At first blush, summer seems to conjure happy thoughts such as sun, beaches, baseball, fireworks and family vacations with songs like “Surfin’ U.S.A.,” “Summer Nights” and “Cool for the Summer” helping to create the season’s soundtrack.

However, a darker soundtrack for the season can just as easily be formed with classics like “Cruel Summer,” “Summertime Blues” and “Summertime Sadness” leading that playlist.

This summer undoubtedly falls in the latter category for the hydrocarbon market with prices continuing to slump in the natural gas, NGL and crude oil markets.

In this case, the sooner that winter comes, the better, for the energy business.

Indeed, these markets should experience an uptick in the fall and winter as heating demand increases and with Saudi Arabia set to pull back production from its record high of 10.56 million barrels per day (bbl/d) produced in June by 200,000 to 300,000 bbl/d, according to press reports. This isn’t a reflection of the country changing its stance on production; rather it is related to seasonal reductions in cooling demand as Saudi Arabia uses crude-fired power generation.

The record production out of Saudi Arabia has helped stunt the modest gains that West Texas Intermediate (WTI) crude experienced in the spring and early summer. By the beginning of August, WTI fell below $45 per bbl, its lowest level since 2009.

Global crude remains oversupplied but demand growth is mostly being impacted by macro-economics, especially a worrying outlook for the Chinese economy as Asia represents the largest growth driver for crude demand. This should keep a ceiling on how much crude can improve in the next 12 months.

It is likely that crude prices will improve once the refinery maintenance season is over in the fall, but until that time WTI prices could decrease further. This will create another headwind for NGL prices, which will need to wait until winter for both refinery blending and heating demand to begin to see any sustained price uptick.

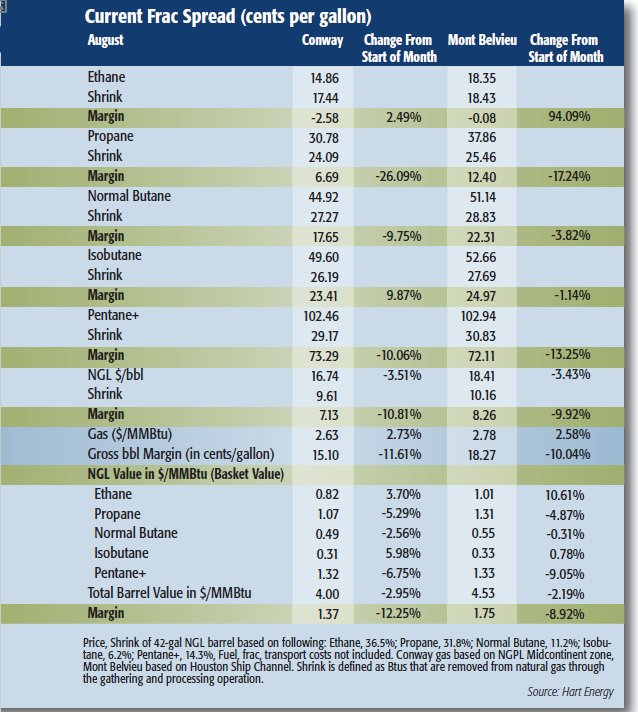

Heavy NGL prices were down at both the Conway, Kan., and Mont Belvieu, Texas, hubs with C5+ hitting its lowest levels at the start of August, at each location, since January.

There is an equally negative short-term outlook for the light NGL market as propane awaits heating demand to begin to work off its overhang, which is expected to far exceed the five-year average by the time winter begins. Margins remain positive but are getting thinner, especially at Conway.

Ethane storage levels have been improving and saw declines for the first time in several years as rejection is having a positive impact on the market.

Recommended Reading

Bottlenecks Holding US Back from NatGas, LNG Dominance

2025-03-13 - North America’s natural gas abundance positions the region to be a reliable power supplier. But regulatory factors are holding the industry back from fully tackling the global energy crisis, experts at CERAWeek said.

Trump’s DOE Issues First LNG Permit of Term to Commonwealth LNG

2025-02-14 - The former administration of President Joe Biden had halted permitting for all of 2024.

NatGas Prices, E&Ps Take a Hit from DeepSeeking Missile

2025-01-28 - E&Ps such as Expand Energy and EQT Corp. saw share prices drop on news of less power-intensive AI, but analysts predict the natural gas market will rebound as LNG exports and overall power demand continues to increase.

DOE Approves Venture Global’s CP2 LNG to Export to Non-FTA Countries

2025-03-20 - The U.S. Department of Energy approved Venture Global’s Calcasieu Pass 2 LNG project in Cameron Parish, Louisiana, to export LNG to non-FTA countries.

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.