Texas Pacific Land Corp. closed a pair of Permian Basin acquisitions, the company said on Aug. 27. (Source: Shutterstock, Texas Pacific Land Corp.)

Texas Pacific Land Corp. (TPL) closed a pair of Permian Basin acquisitions—one for oil and gas mineral interests in the Delaware Basin, the other for Midland Basin surface acreage—for a combined $169 million cash.

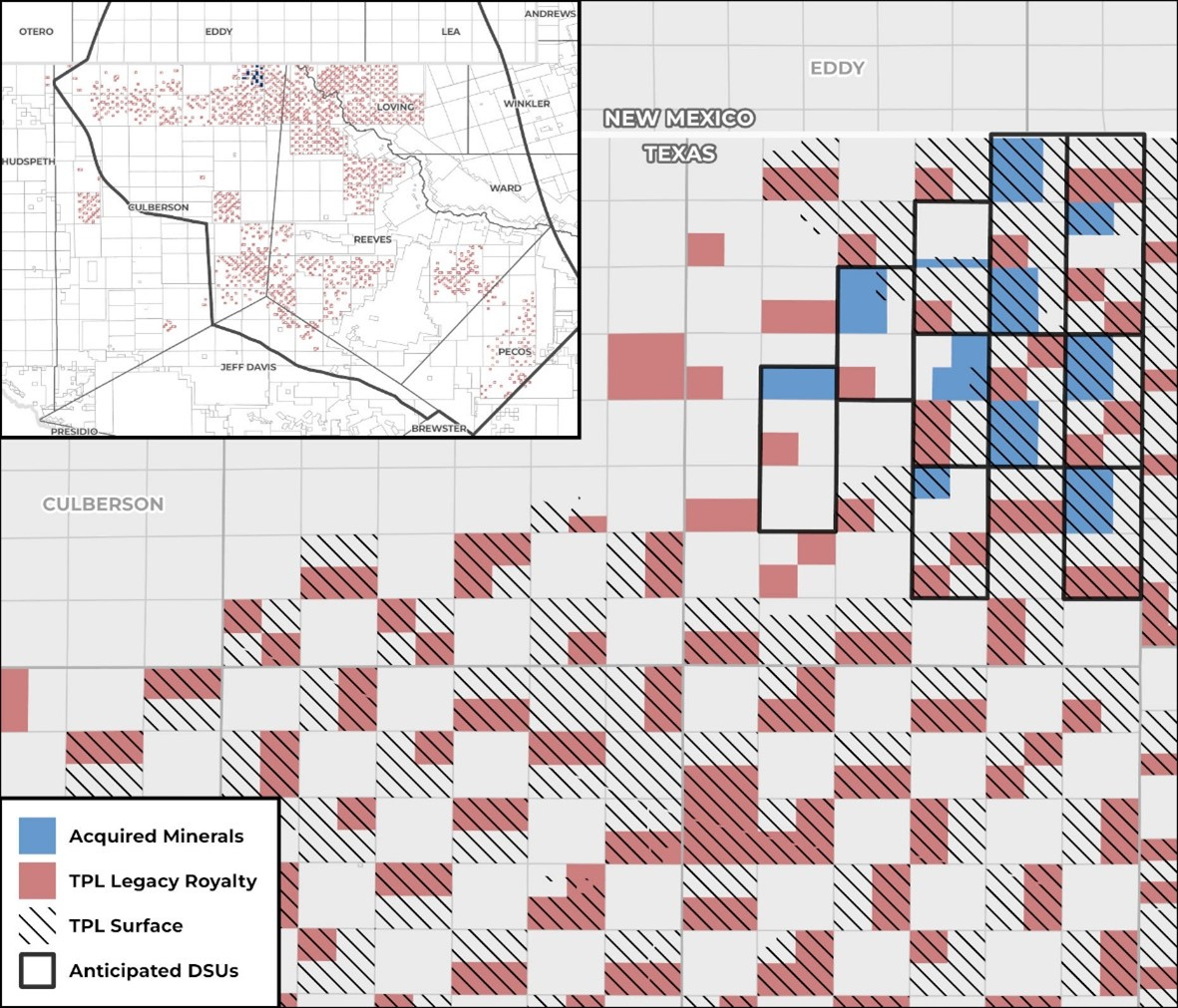

TPL acquired mineral interests across approximately 4,106 net royalty acres located in northern Culberson County, Texas, the company said on Aug. 27. The mineral interests, leased and operated by Coterra Energy, overlap existing TPL royalty acreage in current and anticipated drilling and spacing units, “enhancing TPL’s net revenue interests in existing and future oil and gas wells,” the company said.

The acquired mineral interests also overlap with TPL’s surface acreage.

TPL also acquired approximately 4,120 surface acres in Martin County, Texas, in the core of the Midland Basin.

The asset generates numerous revenue streams across water supply, produced water disposal and multiple other surface-related activities, including royalties from a solid waste landfill owned and operated by Waste Connections, TPL said. The asset possesses significant additional commercial growth opportunities, the company said.

“Acquiring high-quality mineral interests in the northern Delaware Basin and strategic surface acreage in the Midland Basin will immediately contribute to TPL’s free cash flow,” said TPL CEO Tyler Glover. “The combined asset purchase price implies a greater than 13% 2025 free cash flow yield at current strip prices, giving credit to only existing production and line-of-sight wells and opportunities.”

The bolt-on transactions, in addition to the cash flow they currently generate, have excellent growth qualities that fit with TPL’s legacy portfolio, Glover said.

“By owning overlapping and nearby surface and water assets, we believe we can accelerate development and generate incremental value,” he said. “Both assets were sourced through our industry and professional networks and were not part of a broad marketed process. These type of premium assets located within the core subregions of the Permian Basin represent the growth opportunities available to TPL that can provide a substantial incremental value driver to our legacy asset base.”

RELATED

From Failed Post-Civil War Railroad to Permian Basin Royalties Giant

Recommended Reading

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Shell Takes FID on Gato do Mato Project Offshore Brazil

2025-03-23 - Shell Plc will be the operator and 50% owner, with Ecopetrol holding 30% interest and TotalEnergies 20%.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.