Twas 4Q of ’14, when all through the sector, not an investor was happy, the stocks needed a corrector. The deals were assembled by the wonks with such care, in hopes that the billions for Atlas soon would be there.

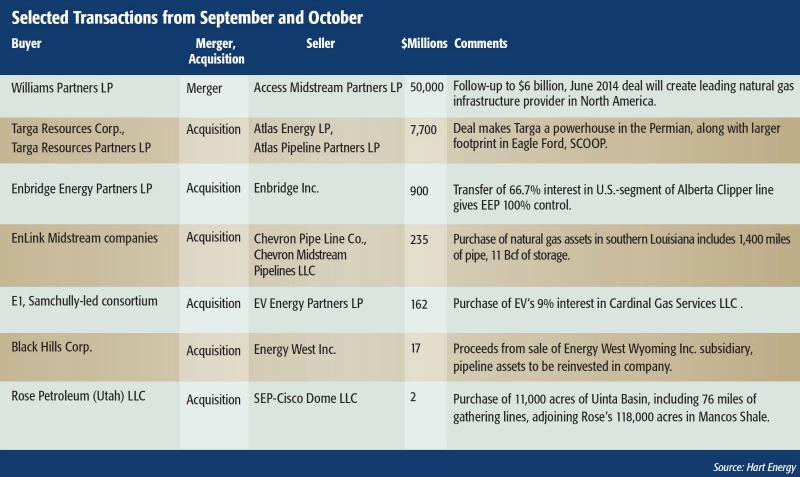

By the time this Midstream Business hits your desk, your biggest fear may be going anywhere near the mall. But back at the start of the quarter, investors were running scared of midstream stocks. Then Targa Resources Corp. (TRGP) and Targa Resources Partners LP chose a direction and bought themselves an Atlas for $7.7 billion.

“Market hated just about everything midstream yesterday,” read Tudor, Pickering, Holt & Co.’s research note on Oct. 14, “but deal is in fact massively accretive for [TRGP] (greater than 30% cash flow per share) even after modest [general partner] giveback to [Targa Resources Partners LP], who also benefits ~10% on per- LP [discounted cash flow] metrics.”

J.P. Morgan’s Jeremy Tonet mentioned that he liked what was missing in the deal: Atlas’ divestment of non-Atlas Pipeline Partners assets before the deal is completed. No reason to gum up the works by diluting what he called Targa’s “solid organic growth midstream story.” But the best part is Targa’s much larger footprint in the Permian Basin, where the Atlas assets provide it with processing capacity that will rank second in the play at around 1.44 billion cubic feet per day.

The season also greeted the announcement of The Williams Cos. Inc.’s $50 billion merger with good cheer. “We expect the merger to be a game-changer for [Williams Partners LP],” said J.P. Morgan. “We see a clean Williams Cos. story that should achieve attractive yield compression as investors regain confidence in a simpler, healthier and faster-growing company.”

Happy investing to all, and to all a good deal.

Joseph Markman can be reached at jmarkman@hartenergy.com or 713-260-5208.

Recommended Reading

DUCs Fly the Coop: Big Drawdowns from the Midland to Haynesville

2025-02-14 - The Midland Basin depleted its inventory of excess DUCs the most last year, falling from two months of runway to one during the past year, according to a report by Enverus Intelligence Research.

Exclusive: Early Findings Show Untapped Potential in Barnett Exploration

2024-12-03 - Steven Jolley, Halliburton’s Permian Basin technology manager, gives insight into potential for new drilling opportunities around Andrews County and efficiencies operators are seeing within the Permian, in this Hart Energy Exclusive interview.

Exxon’s Custom, Lightweight Proppant Boosts Permian EURs by 15%

2024-12-17 - Exxon is lowering drilling and completion costs, boosting EURs by 15% with custom proppant and considering upside from less developed Permian Basin zones.

Shale Outlook Permian: The Once and Future King Keeps Delivering

2025-01-11 - The Permian Basin’s core is in full-scale manufacturing mode, with smaller intrepid operators pushing the basin’s boundaries further and deeper.

SM’s First 18 Uinta Wells Outproducing Industry-Wide Midland, South Texas Results

2025-02-20 - Shallow tests came on with 685 boe/d, 95% oil, while deeper new wells averaged 1,366 boe/d, 92% oil, from two-mile laterals, SM Energy reported.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.