TPG's all-cash acquisition, being made through the TPG Rise Climate Transition Infrastructure strategy, takes the public company Altus Power private at a 66% premium to the company's Oct. 15 share price. (Source: Shutterstock.com)

Altus Power has agreed to be acquired by global asset manager TPG in a deal valuing the company at about $2.2 billion, including debt, the commercial-scale solar provider said Feb. 6.

The all-cash transaction, being made through the TPG Rise Climate Transition Infrastructure strategy, takes one of the largest publicly traded commercial-scale solar companies private. The deal takes shape as solar power generation continues to boom in the U.S. with rising energy demand from manufacturers and data centers, among others.

“TPG Rise Climate’s deep expertise in the clean energy sector, investment-oriented mindset and value-driven approach to infrastructure development aligns perfectly with our vision,” said Altus Power CEO Gregg Felton. “This partnership strengthens our ability to serve both our community solar and commercial clients with clean electric power at a time when demand for power is expected to grow substantially.

The purchase price is $5 per share of Altus Power’s Class A common stock, which will no longer be listed or traded on the New York Stock Exchange when the transaction closes. The price, according to the news release, represents a 66% premium to Altus Power’s unaffected closing price on Oct. 15, 2024, the last trading day before the company announced a formal review of strategic alternatives by its board of directors.

The transaction is expected to be complete in second-quarter 2025, subject to approval of Connecticut-based Altus Power’s shareholders and other customary closing conditions.

Calling the transaction a “pivotal moment” for the company, Felton said becoming a private company will improve Altus’ ability to scale operations, drive innovation and enhance value for its customers.

“Together with TPG Rise Climate, we believe we are poised to accelerate clean energy adoption and ensure more businesses and communities have access to the power they need for a sustainable future,” he said.

The U.S. solar industry is forecast to install at least an annual average of 43 gigawatts from 2025 to 2029, according to the Solar Energy Industries Association’s latest solar market insight report forecast. Power is being added as consumption climbs.

The U.S. Energy Information Administration (EIA) said it expects electricity consumption to grow by 2% annually in 2025 and 2026, continuing its recent growth streak. The EIA attributed the expected increase to rising demand in the commercial and industrial sectors.

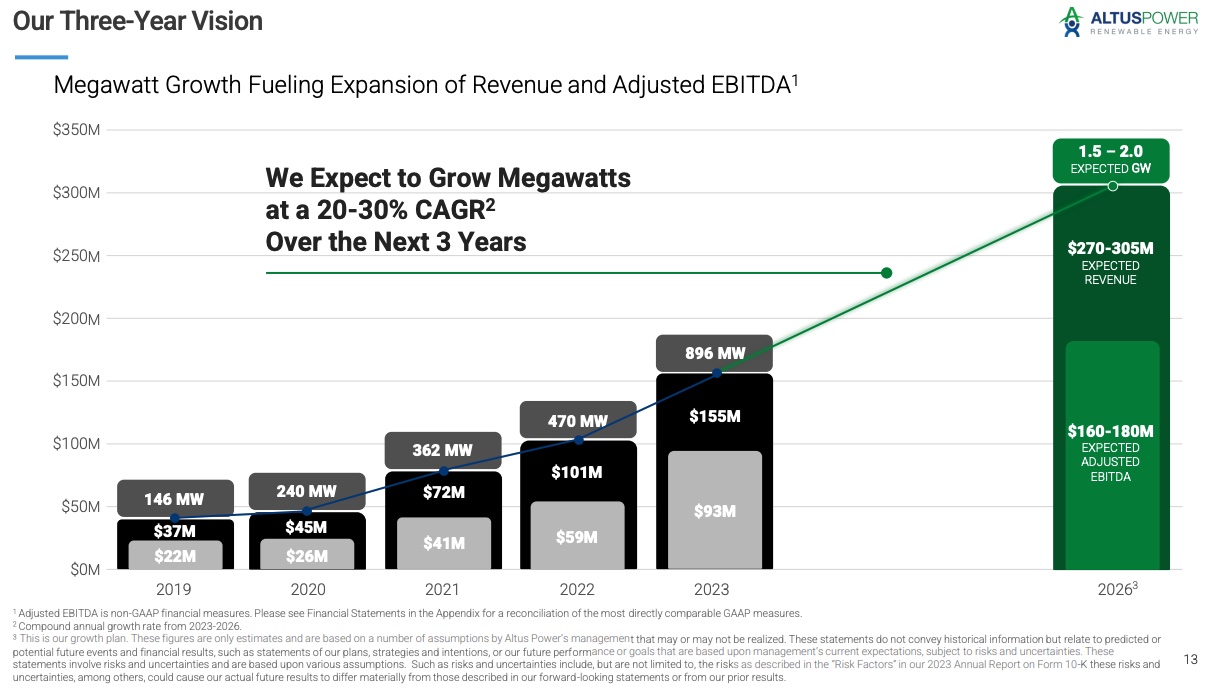

In November, Altus, which has Blackstone among its backers, said it expected 1.5 GW to 2 GW with between $270 million and $305 million in revenue in 2026 based on its three-year vision. At the time, Altus Power reported its operating revenues for the third-quarter of 2024 increased 30% to $58.7 million as it placed more solar energy facilities in service.

The company’s latest moves included the acquisition of three operational solar energy projects in Maine and the completion of a rooftop solar project in California.

TPG Rise Climate Transition Infrastructure strategy is a recent addition to TPG Rise Climate, which was launched in 2021 focusing on global climate solutions. It is part of TPG’s $18 billion global impact investing platform.

“We are excited to partner with Altus Power, which has established itself as a leader in commercial scale, clean power solutions with an exceptional track record of growth,” said Scott Lebovitz, a managing partner and head of infrastructure for TPG Rise Climate.

Stockholders representing about 40% of Altus Power’s Class A common stock, including funds managed by Blackstone Credit and Insurance and a subsidiary of CBRE Group, have entered voting and support agreements supporting the transaction, according to the release.

Moelis & Co. LLC is serving as financial adviser to Altus Power, while PJT Partners serving as financial adviser to TPG Rise Climate. Latham & Watkins LLP is acting as legal counsel to Altus Power, with Kirkland & Ellis LLP acting as legal counsel to TPG Rise Climate.

Recommended Reading

M&A Target Double Eagle Ups Midland Oil Output 114% YOY

2025-01-27 - Double Eagle IV ramped up oil and gas production to more than 120,000 boe/d in November 2024, Texas data shows. The E&P is one of the most attractive private equity-backed M&A targets left in the Permian Basin.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

PEDEVCO Enters Joint Development Agreement with D-J Basin E&P

2025-03-04 - PEDEVCO Corp.’s agreement with a private equity operator will develop drilling spacing units in the Denver-Julesburg Basin’s Weld County, Colorado.

Shell Completes Deal to Buy Power Plant in Rhode Island

2025-01-24 - Shell has completed its previously announced acquisition to buy a 609-megawatt combined cycle gas turbine power plant in Rhode Island from RISEC Holdings.

Ecopetrol Buys Repsol Asset Out from Under GeoPark

2024-12-30 - GeoPark Ltd. said Ecopetrol has exercised its preemptive to acquire Repsol Colombia O&G Ltd., which holds a 45% non-operating working interest Block CPO-9.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.