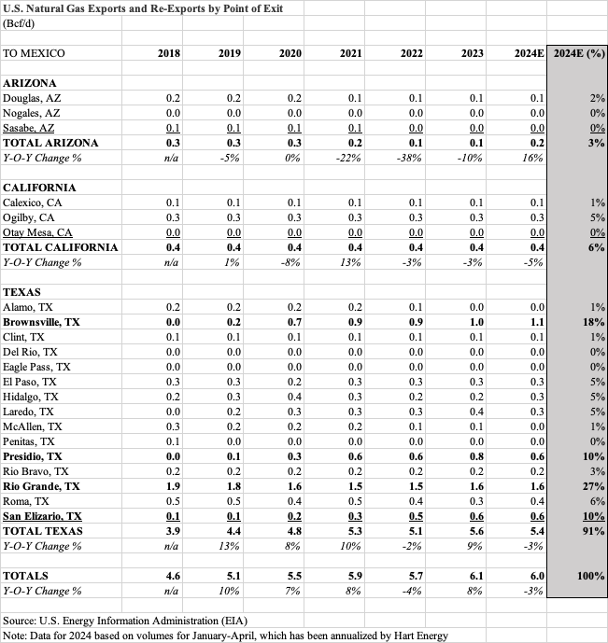

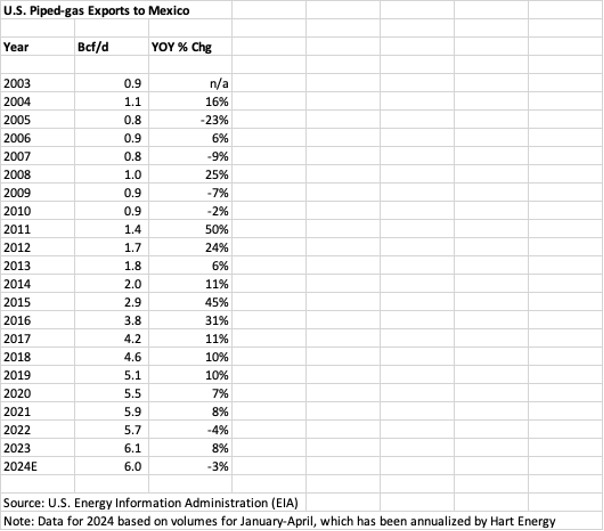

Texas, home to the Eagle Ford Shale and Permian Basin, accounts for 91% of U.S. piped-gas exports to Mexico. The piped-gas trade with Mexico has increased 554% over the last 21 years, peaking at 6.1 Bcf/d in 2023.

Mexico’s demand for U.S. piped gas will continue to rise to meet growing demand from its electric and industrial sectors to come from nearshoring, followed by massive demand that will emerge from its nascent LNG exporting sector. The latter, in particular, provides Permian producers with a crucial outlet for rising production. But as analysts tell Midstream Business (MB), headwinds related to moving gas molecules persist on both sides of the border.

—Ricardo Falcón, research manager, natural gas markets - commodity trading data & analytics, Wood Mackenzie (Source: Wood Mackenzie)

Mexico’s rising demand for U.S. piped gas has been driven by two key factors, according to Mexico’s Energy Secretariat (Sener). The first is financial strain at Petróleos Mexicanos (Pemex), including payment obligations to the federal government, which limit the state-owned company’s ability to increase gas production. The second is the availability of cheap U.S. shale gas.

Unlike Argentina and Venezuela, Mexico is neither sitting on the largest technically recoverable shale resources in the Americas nor the world’s largest oil reserves. Mexico is simply a manufacturing powerhouse.

Although rising electric and industrial sector energy demand has been increasingly met by growth in piped gas from the U.S., Mexico will need to manage its energy supply or risk growth impacts to its nearshoring boom, already happening, and a looming LNG export boom.

Mexico attracted inward foreign direct investment (FDI) flows of around $36 billion in 2023, the highest level in 18 years, according to data published by BMI, a Fitch Solutions company. This compares to around $14 billion in 2006.

“The inability to supply affordable and reliable energy (electricity and natural gas) risks Mexico’s prospects to fully grasp the nearshoring opportunity. Amid the trade war between the U.S. and China, especially in the realm of electric vehicles, Mexico must up its game to attract investments from firms like Tesla [Motors], which seeks to be competitive vis-à-vis its Chinese counterparts. The current energy landscape in Mexico does not serve that purpose,” Adrian Duhalt, a non-resident scholar at the Center for the U.S. and Mexico at the Baker Institute told MB.

For Ricardo Falcón, Wood Mackenzie research manager, natural gas markets - commodity trading data & analytics, there is room for a U.S. piped-gas-to-Mexico-based nearshoring boom, considering Mexico’s takeaway capacity at the border with the U.S.

“The challenge here is more associated with the risk exposure and the capabilities of all the Teslas and Amazons of the world who are seeking to enter the Mexican market. To date, price signals and demand growth in the power and gas sectors continue to be dictated by a few players, especially Mexico’s CFE [Federal Electricity Commission],” Falcón said. “Although this has helped anchor demand to galvanize the execution of large-scale projects, it has also inhibited participants’ diversification. This situation has become more critical in recent years, owing to private investors’ perception of increasing non-technical risk, particularly in the political and regulatory frameworks.”

In late-July 2024, Tesla’s CEO Elon Musk said his company would pause development of a $5 billion gigafactory in Santa Catarina, Nuevo León, in Mexico until after the U.S. presidential elections.

Over the coming decades, both the Washington-based Energy Information Administration and the Paris-based International Energy Agency (IEA) expect Asia to take center stage as the growth center for LNG imports sourced from Australia, Qatar, the U.S. and elsewhere—Mexico included.

