The tieback required installing new subsea infrastructure and upgrading facilities. (Source: Shutterstock)

Talos Energy announced Jan. 3 it brought its finds at its Lime Rock and Venice prospects onstream, a year after Talos reported discovering hydrocarbons at both prospects.

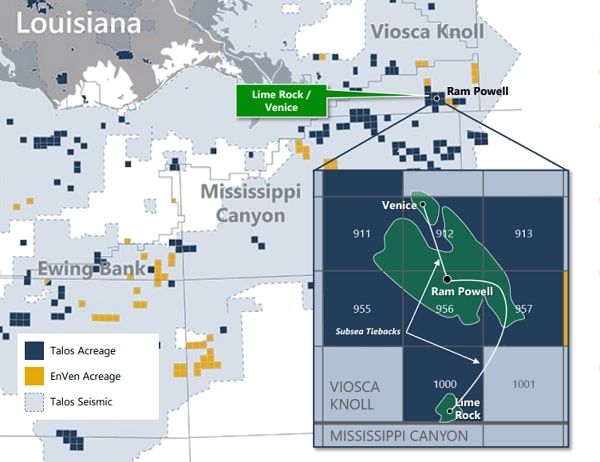

The deepwater Gulf of Mexico discoveries were tied back subsea to the Talos-operated Ram Powell tension-leg platform (TLP) in 3,200 ft water depth. Lime Rock’s tieback was 9 miles long while Venice’s was 4 miles long.

The tieback required installing new subsea infrastructure and upgrading facilities.

“With these production additions, the Ram Powell facility is expected to achieve the highest combined sustainable production rate since approximately 15 years ago,” Talos President and CEO Timothy S. Duncan said in a Jan. 3 press release.

Talos brought the two wells online in late December 2023, ahead of the planned first quarter 2024 start date. The initial combined gross production rate exceeded 18,500 boe/d, averaging about 45% oil and 55% liquids. Talos estimates the combined gross ultimate recoverable resources of the Lime Rock and Venice discoveries at 20 MMboe to 30 MMboe. In addition to Talos’ net production, the company said it will collect volume-based production handling fees from non-operated partners in both discoveries.

Talos acquired the Lime Rock prospect in Lease Sale 256 in 2020. Talos identified the Venice prospect within existing Ram Powell unit acreage. While Talos initially held 100% interest in both prospects, it farmed down to an operated 60% interest in both wells. Talos operates the Ram Powell TLP in Viosca Knoll Block 956 with 100% interest.

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Williams to Invest $1.6B for On-Site Power Project with Mystery Company

2025-03-07 - Williams Cos. did not name the customer or the location of the power project in a regulatory filing.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-03-07 - Baker Hughes said this week's decline puts the total rig count down 30, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.