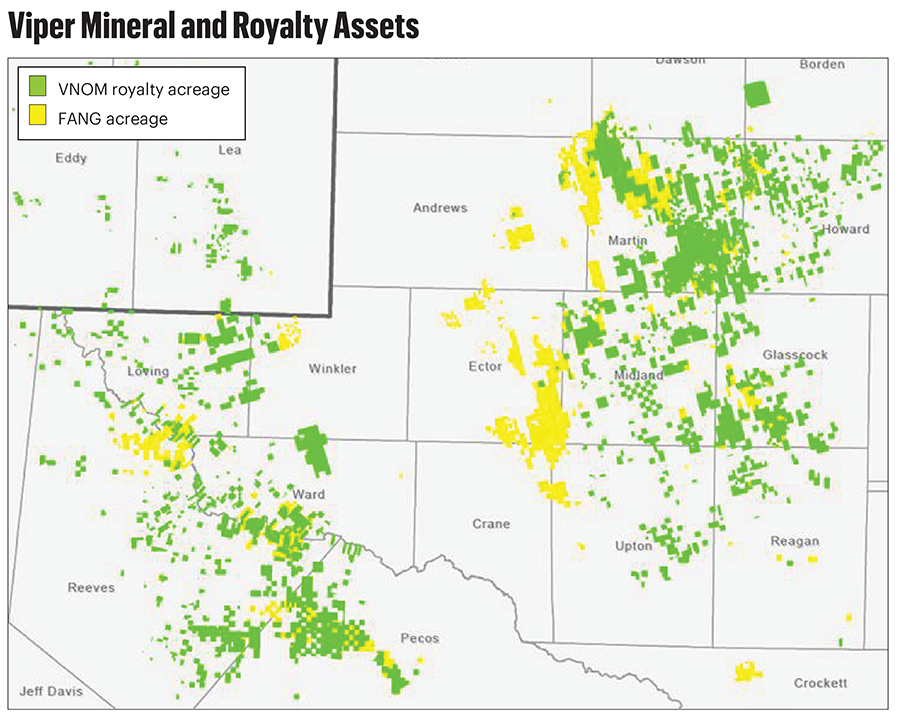

The example historically has been Viper and Diamondback. It’s a dropdown model. And so if Diamondback has minerals, they’ll basically sell it to their subsidiary Viper, who will then manage it for them. Now, the benefit of that is that Viper will know what the drill schedule is because Diamondback is operating the wells. And so they have a lot easier way of determining where they want to invest money and to be able to buy royalties. And they did the same exact thing with their other dropdown in [Rattler Midstream].

DD: How are minerals assets valued compared to traditional E&P acreage assets?

PD: It is a little bit of a two-sided answer. The assets are valued the same from an economic decline standpoint. If you ignore all the cost inputs and all that stuff, you should be coming up with the same basic well profile.

The differentiation is on the financial part. When you’re valuing an operated deal or even a working interest deal, you have to include your capital expenditures. There’s an upfront cost and you make your money over time with minerals. You don’t have that operational expense over time. And so, all your money’s invested upfront. That just means that it’s going to be worth more per acre than it would on the operator side.

The way you evaluate the properties is very similar. You come up with the client profiles, you come up with the number of wells that are going to be drilled, and that gives you a value per-acre percentage, but the actual financial cash flows is where it differs.

DD: Going forward, would you expect more of the larger minerals companies to go public?

PD: Probably not, to be honest. One of the issues that we’ve had in the space is that even though the free cash flow is attractive, the yields are attractive, the asset classes are attractive from a hedge standpoint if you don’t want to be buying with an operator … the public companies are not treated as other types of public companies in different asset classes, right? We’re treated differently than REITs in real estate. We’re treated differently than another cyclical kind of market.

You have these kind of dividend players, and until … institutional investors are really willing to put some money to work in the space to make being a public company attractive, it’s really hard for companies to go public because the only reason you go public is to have the ability to raise capital in a different manner.

If you’re a private company, you can raise money by getting debt or by raising private equity funds. If you’re public, you can raise money by getting debt issuing shares. It’s just other ways of being able to raise capital. And if it’s really hard for companies that are public to be able to raise capital, even though they’re great companies, why would you become public?

The same exact thing is true in minerals. Unless investors are really willing to step in and to make going public attractive, there’s no reason to go public.

Recommended Reading

E&P Seller Beware: The Buyer May be Armed with AI Intel

2025-02-18 - Go AI or leave money on the table, warned panelists in a NAPE program.

Understanding the Impact of AI and Machine Learning on Operations

2024-12-24 - Advanced digital technologies are irrevocably changing the oil and gas industry.

SLB’s Big Boost from Digital Offsets Flat Trends in Oil, E&P

2025-01-20 - SLB’s digital revenue grew 20% in 2024 as customers continue to adopt the company's digital products, artificial intelligence and cloud computing.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.