In an effort to better reflect the logistics of the midstream industry and identify the real players in this sector, Hart Energy altered its reporting criteria for its annual rankings of the top natural gas processors and natural gas liquids (NGL) producers.

In the past, the survey—conducted by Midstream Business' sister publication, Midstream Monitor— based rankings on first-party processing and production volumes. While this helped to rank the largest producer/midstream operators, the study found that it wasn't an accurate record for the true midstream players.

To better reflect this field, the survey asked owners of processing plants and fractionators to submit their full processing and production totals at the facilities for 2011. While many of the names remain the same from past years, the figures have changed in many ways. In order to provide readers with a better understanding of these new rankings the results also include updated figures for 2010 as well.

From the start, note that two majors, ExxonMobil and BP, are no longer ranked as the top gas processors—Enterprise Products Partners now holds this designation. ExxonMobil and BP dropped out of the rankings because of their lack of pure midstream infrastructure holdings.

Enterprise experienced an 11% increase in its natural gas processing to 6.131 million cubic feet (MMcf) per day from its 2010 volumes of 5.5 MMcf per day. The 2011 processing volume was just ahead of DCP Midstream's processing volume of 6.079 MMcf per day.

DCP Midstream maintained its ranking as the top NGL producer, which it has held for five consecutive years, following a 4% increase in production to 383,021 barrels (bbl.) per day in 2011. Enterprise came in second in these rankings after a 2% increase to 303,000 bbl. per day.

While DCP maintained its ranking in this category, ONEOK Inc. has vaulted to the third spot from the eighth spot last year. This was based solely on all volumes, whether first party or third party, being included in the count.

The rankings reflect the changes that began to occur in the midstream in 2011, namely the renewed focus on liquids over gas, as liquids production has risen dramatically during the past three years. Looking at how top-ranked midstream companies are planning capital expenditures, it is safe to say this change will continue for at least the next few years.

The top NGL producer in the survey, DCP Midstream, is increasingly moving toward projects focused on liquids-rich plays such as the Permian and Denver-Julesburg basins, the Eagle Ford and Midcontinent.

Wouter van Kempen, president and chief operating officer at DCP Midstream, tells Midstream Business, his firm is focusing on its core business areas.

"We're trying to unlock all of our key basins and make sure we have NGL solutions from these basins into Mont Belvieu [Texas]," he continues. This approach has helped the company to increase NGL production, at a current rate of more than 400,000 bbl. per day, van Kempen says.

As impressive as these figures are now, it is expected that they will continue to increase at a dramatic rate in the coming years as the company's processing volumes can experience an uptick of approximately 15% as more plants are added in these liquids-rich plays. This would translate to approximately 25% increased NGL production, according to van Kempen.

One company that is not listed—but is still present—is Energy Transfer Equity (ETE). The company serves as the general partner of Energy Transfer Partners (ETP), the survey's eighth-ranked NGL producer, as well as the parent of the second-ranked gas processing company, Southern Union. In addition, ETE owns the general partner of Regency Energy Partners.

ETP experienced a 7% increase in NGL production to 54,925 bbl. per day. The company's planned capital expenditures for 2012 are between $1.8 billion and $2 billion, with between $700 million and $800 million on its midstream segment and between $1.1 billion and $1.2 billion for its NGL segment.

During ETP's second-quarter earnings conference call, Martin Salinas, ETP's chief financial officer, said that approximately $690 million of this capital spending was related to its projects in the Eagle Ford as well as NGL pipeline and fractionation projects at its Lone Star joint venture with Regency. This joint venture is involved in NGL storage and pipeline transportation as well as processing and fractionating facilities in the Gulf Coast.

ETP moved further into the liquids business in October by acquiring Sunoco in a $2.6 billion merger. The deal not only provides ETP with a further stake in the oily-side of the business, but also helps diversify the holdings of its general partner.

This aim for increased diversity in its holdings and operations started with the acquisition of Southern Union in March. The $9.4 billion merger gave ETE a combined network of approximately 45,000 miles of pipeline along with 2 billion cubic feet (Bcf) of natural gas processing capacity. Despite a 3% dip in processing volumes for 2011, the company anticipates this capacity will continue to grow as Southern Union is planning to spend between $50 million and $100 million of growth-related capital expenditures in the second half of 2012.

