Houston-based Summit Midstream will buy Tall Oak Midstream III in a cash-and-stock deal worth approximately $450 million, Tall Oak’s portfolio partner Tailwater Capital announced Oct. 1. (Source: Shutterstock)

Houston-based Summit Midstream Corp. (SMC) will buy Tall Oak Midstream III in a cash-and-stock deal worth approximately $450 million, Tall Oak’s portfolio partner Tailwater Capital announced Oct. 1.

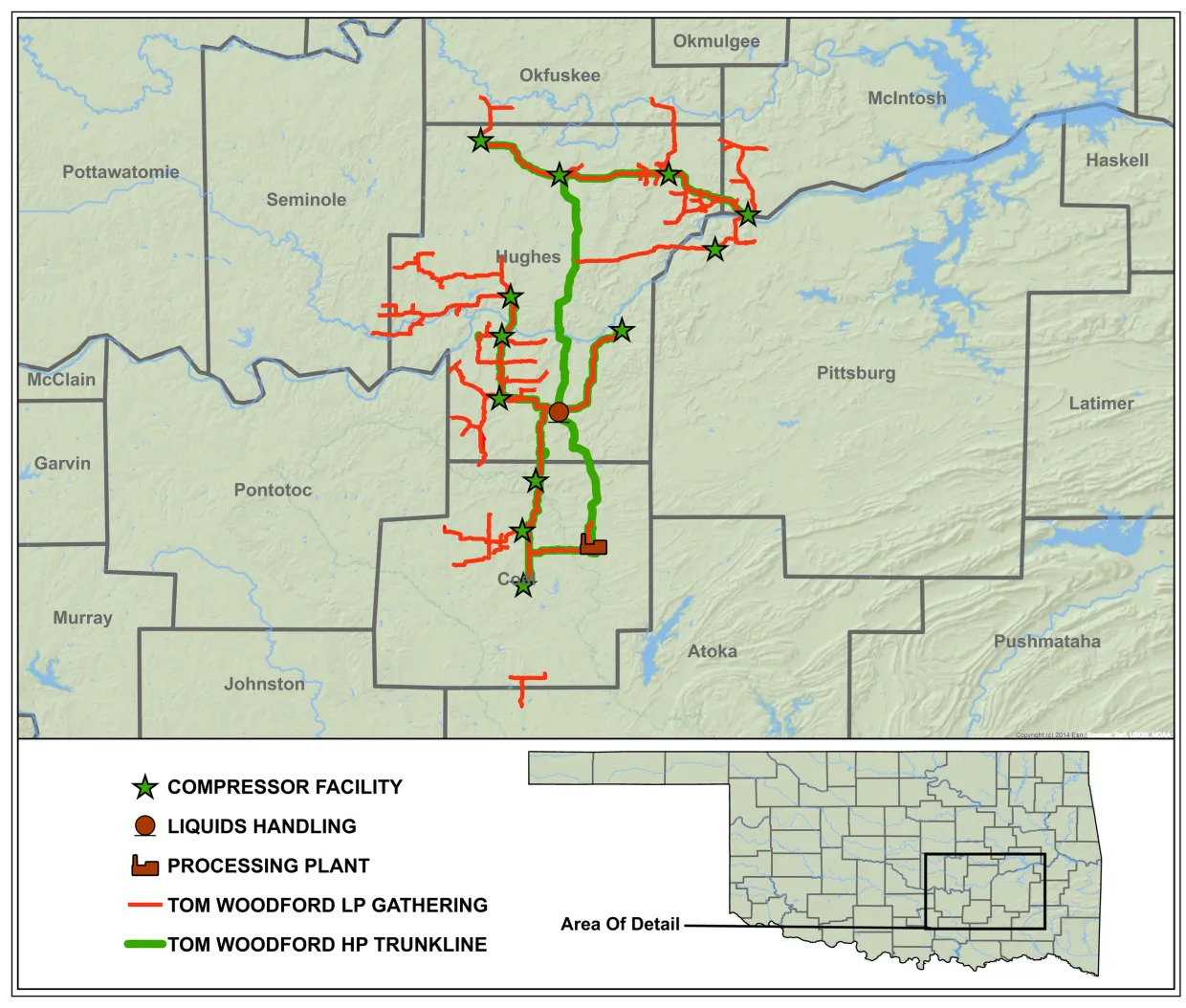

Tall Oak’s assets include a gathering and processing system in the Arkoma Basin in Arkansas and Oklahoma. The company has two 220 MMcf/d natural gas processing plants and 411 miles of gas-gathering lines.

The deal shifts Summit’s commodity exposure to a more equal weight of oil and natural gas as the company prepares for growing natural gas demand in the next ten years, said SMC President, CEO and Chairman Heath Deneke in an announcement of the deal.

“The Tall Oak system in the Arkoma Basin is well positioned, similar to our existing Barnett asset, to help satisfy that demand growth with access to the Gulf Coast, Mexico and key power generation markets."

As per the deal, Summit will fund the acquisition with $155 million in cash and stock representing approximately 40% ownership in Summit, broken down into about 7.5 million shares of Summit Class B common stock and common units of Summit Midstream Partnership, a wholly-owned subsidiary of SMC.

The deal also includes up to $25 million contingent consideration in cash over certain measurement periods through March 2026, according to Tailwater’s announcement.

For SMC, the transaction has a value accretive acquisition multiple of an estimated 5.6x 2025 asset-level adjusted EBITDA.

The deal is expected to close by the end of 2024.

Upon closing, four directors chosen by Tailwater Capital will serve on the pro forma Summit Board.

Lewellyn said in the announcement that he planned to work with Tailwater Capital again in future Tall Oak projects.

"Our entire Tall Oak team has done an exceptional job delivering high-quality service while prioritizing reliability and safety, and I am confident that the Summit team will continue to execute and capitalize on new and exciting opportunities in the Arkoma Basin," said Ryan Lewellyn, Tall Oak president and CEO in the announcement.

Tailwater Capital had a busy Oct. 1. On the same day of the Tall Oak deal’s announcement, the company also announced that it had purchased non-op working interests across 5,000 acres in the Permian Basin for an undisclosed amount.

Recommended Reading

Baker Hughes to Supply Multi-Fuel Gas Tech to TURBINE-X

2025-03-17 - Baker Hughes will provide TURBINE-X with its NovaLT gas turbine is capable of running on different fuels including natural gas, various blends of natural gas and hydrogen.

Element Six, Master Drilling Announce Tunnel Development Partnership

2025-02-19 - Element Six and Master Drilling will deliver a diamond-enabled solution designed to increase tunneling development speed, reducing costs and minimize the environmental impact of tunnel construction.

Pioneer Energy’s Tech Offers More Pad Throughput, Fewer Emissions

2025-01-14 - Pioneer Energy’s Emission Control Treater technology reduces emissions and can boost a well’s crude yield by 5% to10%, executives say.

No Drivers Necessary: Atlas RoboTrucks Haul Proppant, Sans Humans

2025-03-04 - Atlas Energy Solutions and Kodiak Robotics have teamed up to put two autonomous trucks to work in the Permian Basin. Many more are on the way.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.