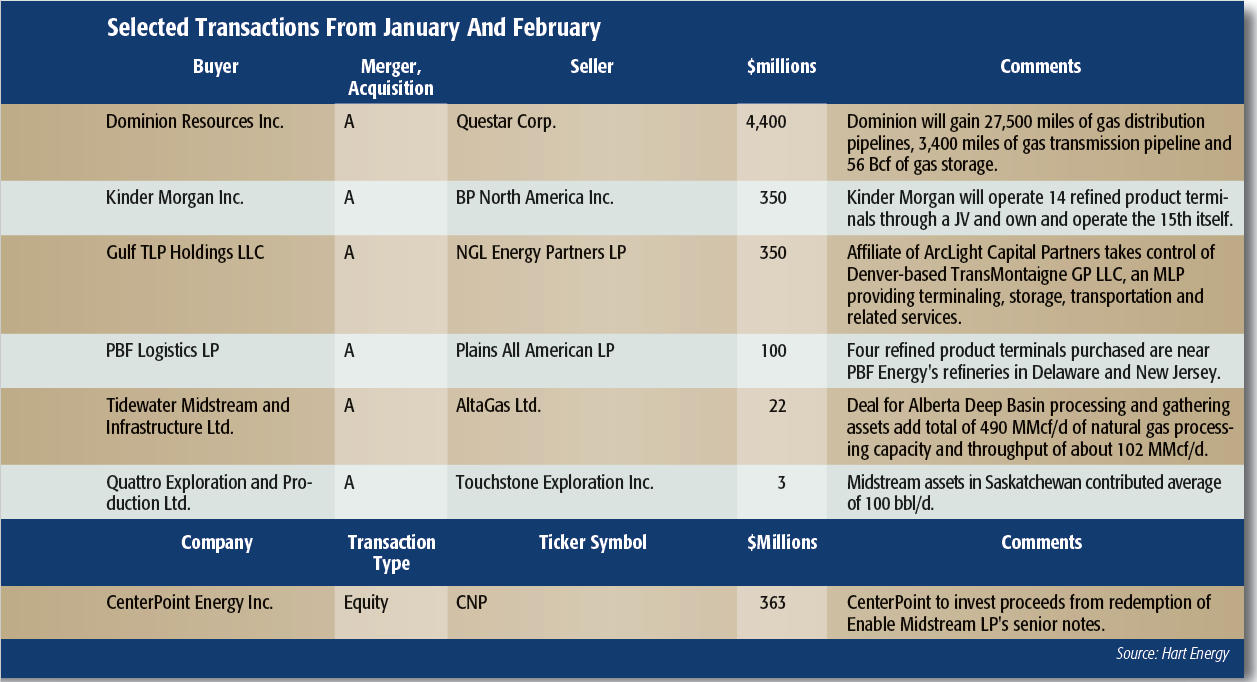

Jefferies LLC was thrilled with the $4.4 billion merger of Dominion Resources Inc. and Questar Corp., at least from the point of view of folks who own units in Questar.

“We believe the deal is hugely positive for STR [Questar] shareholders as it represents a value well north of what shareholders likely would have seen in the near term given current EPS and dividend forecasts,” the analysts wrote soon after the deal was announced. “We applaud STR management for finding an attractive cash-based exit for shareholders.”

Including assumption of debt, the transaction weighs in at around $6 billion, or more than five times Questar’s estimated 2015 revenue.

Is it a good deal for Dominion? Did the Richmond, Va.-based company with operations on the East Coast pay too much for the gas distribution, pipeline, storage and cost-of-service supply company based in Salt Lake City?

Tom Farrell, chairman and CEO of Dominion, maintained during a call with analysts that the acquisition followed the company’s announced growth strategy of pursuing MLP assets with long-term cash profiles. That Questar’s operations are based in western states, adds geographic diversity, he said. Dominion has already invested about $1 billion in solar projects in Utah.

Then there is the 2,500-mile natural gas Questar Pipeline in Utah, Wyoming and Colorado. For Farrell, it’s not a deal between utilities. He said he was particularly attracted to Questar because the pipeline would bolster Dominion’s portfolio, which now includes Carolina Gas Transmission and an interest in the Iroquois Gas Transmission System in the Northeast.

How did the market react to the deal?

Dominion’s share price slumped 4% from time of the announcement to mid-February, with UBS and Citigroup down-grading the stock and Barclays maintaining its overweight rating. Institutional investors showed enthusiasm, with DuPont Capital Management, Farmers Trust Co., CIBC Asset Management Inc., North Star Investment Management and Sky Investment Group LLC increasing positions in the company.

Recommended Reading

Industry Players Get Laser Focused on Emissions Reduction

2025-01-16 - Faced with progressively stringent requirements, companies are seeking methane monitoring technologies that make compliance easier.

Envana Paints a Bigger Methane Picture by Combining Existing Data with AI

2025-01-28 - Envana Software Solutions, a joint venture between Halliburton Co. and Siguler Guff, has been awarded a $4.2 million grant from the U.S. Department of Energy to advance its AI methane detection solution.

Bridger Photonics Announces New CEO to Support Company Growth

2025-01-29 - Bridger Photonics announced Ben Little as the company’s new CEO in support of the growth Bridger has experienced with the growing market adoption of its methane detection solutions.

Electrigen, Hyliion to Partner on Methane Emissions Reduction Project

2025-01-22 - ElectriGen and Hyliion Holdings Corp.’s methane emissions reduction project has been awarded $6 million by the Department of Energy. Hyliion’s Karno generators can use wellhead gas to produce low-emission electricity.

Exclusive: Trump Poised to Scrap Most Biden Climate Policies

2024-11-29 - From methane regulations and the LNG pause to scuttling environmental justice considerations, President-elect Donald Trump is likely to roll back Biden era energy policies, said Stephanie Noble, partner at Vinson & Elkins.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.