Mach Natural Resources, an aggregator in the Midcontinent, is keeping an eye on opportunities outside of Oklahoma. (Pictured): A drilling rig near Sapulpa, Oklahoma (Source: Shutterstock.com, Mach Natural Resources)

When Midcontinent E&Ps were going bankrupt and exiting the SCOOP/STACK plays, Mach Natural Resources dug in and hunkered down, waiting for the market to recover.

Today, Oklahoma City-based Mach Natural Resources LP is one of the most active E&Ps remaining in the Midcontinent.

But as Mach searches for future acquisitions, the upstream MLP is keeping an eye on new basins as prices and competition in the Midcontinent start to heat up, CEO Tom Ward told Hart Energy in an exclusive interview.

The company is organized as an MLP, set up to distribute all available cash to unitholders each quarter after subtracting costs, expenses and reserves.

Instead of using a fixed distribution model like the upstream MLPs of yesteryear, Mach has implemented a variable distribution. Distributions fall as commodity prices go down, but investors reap the upside of the cycle as commodity prices improve.

Mach’s top focus is enhancing distributions to its shareholders, Ward said. To do that, Mach needs to lower drilling costs and acquire discounted, free cash flowing assets.

“We bought 16 acquisitions up and through the IPO,” Ward said, “but we were able to buy all that at discounts to PDP [proved developed producing] PV-10.”

Ward is someone who knows his way around the Midcontinent: He previously co-founded Chesapeake Energy Corp. with Aubrey McClendon and served as the company’s president and COO.

He later helped form and lead SandRidge Energy Inc. and Tapstone Energy, both of which developed deep portfolios in the Midcontinent.

Mach, launched in 2018 with capital partner Bayou City Energy, has grown through a handful of notable acquisitions. In April 2018, Mach purchased Mississippi Lime assets in Oklahoma from Chesapeake, including producing properties concentrated in Woods and Alfalfa counties.

In 2020, Mach acquired upstream assets from Alta Mesa Holdings LP and midstream assets from Kingfisher Midstream LLC as part of Alta Mesa’s Chapter 11 bankruptcy process.

