(Source: Shutterstock.com)

Editor's note: This article has been updated with more information.

Talos Energy President and CEO Tim Duncan has stepped down from his role with the company on Aug. 29, Talos said in an Aug. 30 press release. The company provided no additional information for Duncan’s departure.

In an Aug. 30 analyst report, KeyBanc Capital Markets’ Tim Rezvan said the company told him that the board was concerned by the underperformance of Talos’ share prices and decided that new leadership was needed to rebuild interest and credibility with the investment community. Rezvan called the leadership change a “negative surprise.”

“We appreciate this message, but still view this as a negative, given Mr. Duncan was a founder and the news comes late in the quarter, a week before a (now canceled) sell-side meeting in” New York, Rezvan wrote on Aug. 30. “We can't help but wonder if other issues factored into this decision, including: execution in the field that may drive weak 3Q results; difference of opinion on strategic M&A outlook; and/or a difference of opinion on how to address the growing ownership position of Carlos Slim.”

Talos did not respond to a Hart Energy request for further details about Duncan leaving.

Talos board member and Samson Resources CEO Joseph A. Mills will take the reins of the offshore E&P until a successor is in place. The board has initiated a search for a new CEO in partnership with an executive search firm. Mills also served as a director of QuarterNorth Energy, which Talos acquired in March for $1.29 billion, Rezvan said.

Revzan predicted that share prices would fall on the news. In early morning trading on Aug. 30, stocks were down 6.7% to $11.13 per share.

Revzan also speculated that M&A might have been a source of tension between Duncan and the board.

During the past year, management has said that to grow into a position of scale—effectively tripling production to 300,000 boe/d, “M&A outside the Gulf of Mexico may be needed,” he said.

“Buy-side investors were lukewarm about this possibility. In addition, we wonder if this news has an implication on 3Q24 earnings,” Revzan said.

Rezvan did note that Talos shares clearly declined. Year-to-date, share prices are down 16% year-to-date versus the oil and gas E&P index XOP, which is up 2%. Talos share prices declined by 25% in 2023.

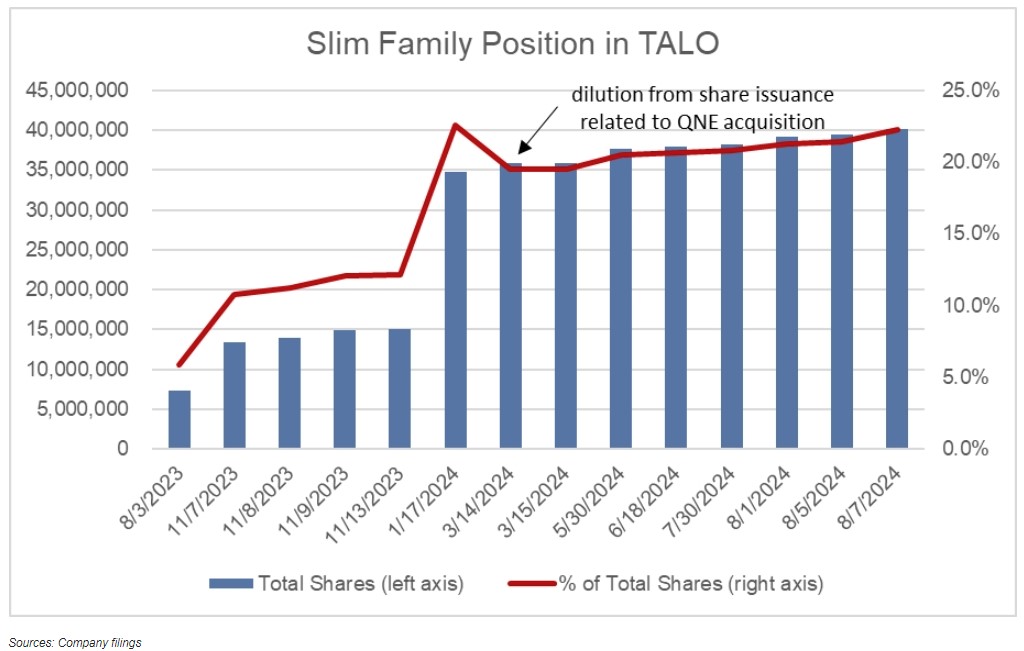

Rezvan also noted that the family office of billionaire Carlos Slim has been steadily buying shares over the past 12 months.

Rezvan said the growing Slim position might raise questions over what commentary is being exchanged by Talos’ leadership and Slim’s family office that might have led to a change in leadership.

“The Slim position now stands at 40.1 [MM] shares (22.3% ownership), raising questions on when/if the board needs to consider a poison pill,” Rezvan said. “It appears the board believes that a new leader, perhaps one with less aspirational long-term goals than Mr. Duncan, may better serve as the face of Talos.”

Neal P. Goldman, chairman of Talos' board of directors, expressed gratitude for Duncan’s “invaluable contributions to the company."

"Currently, Talos stands as a leading exploration & production company in the Gulf of Mexico, backed by a dedicated team committed to safely and efficiently driving long-term value," Goldman said.

Talos reaffirmed its third-quarter 2024 production guidance and operational and financial guidance for the full year 2024. As previously reported, for the third quarter of 2024, Talos expects average daily production of 92,000 boe/d to 97,000 boe/d.

Rezvan said KeyBanc had less confidence in the third-quarter outlook “following this news.”

Mills has served as CEO of Samson Resources II LLC since March 2017. Mills has more than 42 years of experience in the oil and gas energy business. Along with Talos, Mills serves as board member of several other private E&P companies. Prior to joining Samson Resources, Mills served in various leadership roles, including chairman and CEO for several public and private oil and gas companies, including Eagle Rock Energy G&P LLC and Roan Resources Co.

"Mills brings a wealth of industry experience and knowledge, boasting over 42 years in senior leadership positions and serving on the boards of both public and private companies in the oil and gas sector," Goldman said.

Mills said the board has played an active role guiding and evaluating Talos’ strategic approach, “and I am confident about Talos' direction and strategy.”

“Our commitment remains firm in delivering compelling value for our shareholders. I look forward to working closely with the board and leadership team, drawing on their extensive knowledge to advance our strategic priorities during this transitional period," he said.

Recommended Reading

Commercial Operations at Calcasieu Pass LNG to Begin in April

2025-02-18 - Venture Global started selling LNG at the plant in 2022, angering its long-term customers.

EIA Reports Smaller than Expected NatGas Withdrawal-Analysts

2025-03-06 - A mild end to February shows a surprising demand decrease for natural gas, according to analysts citing U.S. Energy Information Administration data.

USGS: 47 MMbbl of Oil, 876 Bcf of Gas in Conventional Rockies’ Basins

2025-03-13 - The U.S. Geological Survey surveyed areas where potential hydrocarbons in as yet undiscovered oil and gas formations in the Wind River, Bighorn and Powder River basins.

Reset Energy to Build a Nitrogen Rejection Unit for Permian Residue Gas

2025-03-04 - Reset Energy will install a nitrogen rejection unit at a large-scale facility in the Permian Basin to deliver a residue gas product for a midstream operator.

Vår Energi Makes Third Oil Discovery in Barents Sea

2025-02-27 - Vår Energi has discovered a third offshore oil reserve in the Goliat area of the Norwegian Continental Shelf as part of an exploratory collaboration with Equinor.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.