The Uinta needs a railway to meet the needs of paraffin-rich crude the basin produces. The basin produces a waxy crude that is primarily solid at room temperature. (Source: Shutterstock)

A proposed railway for Utah’s Uinta Basin to be heard by the U.S. Supreme Court has become part of an ongoing battle over energy policy within the U.S. government that could affect the permitting of pipelines and LNG plants.

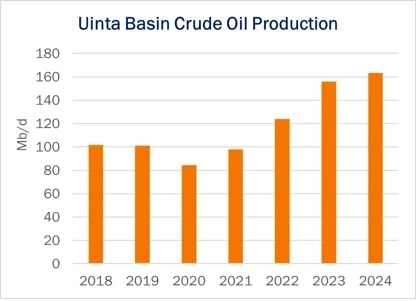

The case concerns a proposed 80-mile line connecting the crude-producing basin to the Union Pacific Railroad in Kyune, Utah. From there, rail connections would deliver the oil to either refineries in Wyoming or along the Gulf Coast, according to an analysis by East Daley Analytics (EDA).

This fall, the Supreme Court will hear arguments over the U.S. Surface Transportation Board’s (STB) approval of the plan and the subsequent denial by the D.C. Circuit Court of Appeals.

The Uinta needs a railway to meet the needs of paraffin-rich crude the basin produces. The basin produces a waxy crude that is primarily solid at room temperature. Refiners prefer the product because of its low sulfur, metal and nitrogen contents, EDA analyst Kristine Oleszek wrote.

RELATED

Uinta Rivals the Best of Permian, XCL Resources Contends

The problem is that the waxy crude can’t be shipped through normal oil pipelines without first being diluted by about 6 bbl of light sweet oil. Today, the product is shipped out of the basin via trucks.

Adding a railway would be a “game changer,” Oleszek wrote, increasing the basin’s oil egress capacity by 8 MMbbl/d.

The project was proposed by a coalition of seven counties in the area, according to an analysis of the case by Arbo, a firm that tracks government regulations and actions regarding the energy industry. In 2021, the project was approved by the STB.

The Eagle County, Colorado, board of commissioners and the Center for Biological Diversity filed appeals of STB’s decision to the D.C. Court of Appeals. The rail project became part of an ongoing battle over the role greenhouse-gas emissions should play in the federal permitting process.

According to Arbo, in several cases the appellate court, made up of three Democratic appointees, has suggested that government regulatory commissions should take a more active role in combatting the release of emissions.

The appeals court panel ruled that STB’s decision should have applied the National Environmental Policy Act (NEPA) not only to the railway but also to related downstream and upstream operations.

The STB argued that upstream and downstream effects were beyond its jurisdiction and that determining the extent of greenhouse-gas emissions would place a massive regulatory burden on organizations trying to build railways in the future.

Arbo noted that the case could have implications well beyond railroads. The U.S. Federal Energy Regulatory Commission (FERC) has also faced controversy over whether the effects of greenhouse-gas emissions on communities near a project should be considered in its decision making process.

A ruling against the STB in the railway case could affect FERC’s decisions on pipelines and LNG plants.

FERC Chairman Willie Phillips “is trying to walk a fine line between the hard left and the hard right as to the scope of FERC’s review, but if the STB case is allowed to stand, it will be a hard shove to the left and may force him into an untenable position that will only lead to a very fractured Commission,” Arbo’s analysis said.

On June 27, FERC approved Venture Global’s Calcasieu Pass 2 LNG facility in a 2-1 decision. The dissenting vote came from Commissioner Allison Clements, who argued that the commission needs to expand its consideration of CO2 emissions when permitting LNG plants.

Recommended Reading

Sage Geothermal, ABB Form Energy Storage, Power Partnership

2025-02-04 - In a memorandum of understanding, ABB said it would support Sage Geothermal on its energy project with Meta.

USA BioEnergy Secures Texas Land for $2.8B Biorefinery

2025-01-13 - USA BioEnergy subsidiary Texas Renewable Fuels plans to annually convert 1 million tons of forest thinnings into 65 million gallons of net-zero transportation fuel, including SAF and renewable naphtha.

TGS, deepC Store to Evaluate Location Offshore Australia for Carbon Storage

2025-02-13 - TGS will work on the assessment in the Browse Basin throughout 2025.

Ormat Starts Operations at New Jersey Energy Storage Facility

2025-01-03 - Ormat Technologies Inc. said the Montague energy storage project has a capacity of 20 megawatt/20 megawatt-hours.

CS Energy, Calibrant Deliver Three BESS in New York

2025-02-05 - CS Energy and Calibrant Energy completed three stand-alone battery energy storage systems in New York.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.