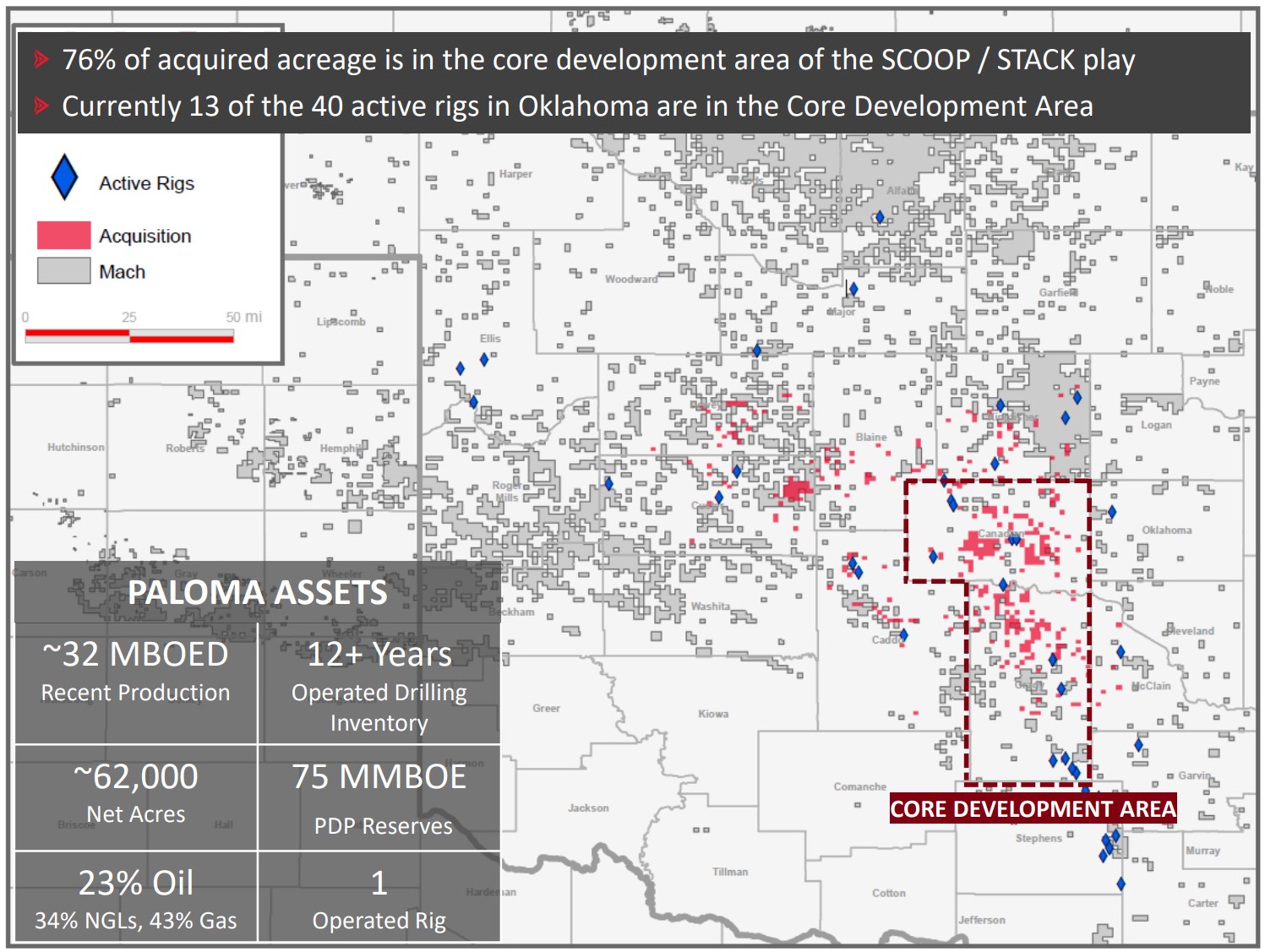

Mach followed on last year with an $815 million acquisition of central Oklahoma assets from EnCap-backed Paloma Partners IV.

The company holds about 1 million net acres of Midcontinent leasehold in its portfolio today.

But as Mach, a self-described “acquisition company,” hunts for its next acquisition, it may be looking outside of the Midcontinent plays the company knows so well.

Competition for Midcontinent acreage and production is increasing, and pricing is creeping up, the company reiterated in its first-quarter earnings call.

“Our focus was always on the Midcon because it was the cheapest molecule in the U.S.,” Ward told Hart Energy, “and that might be moving away from us.”

As Mach evaluates potential deals in the Midcontinent, the company needs to compare them against free cash flowing assets in some of the outer portions of the Eagle Ford Shale, or with Permian Basin assets that haven’t yet traded hands, Ward said.

“So, we are looking outside of the Midcon,” he said.

Other upstream MLPs are on the hunt for accretive acquisitions, too.

TXO Partners, an upstream MLP founded by former XTO leader Bob Simpson, made a roughly $300 million acquisition of low decline Williston Basin assets in late June.

Before the Williston acquisition, TXO’s operations were primarily focused on the Permian Basin and the San Juan Basin of New Mexico and Colorado.

RELATED

Mach Natural Resources Inks $815MM Anadarko Deal Fresh Off IPO

Midcon drilling

Accretive acquisitions are key to Mach’s strategy of growing shareholder distributions. Lowering costs can help, too.

Bringing down drilling costs is another top focus for the upstream MLP, and Mach has pivoted its drilling program to make that happen, Ward said.

