LNG and NGL storage tanks. (Source: Shutterstock)

While natural gas prices languished in 2024, the NGL sector saw a production boom well into the final quarter of the year, thanks to growing infrastructure that allowed volumes to flow out of the Permian Basin.

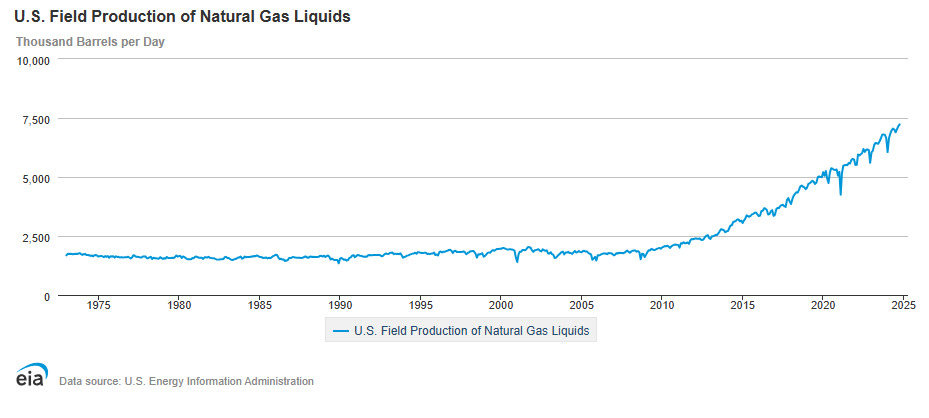

In its monthly report, the U.S. Energy Information Administration reported approximately 7.23 MMbbl/d were produced on average in October 2024. The daily average produced in October 2024 grew by 200,000 bbl/d more than the year before—and set a record for annual production, according to EIA data going back to 1973.

Analysts expected the growth to continue as prices remain strong. For the week ending Jan. 15, the Mont Belvieu NGL composite price rose to $8.38/MMBtu, $0.25 higher than the week before, according to the EIA. The Mont Belvieu composite price for NGLs is the national standard because of the concentration of NGL processing facilities in the area.

Ethane, ethylene, propane and butane prices all rose at the start of 2025, according to the EIA.

In 2024, producers turned to gas processing and NGL production to help turn a profit during a time of low gas prices, especially out of the Permian Basin. Natural gas prices in the oil-focused basin frequently fell into negative territory in the spring and summer.

