Chord Energy’s three-mile lateral program is turning wells to sales more quickly and providing substantial production uplift compared to the more common two-mile lateral wells the company had been drilling, executives said on an Aug. 3 earnings call. (Source: Shutterstock.com)

Chord Energy’s three-mile lateral program is turning wells to sales more quickly and providing substantial production uplift compared to the more common two-mile lateral wells the company had been drilling, executives said on an Aug. 3 earnings call.

A year since Chord was formed through the merger of Whiting Petroleum and Oasis Petroleum, the company also updated it’s A&D program, including additional divestitures and the closing of its previous bolt-on of XTO Energy Inc. acreage.

Analysts focused on the company’s three-mile wells, particularly Chord’s Indian Hills acreage, which has shown a 36% uplift compared to two-mile laterals.

Chord President and CEO Daniel Brown said the longer laterals remain an important part of the company’s drilling program for 2023 and beyond. So far this year, the company has turned to sales 13 of the three-mile wells.

“When combined with the 17 wells from 2022, I'm encouraged by the performance we've seen so far,” Brown said on the call. “More specifically, we are seeing improving performance on well delivery and are clearly seeing a strong contribution from the furthest portions of the lateral once that rock is stimulated and cleaned out.”

Brown said the company has materially reduced drilling times for the wells over the past year and the company has made steady improvements to stimulate and access the majority of the third mile of the lateral.

The company is assuming a 40% EUR uplift for 40% longer laterals at about 20% more drilling and completion costs.

“Said another way, we're assuming the third mile is only 80% as productive as the first two miles,” Brown said. “In practice, what we're seeing is a volume response proportional to the percentage of the third mile that's cleaned out.”

The longer wells are premised on “flatter for longer” production rather than splashy IPs, said Charles Rimer, Chord COO.

Brown added that the decline is shallower on a three-mile lateral because more of the reservoir feeds production over time.

“[Chord] is seeing rich well productivity, notably out of their Indian Hills acreage. Uplift on 3-mile Indian Hills improved further to 65% uplift after 200+ days online relative to 2-mile wells vs. 54% prior,” David Deckelbaum, an analyst at TD Cowen, wrote in an Aug. 2 report. “When compared to analogous 2-mile wells with wider spacing, the uplift is still 36%.”

Along with its peers, Chord is seeing encouraging field operations, improving its drilling time to 11.6 days for three-mile laterals in June versus 14.2 days in the first quarter, Deckelbaum said. “At Foreman Butte, recent 3-mile lateral tests show positive contributions from extended laterals once fully cleaned out, while cycle times are improving from both compressed drilling times and clean times of 4.3 days vs. plan of five [days].”

Rimer said Chord will be taking its spacing designs and longer laterals to other areas across the basin.

“I think we'll be able to have some results later next year or early next year [and] probably see how that's working,” he said. “But [we’re] really excited about what we're seeing at the Indian Hills and what that's going to do for the rest of the basin.”

Mark A. Lear, an analyst at Piper Sandler, said Chord delivered mixed financial results for the second quarter, with a production beat offset by lower gas and NGL realizations. However, free cash flow came in ahead of expectations.

“[Chord] updated performance from Indian Hills three-milers with 200-day cume performance +36% vs. similarly spaced two-milers, and testing suggesting strong contribution from the third mile after effective clean out,” Lear said.

Asked during the call about service cost deflation, Brown said he was seeing some “encouraging signs,” but he thought it too early to roll any assumptions about costs into the company’s planning process. He also noted that “labor cost is generally sticky.”

For next year, the company is “working to develop a plan that’s essentially a maintenance level plan versus our current year,” he said.

The Bakken’s ‘natural consolidator’

Brown was circumspect when asked by an analyst about deal flow in the Williston Basin, saying there’s always chatter on a variety of assets from small positions and trades to private equity opportunities.

