A recovering oil and gas industry rewarded its top executives with hefty raises in 2022, relying on ESG performance as a key metric, a global management consultancy said in its annual compensation report.

E&Ps bestowed an average increase of 11.9% in total compensation to their CEOs, bringing the average total package to more than $11.6 million. CEOs at oilfield services companies saw their compensation jump a startling 25.8% to an average of about $9.6 million.

The percentage increases for CFOs was even more dramatic: At E&Ps, the jump was 19.1% to $4.6 million; in oilfield services, pay soared 36.2% to $3.7 million.

“It didn’t surprise me that the overarching amounts went up,” Allison Hoeinghaus, managing director with Alvarez & Marsal Taxand LLC’s Compensation and Benefits practice, told Hart Energy. “I just was surprised how much they went up in terms of the CFO—that is a lot. When you think about packages mostly being driven by equity awards, it made sense.”

The Alvarez & Marsal report noted that ESG continues to rise in importance as a compensation metric. It constituted 11% to 20% of annual incentive plans in the E&P sector and 10% in the oilfield services sector.

For energy companies, it’s something of a legacy issue.

“One thing that’s been well-adopted is safety,” Hoeinghaus said. Safety counts as a key metric within compensation and falls under the ESG umbrella.

All E&Ps and 80% of oilfield services companies used ESG as a metric in 2022. It was not included for executive compensation in the clean energy sector because supporting environmental issues would be assumed as essential to the company’s strategy.

Common incentives

The most common forms of long-term incentive compensation—used by 80% of the higher market capitalization E&Ps surveyed, and 90% of all oilfield service companies—are time-vesting restricted stock/restricted stock units (RSUs). RSUs, which give executives the option to defer payouts beyond vesting, are much more prevalent.

The vast majority of companies surveyed (88% of E&Ps, 94% of oilfield services) choose three-year vesting periods. Most also use awards that vest ratably instead of cliff vesting, in which all of the grant vests at the end of the period.

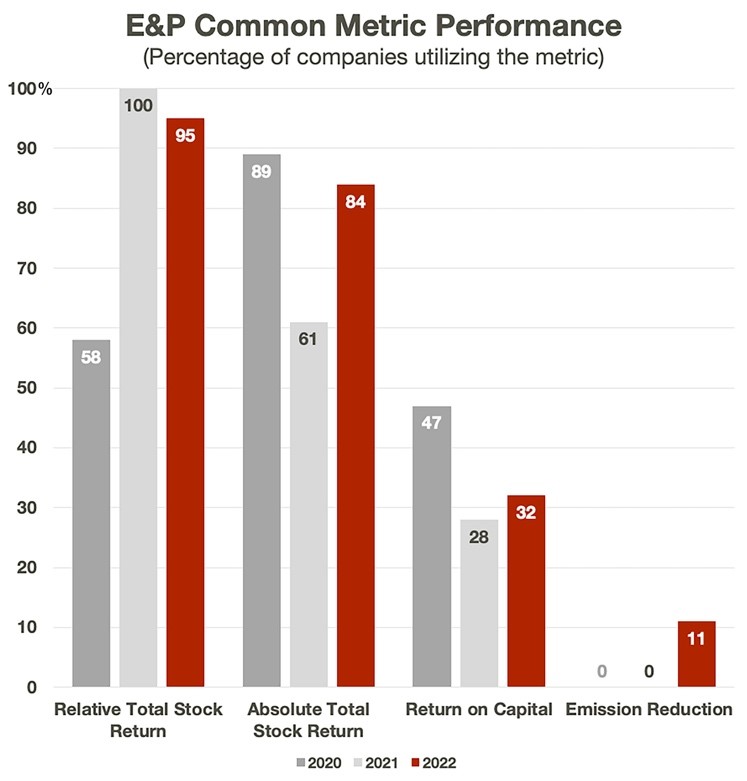

The most common performance metric for E&Ps is total stock return, which is used in 95% of performance-vesting awards among the companies surveyed. ESG made its first appearance as a performance metric for E&Ps in 2022.

In the oilfield services sector, relative total stock return was also the leading metric.

“The most common metric we saw in incentive awards was the relative total shareholder return,” Hoeinghaus said. “That’s directly tied to the stock price, as well as the company stock price relative to companies in a similar situation. It’s not good enough just to increase the stock price—you’ve got to increase more than your peers.”

Exit pay

Stakeholders have often voiced displeasure over change-in-control or non-change-in-control severance packages, the report authors acknowledge. However, in an industry rife with consolidation, energy companies put themselves in a competitive disadvantage in attracting top executives if they don’t include a parachute in the contract.

“This is all geared at giving [CEOs and CFOs] some security if things don’t work out or you’re acquired,” Hoeinghaus said. “It’s essentially bridge pay to get them to that next position, which can take a while, given the industry and their level within an organization.”

A CEO who turns out not to be a good fit with the E&P will receive an average $20.4 million in severance. The average is $7.4 million for a CEO in the same situation with an oilfield services company. For CFOs, the average is $5.7 million at E&Ps and $2.6 million in oilfield services.

If the termination is due to acquisition or merger, the parachutes are a deeper shade of gold. A CEO at an E&P would receive an average $39.6 million, and one at an oilfield services company would garner $17.6 million. A CFO would receive $14.3 million at an E&P and $5.7 million in oilfield services.

“Energy has generally been one of the higher payers in this area, and I think it’s because it has been an industry with a lot of consolidation historically,” she said.

Recommended Reading

Chevron Targets Up to $8B in Free Cash Flow Growth Next Year, CEO Says

2025-01-08 - The No. 2 U.S. oil producer expects results to benefit from the start of new or expanded oil production projects in Kazakhstan, U.S. shale and the offshore U.S. Gulf of Mexico.

Venture Global Targets $110B in Massive IPO

2025-01-13 - Venture Global is expected to pitch its IPO to investors by Jan. 17 to rival the largest energy IPOs on record.

Exxon, Chevron Beat 3Q Estimates, Output Boosts Results

2024-11-01 - Oil giants Chevron and Exxon Mobil reported mixed results for the third quarter, with both companies surpassing Wall Street expectations despite facing different challenges.

Record NGL Volumes Earn Targa $1.07B in Profits in 3Q

2024-11-06 - Targa Resources reported record NGL transportation and fractionation volumes in the Permian Basin, where associated natural gas production continues to rise.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.