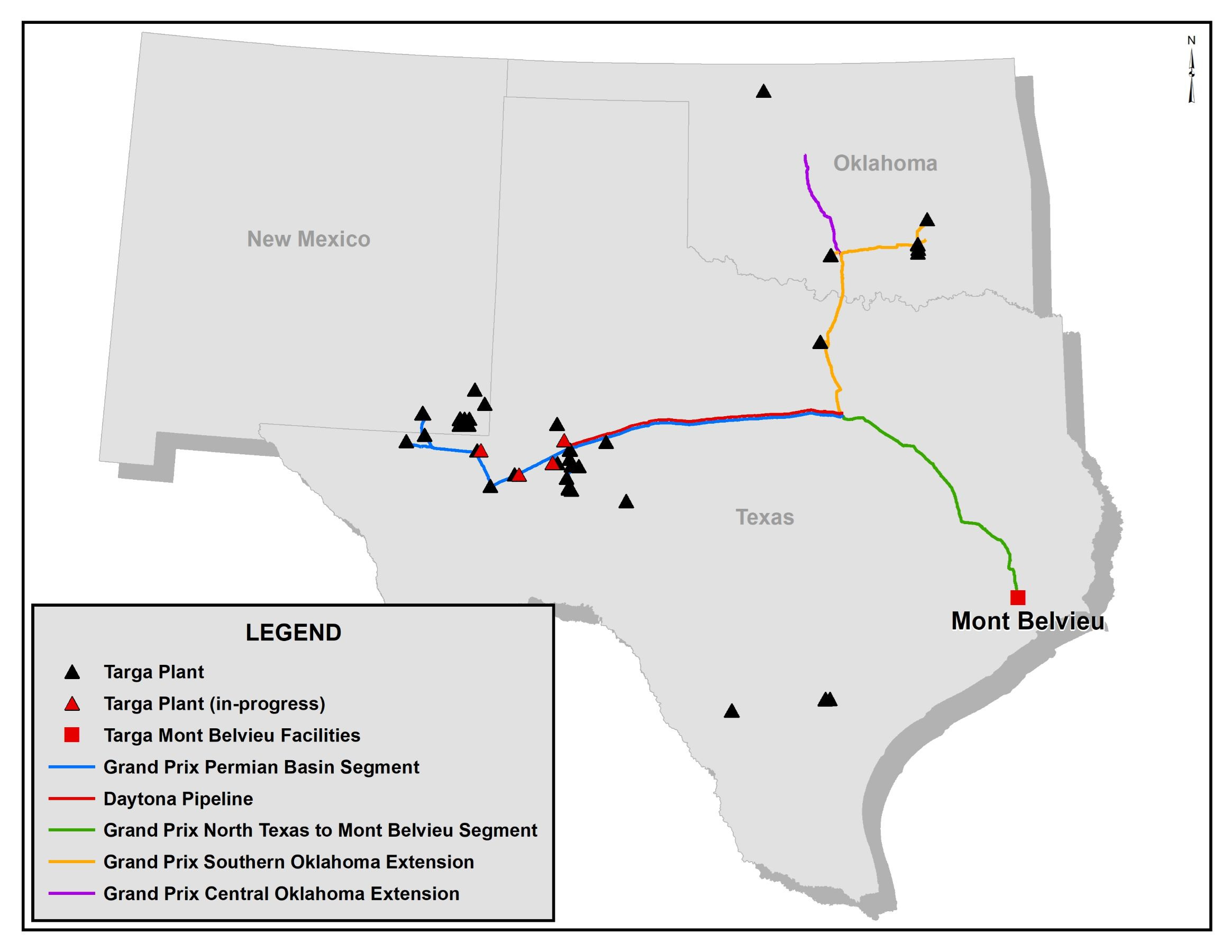

The focus on NGLs included a build out of infrastructure. The trigger for October’s new production record was Targa Resources’ early opening of its Daytona NGL Pipeline, according to Rob Wilson, senior director of East Daley Analytics, in an analysis distributed on Jan. 22.

RELATED

Record NGL Volumes Earn Targa $1.07B in Profits in 3Q

Targa reported completion of the Daytona pipeline in third-quarter 2024. Daytona is a 400-mile, 30-inch diameter line running from the Midland Basin to a connection to Targa’s Grand Prix pipeline network in North Texas. The Grand Prix connects to Mont Belvieu as well as production hubs in Oklahoma.

“New data confirms the (Daytona) project has addressed a bottleneck in the Permian Basin and gives TRGP good momentum heading into 4Q24 earnings,” Wilson said.

Growth in NGL production has come primarily from the heavier molecules in the category—propane, butane and natural gasoline.

Most of the production for “heavies” comes from connections to processing plants in New Mexico, which produce more of the products, Wilson said. The continued growth of crude production in the area led in turn, to a bottleneck for the region’s NGL takeaway.

Targa was aware of the opportunity, as it saw its new line rapidly fill.

“Daytona was much needed when it came online,” Matt Meloy, Targa CEO said during the company’s third-quarter earnings call in November.

Thanks to its expanded network and a new fractionation train on the Gulf Coast, Targa should expect record earnings in the fourth quarter, Wilson said.

Other midstream companies are expanding their Permian NGL footprint. ONEOK (OKE), Enterprise Products (EPD), Energy Transfer (ET), and MPLX also have NGL projects planned for the Permian Basin.

About 1.2 MMbbl/d of capacity is expected to come online by the end of 2025.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.