"[The merger] also complements our existing, supply-focused interstate operations with a largely regulated demand-side, market-centric set of operations," Salinas said during a conference call to discuss the merger earlier this year.

"This provides a larger, more competitive interstate and midstream platform with significantly enhanced and expanded geographic diversity, not to mention the significant organic growth opportunities that we see in the strategic, geographic locations across the United States. In addition, strong commercial and operational synergies will be realized as we combine the existing natural gas and natural gas liquids operations … Needless to say we are, and will be, utilizing Southern Union's assets to maximize value wherever we can within the Energy Transfer family," he continued.

ONEOK is a very liquids-focused company that ranked as the third-largest NGL producer for 2011. However, the survey's figure of 222,000 bbl. per day is an estimated total for the company. The company reported 537,000 bbl. per day of fractionated volumes in 2011 but this figure included some volumes from third-party facilities. Hart Energy's estimates were established using various studies and published figures. The survey was unable to obtain an official figure from ONEOK at press time, but the company's verified figures utilizing only fully owned facilities should not affect ONEOK'S ranking based on estimated totals.

The survey estimated that the company experienced a 3% gain in NGL production in 2011. The company has been increasing its focus on liquids-production over the past several years, especially production out of the Bakken. The company added the Garden Creek I processing plant in North Dakota in December 2011 and is currently constructing three other processing plants in the play.

The Garden Creek II plant is scheduled to complete construction in the third quarter of 2014, while the Stateline processing plant's construction is expected to complete in the third quarter of 2013 with the Stateline II plant completing construction in the first half of 2013. Each of these four plants will have a processing capacity of 100 MMcf per day.

During a conference call to discuss the company's second-quarter earnings, Pierce Norton, the company's executive vice president and chief operating officer, said that the company continues to evaluate its large backlog of gas and NGL-related infrastructure projects. These projects include processing plants and fractionation facilities. "Even with the recently announced projects totaling $1 billion [between now and 2014], this backlog still totals more than $2 billion," he said.

Outside of the Bakken, ONEOK is also enhancing its liquids focus by building a new 75,000 bbl. per day fractionator and a 40,000 bbl. per day ethane and propane splitter in Mont Belvieu.

While Enterprise Products Partners experienced growth in both its processing and NGL production figures in 2011, it saw the most growth from natural gas processing. The company continues to view the Eagle Ford as an area of growth for both processing and NGL production.

The company started up its second 300 MMcf per day train in September at its Yoakum processing plant in Lavaca County, Texas. The company is on track to bring the plant's third train online in the first quarter of 2013, which will increase capacity to 900 MMcf per day and 111,000 bbl. per day of NGLs. Enterprise ultimately expects to offer approximately 2.4 Bcf per day of natural gas processing capacity for the region.

"Like the Eagle Ford shale play itself, our Yoakum natural gas facility continues to exceed expectations and provide Enterprise with new growth opportunities," A.J. "Jim" Teague, executive vice president and chief operating officer of Enterprise's general partner, says. "Based on the operating results we've seen from the first train, which began service in May 2012, we expect the second and third trains to perform above their original design capacity, giving us the confidence to pursue additional processing commitments for all three plants."

Similar to DCP Midstream, Enterprise has a diversified asset base that covers the full midstream sector. The company's assets include 25 gas processing plants and 20 fractionators.

During the next two years, these assets will increase as the company is targeting $7.6 billion worth of new projects with a primary focus on the Eagle Ford, Rockies, Permian, Avalon, Bone Spring, Marcellus and Utica shales.

Williams experienced an 11% increase in NGL production in 2011 with much of this coming from its traditional operations center in the Rockies. However, the company will see much of its growth coming from the Northeast as it made a big splash in the Marcellus this year through the acquisition of Caiman Eastern Midstream from Caiman Energy for $2.5 billion.