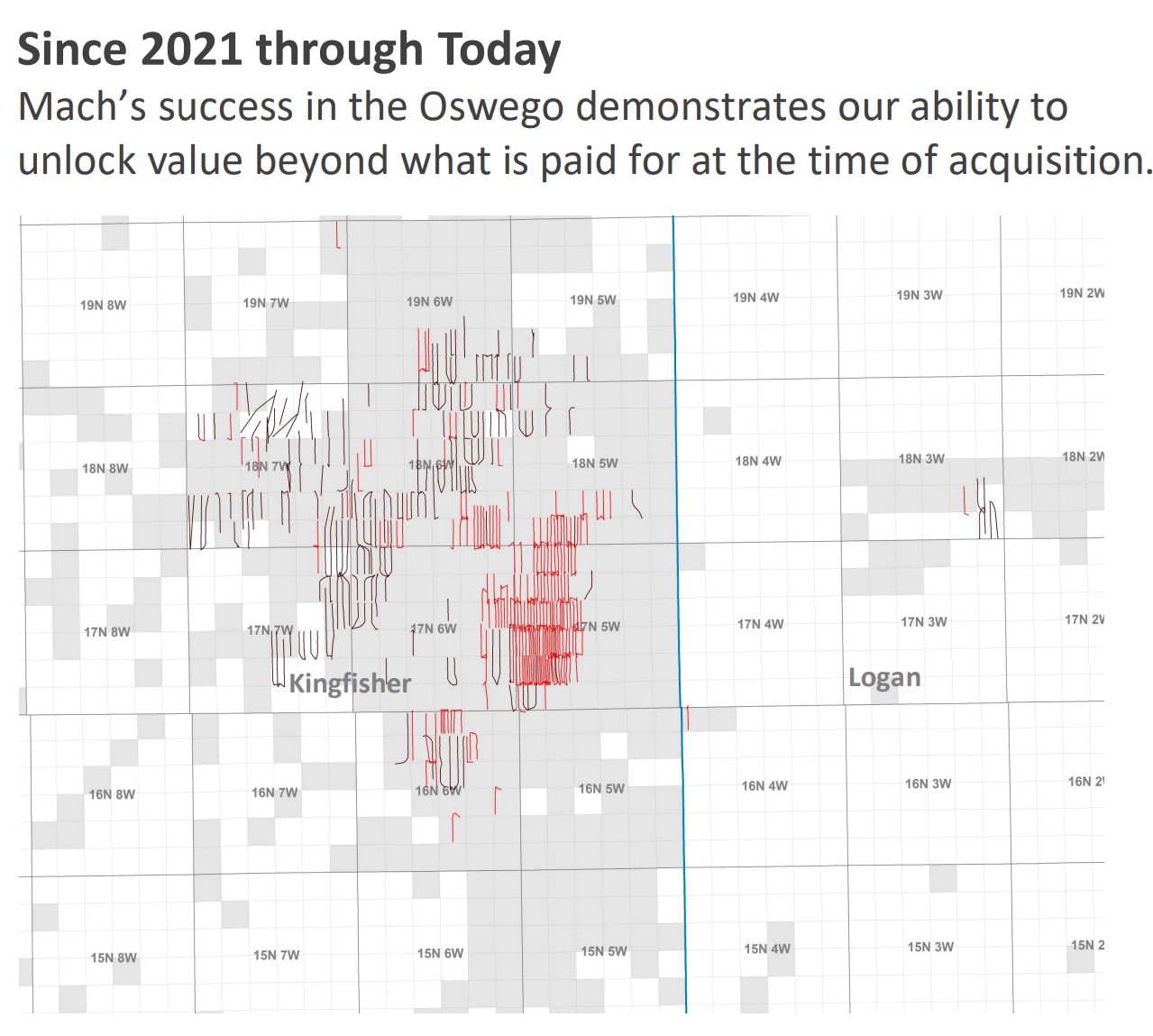

When Mach picked up Alta Mesa’s assets in central Oklahoma and Kingfisher County, the company started looking to drill the Mississippian intervals on the asset.

But Mach quickly pivoted to shallower zones — the Oswego interval and the Pennsylvanian limestones. That allowed Mach to do away with proppants and use acid completions to save costs.

The Oswego program has been Mach’s most active since 2021.

“We’ve drilled nearly 250 wells in the Oswego,” Ward said. “That is completely different than anyone that’s been drilling across the Midcon.”

