Cona Resources agreed to acquire all outstanding Pengrowth shares in a cash offer of 5 Canadian cents per share, which equates to a 75% discount to Pengrowth’s stock close on Oct. 31. (Source: Shutterstock.com)

Pengrowth Energy Corp. agreed on Nov. 1 to be bought out by privately-backed Cona Resources Ltd. after the company struggled for years to regain its footing after the 2014 oil crash and growing volatility in the Canadian energy market.

The transaction, valued at about C$740 million including the assumption of debt, is the “best available alternative” for the Calgary, Alberta-based oil and gas producer, the company’s president and CEO, Pete Sametz, said in a statement.

Following the oil market crash of 2014, Pengrowth took immediate action to shore up the company’s balance sheet by selling assets to pay down C$1.2 billion of debt, according to Ken Johnston, chairman of Pengrowth’s board of directors.

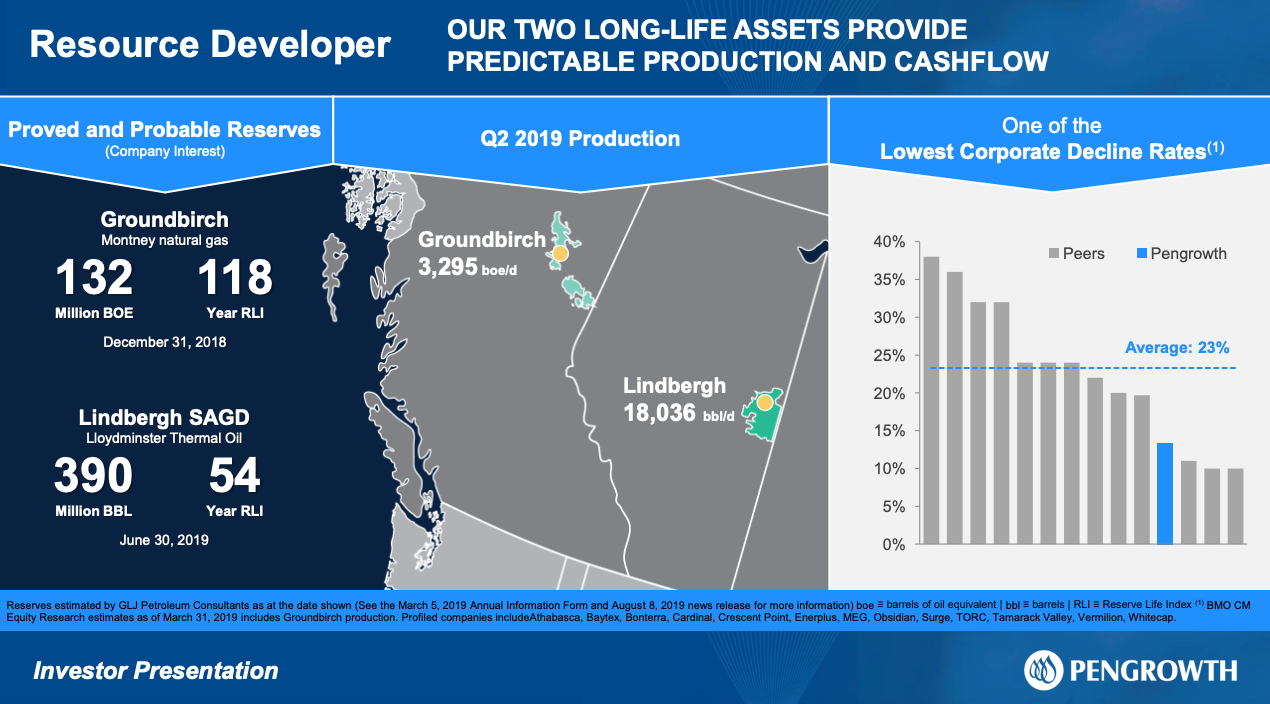

Johnston added that further efforts were undertaken in 2018 by marketing an additional overriding royalty on its Lindbergh asset, the largest capital project in Pengrowth history. The company also aimed to secure high-yield debt to replace its currently outstanding secured debt.

“Both funding initiatives proved unsuccessful,” he said in a statement. “The extreme volatility in the price of Western Canadian oil in the fall of 2018, coupled with an uncertain political and regulatory environment, has led to a severe funding crisis in the Canadian energy capital markets which impeded the company’s ability to achieve a funding solution.”

As part of the transaction agreement, Cona Resources, a portfolio company of Waterous Energy Fund, will acquire all outstanding Pengrowth shares in a cash offer of 5 Canadian cents per share, which equates to a 75% discount to Pengrowth’s stock close on Oct. 31.

“Despite the discount this transaction represents to Pengrowth’s recent trading price, we strongly recommend our stakeholders support the arrangement agreement as it represents the most attractive alternative for all stakeholders given the current environment where there is essentially no access to capital for the company or participants in the Canadian oil and gas industry, in general,” Sametz said in the statement.

Per Sametz, in addition to repaying the company’s looming secured debt bill, the deal will also provide some measure of value for Pengrowth shareholders and other stakeholders.

Pengrowth said in the release it expects to close the transaction in late December. Tudor, Pickering, Holt & Co. and Perella Weinberg Partners LP were financial advisers to Pengrowth in connection to the transaction as well as a strategic review the company launched in March 2019.

Recommended Reading

Vantage Drilling Names Williams Thomson as New COO

2024-12-31 - Thomson is currently Vantage’s chief commercial officer and CTO and has served the company since 2008.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.