The Lower 48’s oil and gas landscape is in for some pruning as rig counts are forecast to fall, especially in the Permian Basin, according to an outlook from TPH&Co., the energy business of Perella Weinberg Partners.

Taking into account fourth-quarter 2023 earnings and upstream operators’ 2024 guidance, TPH is reducing its near-term outlook for the Lower 48, with the “Permian (-10 rigs), Northeast (-10 rigs) and Eagle Ford (-9 rigs) primarily driving the decline into the third quarter, troughing at 533 rigs (vs. prior 563 rigs and TPH spot of 575 rigs),” Jeff LeBlanc, a TPH analyst, wrote in a March 12 report.

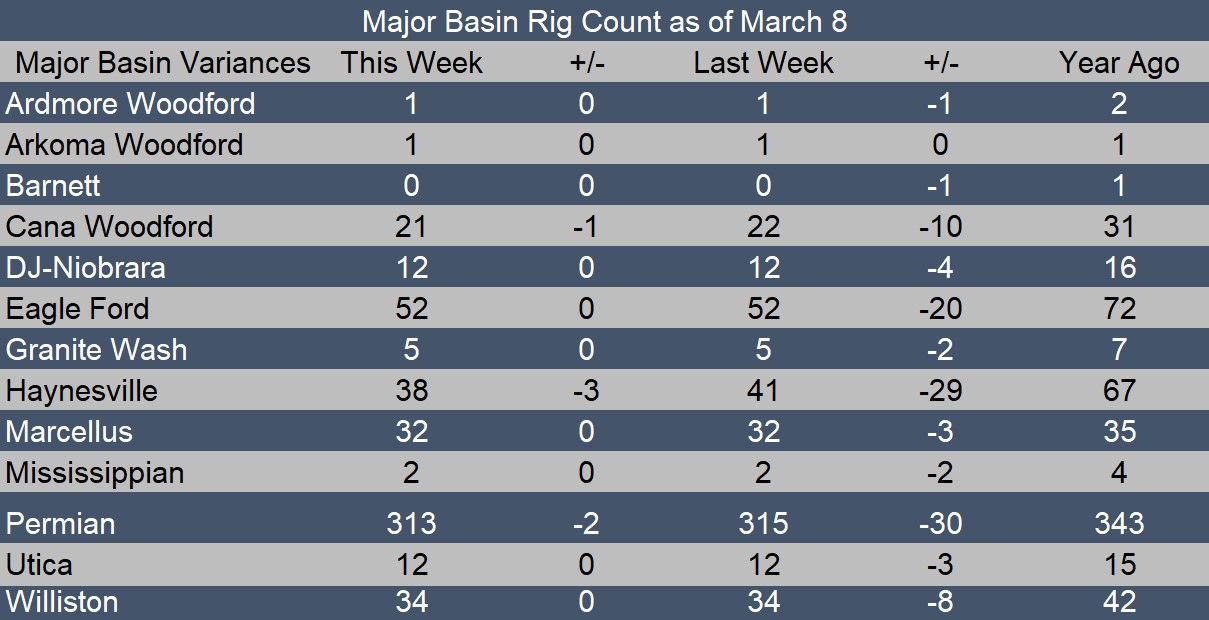

For the week of March 8, the Lower 48 rig count stood at 606, according to Baker Hughes. The Permian was running 313 rigs, the Eagle Ford with 52 and the Marcellus Shale with 32.

TPH’s outlook is primarily based on the public operators executing on their plans, with guidance indicating a decline of five rigs in the Permian, seven in the Eagle Ford and eight in the Northeast. However, TPH said “continued churn should bias private aggregate activity lower over the next 6-9 months.”

“Year-to-date reductions have been most severe in the Haynesville (-11 rigs), but with a handful of reductions still pending, we expect basin activity to ultimately trough at ~35 rigs (~4 rigs below spot levels),” LeBlanc said in the report.

Year-over-year, the Haynesville has seen the rig count fall by 29 rigs, with 38 currently running, according to Baker Hughes. The cuts come as E&Ps reduce activity in the face of declining natural gas prices. Gas-focused E&Ps in the Haynesville, Marcellus and Utica shales, including EQT Corp., Chesapeake Energy, Comstock Resources and Antero Resources have announced reductions in drilling and completions. Most recently, CNX Resources said March 12 it would delay completions on 11 Marcellus wells to “avoid brining incremental volumes into the current oversupplied market.”

