TC Energy made the decision to halt service after pressure dropped on a line segment from Hardisty, Canada, to Steel City, Nebraska. (Source: Shutterstock)

The offline period for the Keystone oil pipeline was too brief to cause major disruptions on the crude market, a director at East Daley Analytics (EDA) said March 8.

TC Energy temporarily suspended service on the Keystone line on March 7 as a precautionary measure, Reuters reported. In a statement, the company said it had checked the pipeline’s integrity and no oil had spilled.

Canada moves about 4.4 MMbbl/d across the border into the U.S. Keystone carries about 600,000 bbl/d—approximately 14% of that volume, said Kristy Oleszek, EDA director of energy analytics.

“Keystone being down for less than a full day will not have a material effect on Canadian production flows or U.S. oil markets,” Oleszek said.

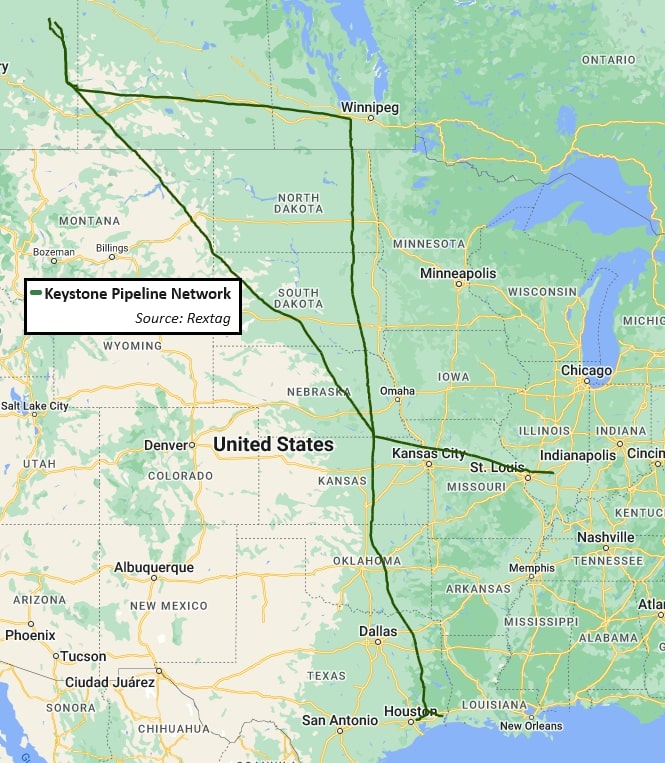

TC Energy made the decision to halt service after pressure dropped on a line segment from Hardisty, Canada, to Steel City, Nebraska, meaning the line is potentially sending less oil to the storage hub in Cushing, Oklahoma, Bloomberg reported. Enbridge’s Mainline, which has a capacity 2.85 MMbbl/d, is the primary alternative for transporting Canadian crude into the U.S.

On March 8, U.S. crude oil futures briefly went over $79.90/bbl but had dropped below $78/bbl later in the day.

One analyst reported that Canada has been experiencing a pattern of sporadic network outages, due possibly to the country's packed pipelines. Thanks to increasing crude production, the available infrastructure is constantly running close to capacity.

“Canada is moving every barrel they can through available egress options,” Oleszek said. “All of the pipelines are at the threshold of what they can carry as producers wait for the long overdue Trans Mountain Expansion, TMX, to come online.”

Line fill for the TMX is expected to begin in April. The Trans Mountain Pipeline, running from Alberta to the Canadian West Coast, will triple the available lines capacity from 300,000 bbl/d of crude to 890,000 bbl/d. Trans Mountain Corp., the government-owned company building the line, announced March 1 that the system would be running at maximum capacity once it opens.

Builders are working to keep to the most recent in-service date forecasted for March or May of 2024. Trans Mountain announced the new in-service date in January after moving the last opening date back from the first quarter of 2024.

“The markets reacted aggressively to the news that TMX is once again delayed as line fill is slated for March and April 2024,” Oleszek said.

Recommended Reading

If US Cancels, US Pays: Interior’s Burgum Calls for Sovereign Risk Insurance

2025-04-25 - With a sovereign risk insurance in place, a president cancelling a permit “would have to say ‘We're canceling this thing by fiat, but you get your money back that you've invested,” Interior Secretary Doug Burgum told energy industry members in Oklahoma City.

Expand’s Dell'Osso: E&Ps Show ‘Unusual’ Discipline with $4 NatGas Strip

2025-04-25 - Haynesville Shale’s largest gas producers are displaying restraint with a $4/Mcf forward curve. “That’s really unusual,” said Expand Energy CEO Nick Dell’Osso.

Amplify Energy Cancels PRB, D-J Deal on ‘Extraordinary Volatility’

2025-04-25 - Amplify Energy terminated an acquisition of oil-weighted assets in the Powder River and Denver-Julesburg basins from Juniper Capital after Amplify’s stock fell 58% since the deal was announced.

SLB Sees Short-Term Softening, Long-Term Rebound in Oil & Gas

2025-04-25 - SLB Ltd. says customers are likely to behave cautiously amid global trade concerns this year, but the future looks brighter in the long term.

Dividends Declared Week of April 21

2025-04-25 - With first-quarter 2025 earnings underway, here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.