The Trump administration’s topsy-turvy stance on international trade is giving whiplash to global and American energy players alike.

President Donald Trump began his second term by giving prize after prize to the energy industry:

- Industry executives and friendly faces in cabinet and staff positions.

- Executive orders re-opening areas to exploit and LNG development.

But Trump followed up his opening salvo by engaging in one of his other loves—tariffs.

Citing illegal immigration and fentanyl traffic, Trump pledged to implement a 25% across-the-board tariff on Canada and Mexico as soon as he took office on Jan. 20. The plan was delayed, almost implemented a week later, and then delayed again after both countries made temporary concessions. The tariffs went into effect on March 4—before again being put on pause for Mexican imports on March 6.

Meanwhile, Trump implemented a 10% tariff on all Chinese imports on Feb. 4. China retaliated, putting a duty on U.S. LNG, among other products. Six days later, Trump raised tariffs on aluminum and steel on everyone.

“That’s all countries, no matter where it comes from, all countries,” Trump said while signing the measures scheduled to take effect on March 4. Now, Trump is considering potential reciprocal tariffs globally.

Whatever their opinion of the president’s moves, businesses in the energy sector are in for a bumpy ride.

In U.S. history, the government has generally limited the use of tariffs for economic reasons, to protect an American industry or to punish another country for not playing fair.

The current president sees tariffs as one of his favorite all-purpose tools, meaning an industry heavily focused on international trade is to likely see the issue come up over and over for the next four years.

Takes on tariffs

Overall, free trade has been beneficial to the U.S. petrochemical industry, said Anne Bradbury, president and CEO of the American Exploration and Production Council. Bradbury spoke on a panel at NAPE in February.

“We’ve only been exporting since 2016, and now we are one of the biggest oil exporters; we’re the biggest exporter of LNG,” she said. “Our products are global commodities.”

With Trump in office, the administration’s focus will most likely shift away from maintaining or expanding free-trade agreements, due to the president’s preferred negotiating tactics.

“We have a president who thinks of tariffs as a strategic tool when it comes to international diplomacy, who both threatens to use the tool and uses the tool—both in a targeted manner and in a much more widely applied manner,” Bradbury said. “I think that is something that we are going to see for the next four years.”

As a negotiator, Trump is loath to refuse any leverage available to him, such as when he set off mini-tempests by refusing to rule out the use of force to reclaim the Panama Canal or buy Greenland. But beyond its usefulness as a diplomatic weapon, the president has claimed that tariffs are simply a positive for an economy.

“To me the most beautiful word in the dictionary is ‘tariff,’” Trump said during the campaign.

In interviews since his election, the president has said that tariffs have worked well in the past and, if implemented, would bring in enough foreign revenue to allow the federal government to cut taxes. Tariffs have been one of the issues that Trump has remained steadfast upon since becoming a public figure.

“If you look at President Trump’s views on tariffs all the way back, he was talking about tariffs and immigration in the 1980s,” said Dan Naatz, COO and executive vice president of the Independent Petroleum Association of America.

“People often ask me, ‘What are his core beliefs?’ Those are the two. Other things have evolved, other things have changed.”

Though, as on other issues, the president has given conflicting opinions on different days and often in the same press conference.

“Oil is going to have nothing to do with it as far as I’m concerned,” Trump said in late January about the potential tariffs on Canada and Mexico. When asked about oil later at the same press conference, the president said his administration “may or may not” place tariffs on oil.

Three targets

While the negotiating parameters shift, the energy industry is focused on real, large numbers, especially with Canada, Mexico and China.

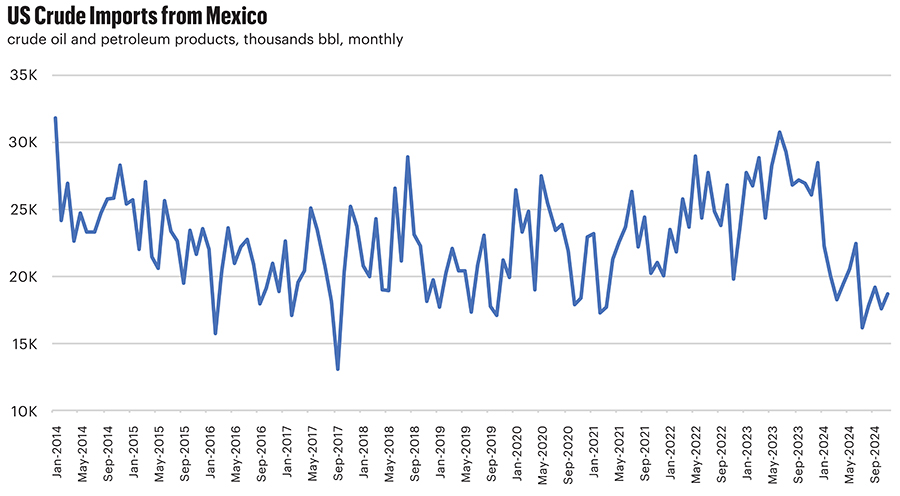

In 2023, the last full year of data, Canada exported 3.9 MMbbl/d of crude to the U.S.—more than half of all U.S. crude imports—while Mexico exported 733,000 bbl/d, according to the U.S. Energy Information Administration (EIA).