The company’s Oswego wells cost an average approximately $2.63 million during the first quarter. Ward thinks drilling costs on the company’s newly acquired Paloma assets can be even more competitive.

The Paloma acquisition added approximately 62,000 net acres across Canadian, Grady, McClain, Caddo, Custer, Dewey, Blaine and Kingfisher counties, Oklahoma.

Mach plans to drill nine wells on the Paloma acreage this year, targeting a mix of Woodford and Mississippian wells.

The company is leaning more toward the 2-mile Woodford wells currently being developed, Ward said during first-quarter earnings.

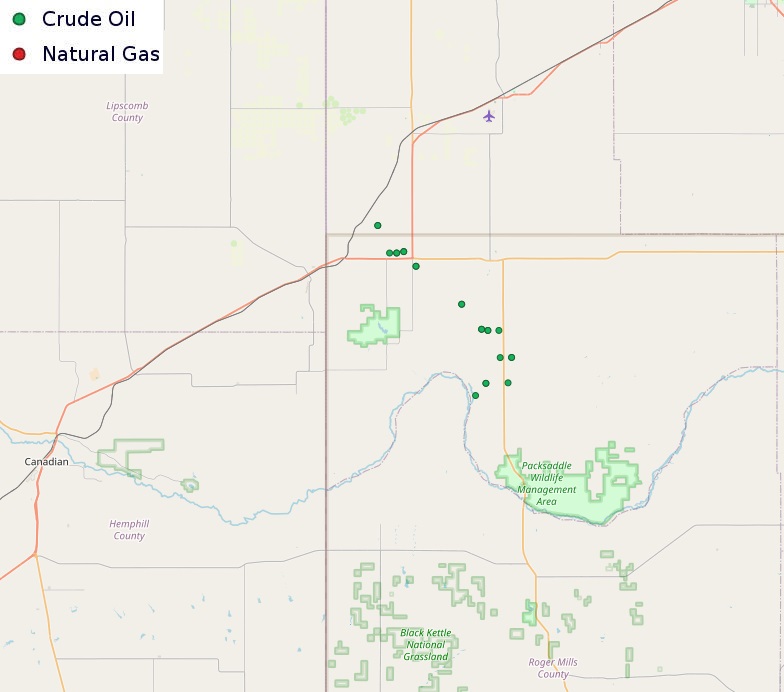

Mach is also keeping an eye on emerging developments in the western Anadarko’s Cherokee play, near the Texas Panhandle.

Horizontal Cherokee drilling has been mainly developed out of Ellis County, Oklahoma, by private companies Mewbourne Oil and Upland Operating.

But the play has been extended to the south into Roger Mills and Custer counties, Ward said.

“It looks very interesting,” Ward said. “We have close to 20,000 acres of leasehold that’s held by production and we’re just watching that play.”

RELATED

Recommended Reading

BPX’s Koontz: The Rise of a Shale Man

2024-07-02 - CEO Kyle Koontz takes the reins of BPX Energy’s rapid onshore growth amid big changes at BP.

Private Producers Find Dry Powder to Reload

2024-09-04 - An E&P consolidation trend took out many of the biggest private producers inside of two years, but banks, private equity and other lenders are ready to fund a new crop of self-starters in oil and gas.

Scott Sheffield Among Investors in Australian Shale Gas IPO

2024-06-27 - The operator who sold Pioneer Natural Resources Co. to Exxon Mobil in May for $59.5 billion joins his son Bryan Sheffield in shale gas investment Down Under.

Permian Consolidation Piques Interest in Drill-to-earn Opportunities

2024-08-14 - Drill-to-earn arrangements have been utilized in the Permian for years in the forms of joint ventures, farm-outs and other customizable agreements.

LandBridge Chair: In-basin Data Centers Coming for Permian NatGas

2024-06-28 - Newly public Delaware Basin surface-owner LandBridge Co. has a 100-year lease agreement with one developer that could result in ground-breaking in two years and 1 GW in demand.