Source: Hart Energy

A Nov. 21 agreement by Sunoco Logistics Partners LP (NYSE: SXL) to acquire Energy Transfer Partners LP (NYSE: ETP) may be the icing on one of the strangest cakes that 2016 had to offer.

Sunoco said it would merge with ETP in an all-equity deal that pays a 10% premium to ETP based on its 30-day trading average but adds virtually zero premium to ETP’s Nov. 18 trading price. ETP will essentially be purchased for its current value of 19.93 billion.

The deal calls for ETP unitholders to receive 1.5 common units of SXL for each common unit of ETP they own.

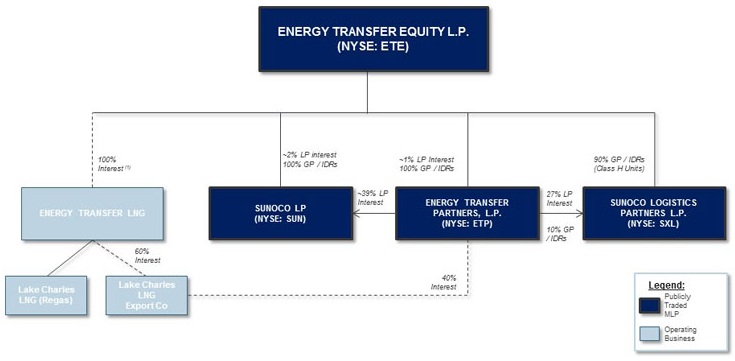

The MLPs involved in the transaction fall under the general umbrella of Energy Transfer Equity LP (NYSE: ETE). Sunoco’s general partner is itself a consolidated subsidiary of ETP. On a consolidated basis, ETE’s family of companies owns and operates about 71,000 miles of natural gas, NGL, refined products and crude oil pipelines.

Elvira Scotto, an analyst at RBC Capital Markets LLC, said Sunoco’s acquisition creates a simpler structure for the MLPs and will improve ETP’s cost of capital, which should allow the combination to complete its various projects with improved economics.

The two MLPs have spent about $15 billion in organic growth capital over the past several years. The expenses, combined with the completion of other major capital projects currently in progress, are expected to continue generating strong distributable cash flow growth.

Cash savings resulting from reduced combined distribution payments should allow Sunoco to reduce leverage more quickly.

“We estimate an effective 27% distribution reduction to current ETP unitholders,” Scotto said. “That said, we believe the lack of an [incentive distribution rights] IDR reset [is] putting pressure on SXL/ETP units today; but we believe the surviving entity is in a stronger position longer-term.”

After the announcement, ETP’s stock, which closed at $39.37 on Nov. 18, fell to $36.73 in morning trading.

Sunoco and ETP said that they expect the transaction will create commercial synergies and cost savings in excess of $200 million annually by 2019. Sunoco said it expects the merger to be immediately accretive to its cash flow per common unit. Scotto said the MLP will be able to grow its distribution in the low double-digit range in the near future while maintaining above 1x distribution coverage.

ETP has had a tumultuous year. In September 2015, EYE, which owns the IDRs of ETP, tried to purchase Williams Cos. Inc. (NYSE: WMB) for $37.7 billion. Williams had rejected past overtures and the merger appeared to grow acrimonious before it was terminated June 29 over tax complications.

In October, ETP moved on by making a deal to buy PennTex Midstream Partners LP (NASDAQ: PTXP) for $640 million. However, the company’s Dakota Access Pipeline (DAPL) continues to face battles with protestors and shifting ground with federal agencies.

Following the Sunoco merger, ETE will own Sunoco’s IDRs. However, ETE has agreed to continue to provide all the incentive distribution right subsidies that are currently in effect with both partnerships.

At the closing of the transaction, Dallas billionaire Kelcy Warren, ETE’s CEO, will head the combined Sunoco/ETP partnership.

The merger is expected to close in the first quarter of 2017, subject to approval by ETP unitholders.

Latham & Watkins LLP was legal counsel to ETP. Vinson & Elkins LLP was legal counsel to SXL. Barclays was financial adviser to, and Potter Anderson & Corroon LLP was legal counsel to, ETP’s conflicts committee. Citi was financial adviser to, and Richards Layton & Finger, PA was legal counsel to, SXL’s conflicts committee.

A conference call on the combinationwas set for 3 p.m. CT on Nov. 21.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

TotalEnergies, Skyborn Commission Yunlin Wind Farm Offshore Taiwan

2025-03-04 - Located about 15 km off Taiwan’s west coast, Yunlin consists of 80 wind turbines.

Norges Bank Acquires $1.5B Stake in North Sea Wind Projects

2025-03-31 - Norges Bank’s deal with RWE includes the Nordseecluster wind farm in the German North Sea and the Thor wind farm in the Danish North Sea.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

Costs for Dominion’s 2.6-GW Offshore Wind Project Swell to $10.7B

2025-02-03 - With 176 turbines, Dominion Energy’s Coastal Virginia Offshore Wind has seen costs rise by about $900 million, or 9%, the company said.

Energy Transition in Motion (Week of April 11, 2025)

2025-04-11 - Here is a look at some of this week’s renewable energy news.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.