John Spath, Talos' interim co-president, executive vice president and head of operations, said the deepwater well was 35% under budget and more than a month ahead of schedule. (Source: Shutterstock)

Talos Energy Inc. said Jan. 15 that its Katmai West #2 well in the Ewing Bank area of the U.S Gulf of Mexico successfully encountered 400 ft of gross oil and natural gas pay.

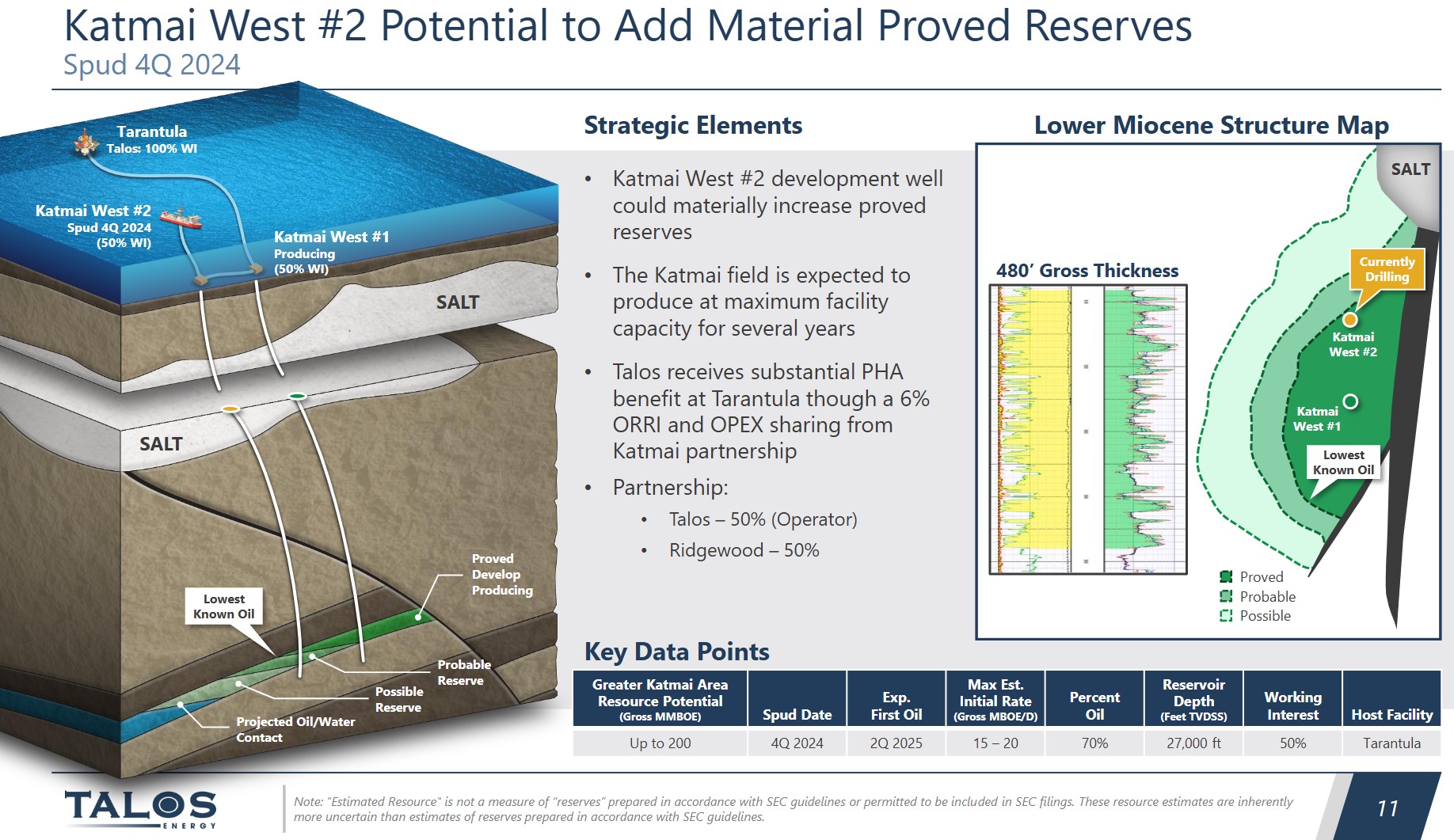

The well, drilled to a true vertical depth of 27,000 ft, is expected to deliver in-line with pre-drill estimates of approximately 15,000 boe/d to 20,000 boe/d gross, the company said. First production is expected late second- quarter 2025.

The well encountered the primary target sand full-to-base with “excellent rock properties,” the company said.

John Spath, Talos' interim co-president, executive vice president and head of operations, said the deepwater well was 35% under budget and more than a month ahead of schedule, demonstrating “our ability to efficiently execute complex projects while maintaining top safety and environmental standards.”

Combined with the Katmai West #1 well, the Katmai West #2 well has nearly doubled the Katamai West Field’s proved EUR to approximately 50 MMboe gross, Talos said. That further affirms the company's expected total resource potential of approximately 100 MMBoe gross, Talos said.

Last year, Talos added a 50% working interest in the Katmai discovery in its $1.29 billion acquisition of QuarterNorth Energy Inc. Talos is the operator. Entities managed by Ridgewood Energy Corp. holding the other 50% in Katmai West Field.

The drillship West Vela began drilling the Katmai West #2 well in late October 2024. Talos plans to case and suspend the well by late January 2025 while the company finalizes completion plans to be executed in the second quarter.

The well will be connected to the existing subsea infrastructure that flows to Talos’ 100% owned Tarantula facility, which has been expanded to increase capacity to 35,000 boe/d.

Recommended Reading

Burgum: Yes to US Power Supply, Reliability; No on Sage Grouse

2025-01-16 - Interior Secretary nominee Doug Burgum said the sage grouse is neither endangered nor threatened; he'll hold federal leases as scheduled; and worries the U.S. is short of electric power and at risk of losing the “AI arms race” to China and other adversaries.

VanLoh: US Energy Security Needs ‘Manhattan Project’ Intensity

2025-02-06 - Quantum Capital Group Founder and CEO Wil VanLoh says oil and gas investment, a modernized electric grid and critical minerals are needed to meet an all of the above energy strategy.

Chevron’s Wirth: Rapid Transitions in Energy Strategy ‘Not the Right Policy Approach’

2025-03-10 - Relying on the president, whoever it is, leads to a wildly inconsistent energy policy in the U.S., Chevron CEO Mike Wirth said at CERAWeek by S&P Global.

Corrolytics Diagnoses Corrosive Microbes Before Symptoms Appear

2025-03-18 - Cleveland startup Corrolytics offers a solution to detect microbial corrosion rates on site and in near-real time—and head off a problem that costs trillions of dollars to industrial assets worldwide.

Hamm: Interior, DOE Leadership is a ‘Dream Team’

2025-02-06 - Harold Hamm, U.S. energy policy influencer and founder of wildcatter Continental Resources, said his top choices of Interior Secretary Doug Burgum and newly confirmed Energy Secretary Chris Wright will be a “dream team of unimaginable proportions.”

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.