RELATED

CNX Joins Crowd of Companies Cutting Back NatGas Production

Looking further out, TPH is more optimistic about the gas drilling environment in 2025.

TPH expects stronger fundamentals to support a rebound in gas-directed drilling, with rig counts rising from third-quarter 2024 to third-quarter 2025. TPH forecasts rig activity to pick up with additions in the Haynesville leading the way with an increase of 24 rigs. The Anadarko Basin will add 10 rigs, the dry gas Eagle Ford will add seven and the Northeast three rigs, according to the outlook.

In the Permian, 2025 will see a flattening of the rig count.

Continued drilling efficiency gains, longer laterals and M&A synergies will dampen the need for incremental deployments and result in basin activity “plateauing below spot levels: ~306 rigs adj. spot, ~302 rigs FY’25 (vs prior ~316 rigs).”

“Specifically, we forecast avg. Permian lateral lengths of ~10,900 ft in 2025 (+7% vs FY’23) with companies realizing double-digit drilling efficiency gains to maintain leading-edge days-to-total depth moving forward,” LeBlanc said.

OFS companies optimize

Despite the more bearish outlook for U.S. activity, TPH sees oilfield service (OFS) companies in its coverage—Helmerich & Payne Inc. (H&P), Patterson-UTI Energy (PTEN) and Nabors Industries (NBR) disproportionately benefitting, though still at net negative versus TPH’s prior models.

“The emphasis on maintaining and further improving upon today’s efficiencies will drive operators to high-grade and standardize their fleets to 1-3 contractors,” LeBlanc said. “Specifically, most operators will look to adopt the highest quality services, equipment and technologies while trying to optimize standard operating procedures.”

Some service companies are likely to expect investors to place a greater scrutiny on their customer base moving forward, in terms of their share of a customer’s overall activity and whether their customers are more likely to be among the buyers or the bought.

“Across the 20 most active operators (pro-forma for M&A), HP holds an ~33% market share, PTEN ~23%, and NBR ~15%,” TPH said. “Furthermore, of these customers, HP holds a plurality or majority of the customer’s fleet with 9 operators, PTEN 6 operators and NBR 2 operators,” although Nabors holds three sizable majorities at the basin level.

While those companies command higher dayrates than some of their peers, the higher costs are unlikely to help much.

“We continue to observe a sizable spread in leading-edge rates with smaller drillers working in the mid-to-high $20k’s, PTEN/NBR in the mid-to-low $30k’s and HP in the high-$30k’s,” LeBlanc said. “Public operators continue to suggest higher sticker prices are not an issue for them as they value the reliable, consistent operations top tier contractors can provide.”

Companies covered by TPH have maintained pricing discipline for the past nine months, a trend unlikely to change anytime soon.

“However, given the reduction in aggregate U.S. activity and our long-term outlook, we see limited upside to dayrates (i.e. ~$1-2k per day) beyond covering any reactivation costs,” TPH said.

Recommended Reading

Burgum: US Electrons are ‘Mission Critical’ in Cyber War with China

2025-03-28 - Natural gas will play a key role in feeding energy to tech providers like Microsoft Corp. as China innovates in the AI arms race at breakneck speed, Interior Secretary Doug Burgum said at CERAWeek by S&P Global.

E&P Execs Level Scathing Criticism at Trump's Drill Baby Drill 'Myth'

2025-03-26 - E&P executives pushed back at the Trump administration’s “drill, baby, drill” mantra in a new Dallas Fed survey: “’Drill, baby, drill,’ does not work with [$50/bbl] oil,” one executive said.

14 Energy Execs Send Open Letter to Canadian Government

2025-03-26 - The leaders requested the government to ease environmental regulations and encourage investments to expand the country’s energy industry.

Venture Global Asks FERC to Approve Calcasieu Pass Opening

2025-03-25 - Shell’s CEO says he expects an update to the company’s ongoing arbitration with Venture Global.

In Colorado, the Regulatory Noose Tightens for E&Ps

2025-03-25 - More stringent rules on everything from drilling and orphan wells to emissions is raising the cost of fossil fuel production in the state.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.