“I don't know if I've seen a noticeable uptick in that I think it's just been a bit steady and we evaluate a lot of things that come through,” he said. “Some of them transact, some of them don't transact. We've got our ear to the ground with our position in the Williston.”

During the quarter, Chord said it sold non-core assets for proceeds of approximately $29 million. Year-to-date, Chord has announced the sale of $64 million in asset sales. The company also closed a previously announced bolt-on acquisition from Exxon Mobil Corp. subsidiary XTO Energy Inc. for $375 million.

RELATED: Chord Acquires Williston Basin Acreage in $375 Million Deal

Brown said the XTO bolt-on acquisition is contributing approximately 3,000 bbl/d of oil in the second half of 2023.

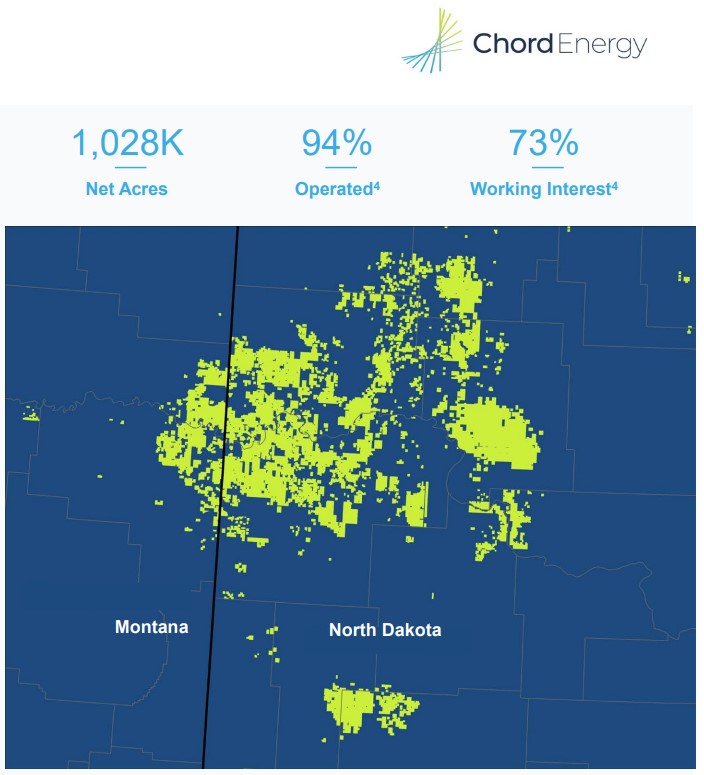

“This bolt-on was an excellent supplement to our core inventory and demonstrates natural synergies from our scale position in the Bakken, which is now over 1 million acres,” Brown said.

The transaction added approximately 123 net locations and, “importantly, we were also able to convert six Chord DSUs to two-mile DSUs into three-mile DSUs,” he said.

Brown said Chord is continuing to be watchful for opportunities.

“We feel like we are a natural consolidator within that basin and so we pay attention to what's going on,” he said. “And as you saw with the XTO acquisition, we think when we have opportunities out there that fit in well with what we're trying to accomplish, which that XTO acquisition did, we can act, and we think it's really going to equate to value for the organization and for shareholders.”

Recommended Reading

FLNG Gimi Receives First Gas from BP’s FPSO in the GTA Field

2025-01-22 - Golar LNG’s Gimi FLNG vessel will support BP, which began flowing gas from wells at the Greater Tortue Ahmeyim Phase 1 LNG project in early January.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

Exxon Seeks Permit for its Eighth Oil, Gas Project in Guyana as Output Rises

2025-02-12 - A consortium led by Exxon Mobil has requested environmental permits from Guyana for its eighth project, the first that will generate gas not linked to oil production.

US Oil, Gas Rig Count Unchanged This Week

2025-03-14 - The oil and gas rig count was steady at 592 in the week to March 14. Baker Hughes said that puts the total rig count down 37, or about 6% below this time last year.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.