Canada and Mexico are the only countries to ship natural gas into the U.S. via pipeline, with Canada making up the lion’s share of contributions. The U.S. imported 253.9 Bcf from Canada in October 2024, the last month EIA statistics are available. Mexico shipped 21 MMcf.

In 2023, Canada supplied the U.S. with 2.05 Bcf from LNG shipments, second only to Trinidad and Tobago, which supplied 11.93 Bcf of natural gas from LNG. (The U.S. leads the world in LNG production but is unable to supply U.S. customers as it has no domestic LNG tanker fleet.)

In early February, both countries threatened to retaliate if the across-the-board 25% tariff was put in place. Canada announced a $155 billion package of tariffs on its own. Mexico vowed to fight the new rule but was not specific.

The two governments did the same when Trump raised the steel and aluminum tariff. Mexico, along with Brazil, delayed its response after the new rate was implemented.

Canadian Prime Minister Justin Trudeaur blasted the move as “entirely unjustified” and said the country would respond swiftly.

Companies in all three countries braced for the impact. The U.S. would likely “win” a trade war with Canada and Mexico because it has more resources and options available, according to an analysis by RBN Energy.

Mexico has long planned to send more of its oil to its new Dos Bocas refinery and also has more ports available to export its products than Canada.

Canada, with most of its infrastructure built in tandem with the U.S., has fewer options overall.

The majority of imported Canadian crude flows into Midwest refineries, which specialize in handling the heavier, sour and generally cheaper blends that come out of Alberta.

The U.S. would be able to handle a drop in Canadian supply if the Midwest can rapidly replace its usual load of Canadian crude with oil piped in from other regions of the U.S.—without paying a premium.

Regardless, tariffs would be a challenge for most major players in the energy business, as they own assets in both the U.S. and Canada. Exxon Mobil owns three refineries, among other downstream assets in Canada.

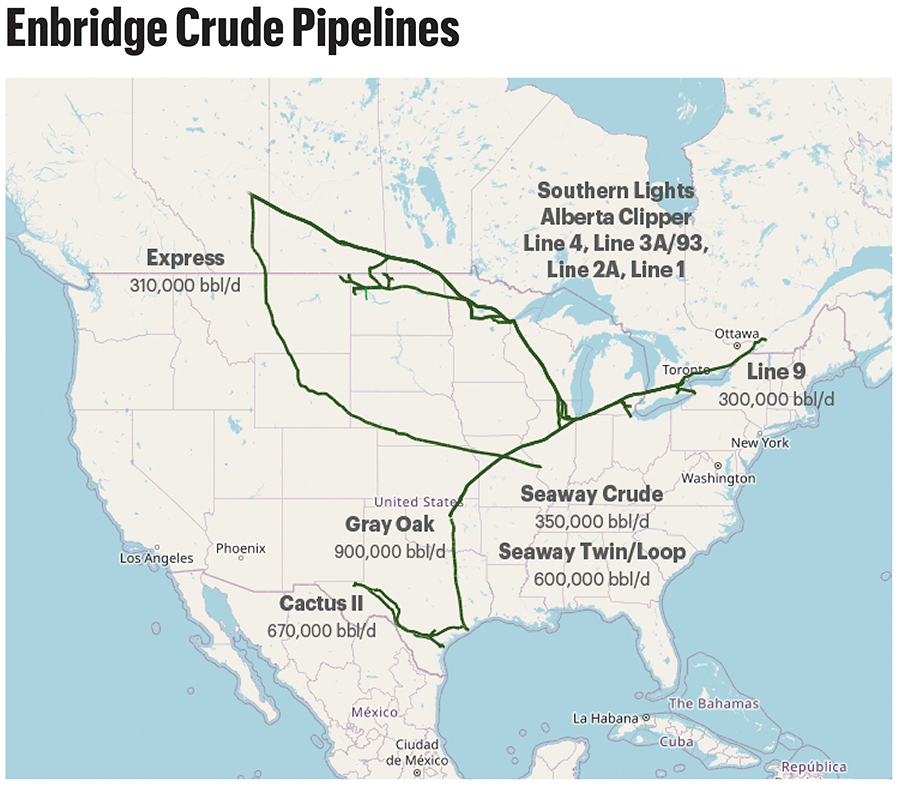

Canada-based Enbridge specializes in shipping Canadian crude to the U.S. and owns one of the largest pipeline networks in North America, moving 3 MMbbl/d of crude south on its Mainline System. Enbridge would not pay the tariff because the fees would go toward its shippers. However, the company could potentially feel an impact if producers find other routes for their product.

