Normally, demand for crude oil and fuel drop off sharply after the first week of July. However, this year, demand for both gasoline and jet fuel has remained strong through August in the U.S. and Asia.

Add in the fact that Saudi Arabia and Russia have now extended production cuts through the end of the year, and the current tight supplies of fuel (especially gasoline) should tighten further.

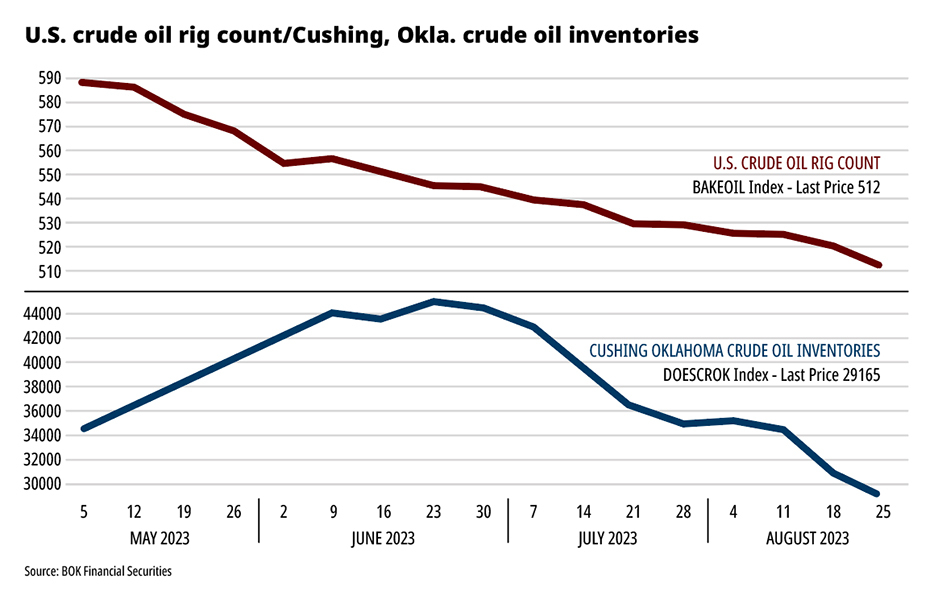

Still, there is a lot at play both domestically and globally. While China has seen a weakening in its manufacturing sector, travel demand has remained elevated, based on air and road traffic numbers. Meanwhile, as of the first week of September, U.S. storage levels of crude have dropped to nearly 16 MMbbl below the five-year average, with the NYMEX delivery point in Cushing, Oklahoma, storage dropping to a new yearly low.

So, why have U.S. crude oil rig counts continued to fall even with the steady increase in prices? The trend continues to reflect the “new” discipline that is being practiced by producers, in that higher interest rates and higher labor costs are now affecting drilling cost and moving break-even prices even higher out in the price curve. Therefore, even the latest strength in prices may not be enough to trigger a new drilling spree.

What could cause prices to weaken from here?

Looking forward, prices are overdue for a seasonal correction in demand, and I think it is coming. The big question will be how much seasonal pullback will be seen. If OPEC+, including Russia, continues to curb production and exports into 2024, and we continue to refill the Strategic Petroleum Reserve (SPR), then the pullback should be minimal and back month futures could be underpriced.

However, if the U.S. Federal Reserve continues on its hawkish path of raising interest rates (which is still a good possibility), it could trigger a “demand fear” sell-off before new winter demand emerges. Another release out of the SPR is possible if prices escalate much further, and that, too, could lower prices.

And so, there are still a lot of unknowns. However, one thing is clear: price volatility should continue with us well into the end of the year.

Recommended Reading

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

Baker Hughes Wins Contracts for Woodside’s Louisiana LNG Project

2024-12-30 - Bechtel has ordered gas technology equipment from Baker Hughes for the first phase of Woodside Energy Group’s Louisiana LNG development.

Chevron Names Laura Lane as VP, Chief Corporate Affairs Officer

2025-01-13 - Laura Lane will succeed Al Williams in overseeing Chevron Corp.’s government affairs, communication and social investment activities.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

Gigablue Enters CCS Agreement with Investment Firm SkiesFifty

2025-01-14 - Carbon removal company and investment firm SkiesFifty have partnered to sequester 200,000 tons of CO2 over the next four years.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.