The acquisition is in the wet gas portion of the play and includes the Fort Beeler cryogenic processing plant near Cameron, West Virginia, as well as the Moundsville processing and fractionation plant in Marshall County, West Virginia.

"This acquisition continues to expand on Williams' footprint in the Marcellus allowing us to expand our NGL footprint. It's a great opportunity for us because we like scale," Frank Billings, vice president, Williams Partners, said at a March news conference at Hart Energy's Marcellus Midstream conference in Pittsburgh.

He added that these holdings could help Williams achieve a similar stance in the Marcellus as it has in the Piceance on the Western Slope of the Rockies. "We have large processing plants out west and we can bring that same operating capability to this play and help producers maximize their production through high reliability and over time lower costs because of our scale," he said. This scale could be increased in the coming years as the company seeks bolt-on acquisitions in the play.

In addition to providing Williams with a large holding in the Marcellus, the acquisition will also provide the company with an entry point into the Utica as Williams formed a joint venture with Caiman Energy and its private equity investors to develop midstream infrastructure in the play. Billings added that the midstream assets in the Marcellus might also be used to process gas from the Utica.

MarkWest Energy Partners is another major midstream player in the Marcellus as it is the largest processor in the play. This designation helped the company post the largest year-on-year gains in both rankings this year as it experienced a 29% increase in its processing volumes and a 15% increase in its NGL production totals.

Much of this growth was due to its Liberty segment in the liquids-rich portion of the Marcellus, according to Frank Semple, the company's chair, president and chief executive. The Liberty segment has 715 MMcf per day of processing capacity and 60,000 bbl. per day of fractionation capacity.

"We continue to focus on our announced organic growth projects, including the expansion of our Liberty segment and the completion of the first phase of our Utica projects," he said during the company's conference call to discuss second-quarter 2012 earnings.

The company also expanded its holdings in the region through the $512 million acquisition of Keystone Midstream Services LLC from Stonehenge Energy Resources and subsidiaries of Rex Energy and Sumitomo. This agreement included two processing plants with a total capacity of 90 MMcf per day in Butler County, Pennsylvania.

MarkWest also formed a joint venture with The Energy and Minerals Group called MarkWest Utica EMG that is focused on developing gathering, transportation, processing fractionation and marketing infrastructure in the Utica shale in eastern Ohio.

As more of the liquids-rich basins continue to be focused on and developed by producers, the midstream should continue to experience significant gains in processing and NGL production volumes in the coming years. It is entirely possible that the significant increases in NGL production from 2009 to 2011 will continue to grow in 2012 and beyond with processing volumes also increasing in the years ahead.

Recommended Reading

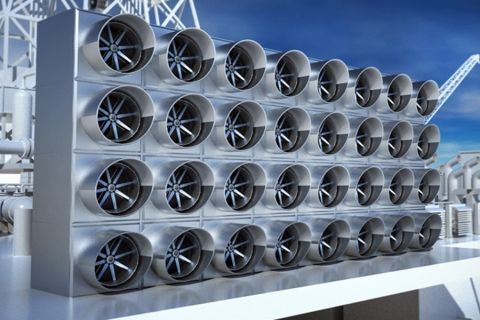

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Oxy’s Hollub Drills Down on CrownRock Deal, More M&A, Net-zero Oil

2024-11-01 - Vicki Hollub is leading Occidental Petroleum through the M&A wave while pioneering oil and gas in EOR and DAC towards the goal of net-zero oil.

Exxon’s Upstream President Liam Mallon to Retire After 34 Years

2024-12-03 - Exxon Mobil’s board has appointed Dan L. Ammann, currently Exxon’s low carbon solutions president, to assume Liam M. Mallon’s roles.

Apex Locks in Financing for North Carolina Wind Farm

2024-12-05 - Apex Clean Energy said commercial operations at a 189 megawatt wind farm are expected to begin by year-end 2024.

BKV Prices IPO at $270MM Nearly Two Years After First Filing

2024-09-25 - BKV Corp. priced its common shares at $18 each after and will begin trading on Sept. 26, about two years after the Denver company first filed for an IPO.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.