Enbridge could also feel the results of tariffs at the downstream end of its system. The company owns the Ingleside Energy Center in South Texas, which handles about 25% of U.S. crude exports moving through the Corpus Christi port.

Trump said during an interview with Fox News that Canada and Mexico had not done enough on illegal immigration and drug trafficking to stop him from implementing the across-the-board tariffs he had threatened earlier in the month.

Asia’s share

China, involved in trade disputes with Trump going back to his first administration, made no deals after the president’s latest moves.

Instead, China immediately moved to implement a response. On Feb. 4, the government made the U.S. energy sector a primary target, putting a 15% tariff on U.S. LNG and coal, plus a 10% tariff on crude.

The government also said it would open an investigation into Google.

“The U.S.’ unilateral tariff increase seriously violates the rules of the World Trade Organization,” China’s State Council Tariff Commission said in a statement. “It is not only unhelpful in solving its own problems, but also damages normal economic and trade cooperation between China and the U.S.”

One analyst said China’s response to the tariffs was strategic, aiming to limit damage on both sides while still responding to the president.

According to the EIA, the U.S. exported more than 362 MMbbl of crude to China in 2023, the last full year for which numbers are available. In 2024, however, monthly exports had fallen, never surpassing 30 MMbbl in a 30-day period. In 2023, U.S. exports to China surpassed 30 MMbbl/month four times.

China nevertheless remained the second-largest customer for U.S. crude exports, behind only Mexico.

The Asian giant may be sending a warning with LNG. The U.S. leads the world in LNG exports and currently does not export much to China. In 2023, the U.S. exported 173 Bcf of LNG to China, about 2.3% of its total natural gas exports, according to the EIA.

However, continued forecasts for growing demand in China drive much of the reasoning behind growing investment in U.S. liquefaction facilities. ING predicted in a study that global demand for LNG would increase by as much as 35% by the end of the decade, with Asia dominating the growth.

“China can make all the difference between the global LNG market being tight or more manageable,” the study said. China has planned extensively for LNG import growth and currently has 190 Bcm of regasification capacity expected to come online by 2026.

Turbo-mixed messages

While blasting out global trade threats, Trump displayed his enigmatic nature in February with another Asian country, Japan.

At a joint press conference with visiting Prime Minister Shigeru Ishiba, the president announced that the U.S. and Japan planned to enter a joint venture to develop an LNG project in Alaska.

“We’re talking about the pipeline in Alaska, which is the closest point of major oil and gas to Japan, by far,” Trump said.

The Alaska Gasline Development Corp., which is developing the project, celebrated the announcement, saying in a press release that it welcomed further support and engagement from Japan.

The Japanese were less committed. Ishiba said Japan was interested in more U.S. LNG, along with bioethanol and ammonia. The Japanese Embassy did not respond to requests for comment after the press conference.

Trump the negotiator doesn’t mind remaining an unknown factor, and often ends up contradicting himself or switching tactics on a dime. Over the course of February, the White House’s stance on tariffs changed so quickly that several news websites established pages that promised hourly updates.

The president has, however, remained consistent in his belief that tariffs can work as an overall economic good, even if the immediate results aren’t what his constituents expected.

“WILL THERE BE SOME PAIN? YES, MAYBE (AND MAYBE NOT!),” Trump said in a social media post. “BUT WE WILL MAKE AMERICA GREAT AGAIN, AND IT WILL ALL BE WORTH THE PRICE THAT MUST BE PAID.”

Recommended Reading

In Inventory-Scarce Permian, Could Vitol’s VTX Fetch $3B?

2025-03-28 - With recent Permian bids eclipsing $6 million per location, Vitol could be exploring a $3 billion sale of its shale business VTX Energy Partners, analysts say.

Hirs: Investing for 2025—Growth by Acquisition

2025-01-29 - Fundamentals will push against increased production and a buyers’ market will rule.

‘Golden Age’ of NatGas Comes into Focus as Energy Market Landscape Shifts

2025-03-31 - As prices rise, M&A interest shifts to the Haynesville Shale and other gassy basins.

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

Exxon Sits on Undeveloped Haynesville Assets as Peers Jockey for Inventory

2025-04-09 - Exxon Mobil still quietly holds hundreds of locations in the Haynesville Shale, where buyer interest is strong and inventory is scarce.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.