Gas-hungry Mexico, which until recently also relied on LNG imports, is now betting big on LNG exports, owing to the country’s proximity to Texas, which gives it direct access to Permian feed gas. Mexico’s five initial Pacific Coast liquefaction projects could offer Permian producers a relief valve for their associated gas and connect the U.S.’ cheapest gas to Asia.

Sempra affiliate Sempra Infrastructure, Mexico Pacific and LNG Alliance Pte Ltd. Singapore are leading the five projects that could bring to market around 7.8 Bcf/d or 59 mtpa. According to a recent analysis by Rystad Energy, such volumes could propel Mexico to the ranking of the third-largest LNG exporter in the Americas, trailing only the U.S. and Canada.

But Mexico’s ability to achieve LNG exporting glory will not be easy. It will depend on completion of the Pacific Coast-based liquefaction plants as well as pipelines from the Permian to counter supply bottlenecks and even more necessary pipelines in Mexico.

“Natural gas demand in Mexico will certainly increase on the back of additional power generation capacity and LNG exports projects that are expected to come online in the next few years. Nearshoring may also drive demand up as it could lead to a boom in manufacturing activities, especially in border states,” said Duhalt, who also is a non-resident scholar at Southern Methodist University’s Texas-Mexico Center.

“Without a doubt, Mexico will be under pressure to expand its capacity to transport greater volumes of natural gas, and failing to do so could become a key constraint to meet expected demand increases,” Duhalt said. “Politics can also be another factor to consider as the government of [President-elect] Claudia Sheinbaum will have to first recognize how important pipelines are for the country’s economic activity and then support the development of this critical infrastructure.”

Numerous projects that will add capacity are already underway in Mexico, Rodrigo Rosas, Wood Mackenzie Senior Analyst, Americas Gas Research told MB.

“The CFE anticipates the completion of nearly 4 GW of capacity set to gradually enter operation by 2025. Additionally, with announcements forthcoming, the National Electric Development Program (Prodesen) plans to build a total of 6 GW of combined cycle plants between 2024 and 2027,” Rosas said. “Since 2021, gas-to-power demand has been steadily increasing. Power burns have risen by 0.5 Bcf/d, reaching 4.6 Bcf/d in 2024. This trend is expected to continue, with projections indicating a further increase to 4.7 Bcf/d in 2025.”

Texas dominates piped-gas flows to Mexico

Pemex, which is the world’s most indebted oil company with around $101 billion in debt, has struggled to boost Mexico’s reserves and production. Mexico has had no other option but to look abroad for necessary gas supply. Expensive LNG imports have been pushed aside for a preference for the advantaged low-carbon, low-cost gas just north of Mexico’s border.

Between 2003 and 2023, U.S. piped-gas exports to Mexico followed an impressive upward trajectory, owing to Mexico’s positive economic growth. These exports peaked at 6.1 Bcf/d in 2023 compared to just 0.9 Bcf/d in 2003, according to data from the EIA, growing 11% per year on average over this 20-year period. Based on the U.S. piped-gas export data published by the EIA for the period between January and April 2024, annualized by MB, these exports could average 6 Bcf/d in 2024.

Beyond any limitations imposed by Mexico’s economic growth—a main pacesetter for natural gas demand—there are constraints to rapid expansion of U.S. piped-gas exports to Mexico, Wood Mackenzie’s Falcón said.

“On the U.S. side of the border, supply bottlenecks, localized competition for marginal gas molecules, and price action have affected the deliverability of U.S. pipeline exports to Mexico at different U.S. exit points, especially during peak demand seasons,” Falcón said.

“On Mexico’s side, takeaway capacity of U.S. piped gas is still significant, considering that the average utilization rate remains roughly at 45% (relative to a nominal 14 Bcf/d),” he said. “However, inadequate system reinforcements and interconnections have limited more liquid transactions between privately run and state-controlled routes, restricting deeper integration of demand centers across regions.

“On top of that, the Mexican natural gas market is yet lacking strategic and commercial storage capacity. Apart from securing better response mechanisms to external shocks, robust gas storage would enhance physical optionality for better supply/demand balancing, which in turn, would give Mexican fundamentals a more stable platform for long-term growth,” Falcón said.

Only three states benefit from the uptick in U.S. piped-gas trade with Mexico: Arizona, California and Texas. But this is far from an even three-state race. In 2024, piped-gas exports from Arizona will account for just 3% of the total volume sent to Mexico, with California contributing 6% and Texas supplying 91%, according to MB calculations.

Within Texas, the border cities of Brownsville, Presidio, Rio Grande and San Elizario are on track to account for 65% or 3.9 Bcf/d of the U.S. piped-gas exported to Mexico in 2024. Piped-gas exports from West Texas to South Texas have grown steadily since around 2017, owing to an increase in pipelines that have come into service connecting Central and Southwest Mexico according to the EIA.

Recommended Reading

Exxon Seeks Permit for its Eighth Oil, Gas Project in Guyana as Output Rises

2025-02-12 - A consortium led by Exxon Mobil has requested environmental permits from Guyana for its eighth project, the first that will generate gas not linked to oil production.

Exxon Enlists Baker Hughes to Support Uaru, Whiptail Offshore Guyana

2025-02-03 - Baker Hughes’ will provide specialty chemicals and related services in support of the Uaru and Whiptail projects in the Stabroek Block.

E&P Highlights: March 17, 2025

2025-03-17 - Here’s a roundup of the latest E&P headlines, from Shell’s divestment to refocus its Nigeria strategy to a new sustainability designation for Exxon Mobil’s first FPSO off Guyana.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.