Trace Midstream Partners, backed by Quantum Capital Group, will acquire LM Energy Delaware, a portfolio company of Old Ironsides Energy, with gas gathering assets in Eddy and Lea counties, New Mexico. (Source: Shutterstock.com, Trace Midstream, LM Energy)

Trace Midstream Partners II has entered into agreement to buy New Mexico midstream company LM Energy Delaware, a portfolio company of Old Ironsides Energy.

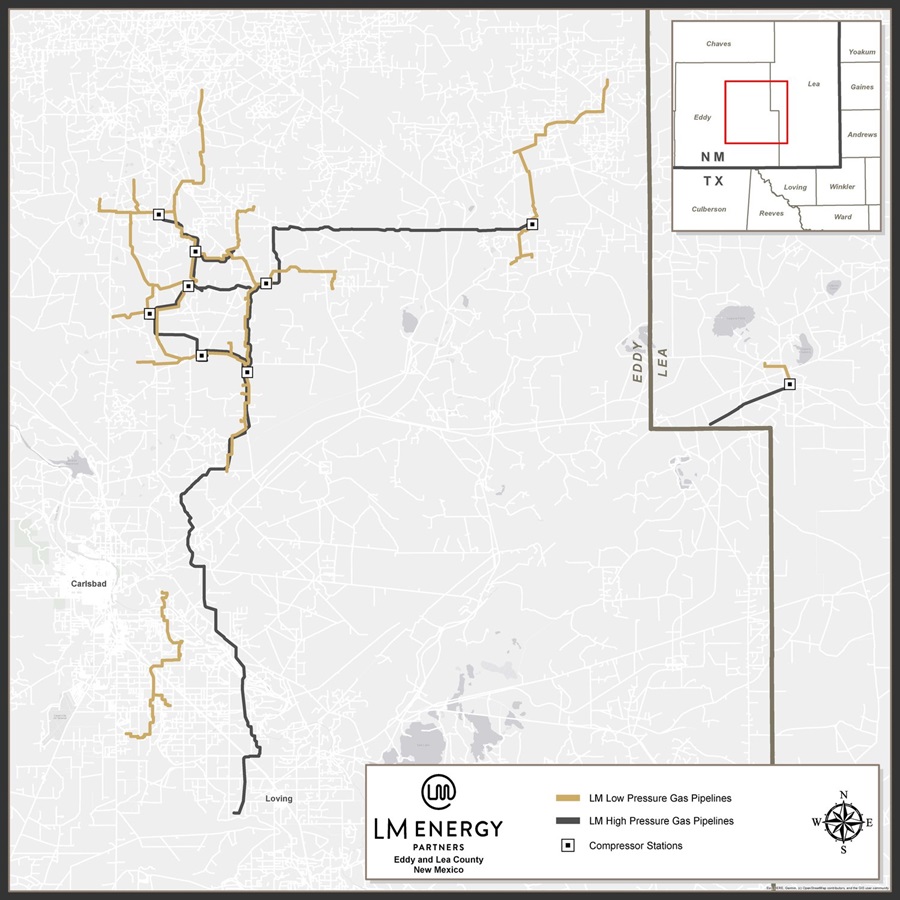

Trace Midstream, backed by Quantum Capital Group, will acquire LM Energy’s natural gas gathering system in Eddy and Lea counties, New Mexico. Financial terms of the deal weren't disclosed.

LM Energy is constructing multiple new compressor stations, gathering pipelines and a 20-inch diameter high-pressure transportation pipeline that will connect its existing gas gathering system to a number of gas processing facilities near Loving, New Mexico.

When completed, the system will consist of approximately 170 miles of pipeline and 12 compressor stations, with a total design capacity of 650 MMcf/d. The system has more than 80,000 dedicated acres and is supported by long-term, fixed-fee contracts from multiple producers, Trace Midstream said.

In connection with the transaction, Quantum Senior Advisor Jack Harper has joined the Trace board of directors. Prior to joining Quantum, Harper served as executive vice president, Lower 48 at ConocoPhillips and was a member of its executive committee.

In 2022, Trace successfully exited its previous midstream business with the sale of its Haynesville assets to Williams and its midcontinent assets to Energy Transfer for a combined transaction value of approximately $1.5 billion.

Vinson & Elkins LLP represented Trace in the LM Energy acquisition. Piper Sandler and Co. and Kirkland & Ellis LLP represented LM Energy.

Recommended Reading

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

2024-12-02 - Spurned or simply ignored by the big publics, the Permian Basin’s conventional zones—the Central Basin Platform, Northwest Shelf and Eastern Shelf—remain playgrounds for independent producers.

DNO Discovers Oil in New Play Offshore Norway

2024-12-02 - DNO ASA estimated gross recoverable resources in the range of 27 MMboe to 57 MMboe.

Freshly Public New Era Touts Net-Zero NatGas Permian Data Centers

2024-12-11 - New Era Helium and Sharon AI have signed a letter of intent for a joint venture to develop and operate a 250-megawatt data center in the Permian Basin.

DNO Makes Another Norwegian North Sea Discovery

2024-12-17 - DNO ASA estimated gross recoverable resources in the range of 2 million to 13 million barrels of oil equivalent at its discovery on the Ringand prospect in the North Sea.

Wildcatting is Back: The New Lower 48 Oil Plays

2024-12-15 - Operators wanting to grow oil inventory organically are finding promising potential as modern drilling and completion costs have dropped while adding inventory via M&A is increasingly costly.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.