Alta Mesa Resources operations in the Oklahoma Stack play. Photo courtesy Alta Mesa.

Editor's note: This is a breaking news article. The article has been updated to clarify single-well RORs and to correct that ARM Energy Holdings's compensation includes $550 million worth of Silver Run stock.

The architects of a long-brewing merger of Jim Hackett’s Silver Run Acquisition Corp. II (NASDAQ: SRUNU), Kingfisher Midstream LLC and Alta Mesa Holdings LP, led by CEO Hal Chappelle, are ready to hoist a pint.

The companies said Feb. 9 they closed a deal uniting Silver Run’s financing, Alta Mesa’s 130,000-acre Stack position and a tailor-made midstream company into a single, public pure-play Stack company called Alta Mesa Resources Inc.

At $10 per share, Alta Mesa Resources is expected to have a market capitalization of about $3.8 billion, the same value the companies expected when the deal was announced last August. Since then, the E&P and midstream units have continued to improve. Alta Mesa has added another 10,000 net acres in the Stack, and Kingfisher Midstream has significantly expanded its infrastructure and gathering system.

The deal includes cash and stock from Silver Run and funding from private-equity firms that will likely eclipse $1.6 billion. On Feb. 5, Silver Run reported it held more than $1.04 billion in its trust account to complete the combination.

Hackett said Alta Mesa Resources’ finances “will be strong and consistent with our announcement of the transaction last year.” On Feb. 6, more than 98% of Silver Run II’s shareholders approved the deal.

“We are excited to take the final step toward closing the transaction,” Hackett said on Feb. 5.

Alta Mesa Resources will come out of the gate with formidable balance sheet strength. Alta Mesa and Kingfisher entered the combination with no debt and a restated senior secured revolving credit facility of $1 billion credit facility. Alta Mesa’s initial borrowing base is $350 million. Kingfisher is party to a $200 million revolving credit facility.

The company includes an all-star roster of leadership and drilling talent.

Hackett, the former CEO of Anadarko Petroleum Corp. (NYSE: APC), will serve as the new company’s executive chairman and COO of Kingfisher Midstream’s operations. Chappelle will serve as president and CEO of the new company.

Alta Mesa founder Michael E. Ellis will oversee upstream operations.

The deal’s financing is largely tied to Silver Run, a blank check company that will contribute most of its $1 billion IPO proceeds to the deal. Private-equity firm Riverstone Holdings LLC may contribute up to $600 million. Riverstone initially contributed $200 million to Alta Mesa in exchange for limited partner interests in Alta Mesa and could inject another $400 million into the company.

ARM Energy Holdings LLC, based in Houston, said Feb. 9 that it agreed to sell Kingfisher Midstream to Silver Run for up to $1.55 billion. The deal includes $800 million cash, $550 million in Silver Run stock and up to $200 million in additional stock based on the company’s performance.

ARM Energy CEO Zach Lee said an in-depth analysis provided the firm with the early insight to identify the Stack play as a successful region that would be profitable well before the area gained momentum with the greater midstream market.

“The Kingfisher system is galvanizing interest from numerous producers in the Stack play that understand and appreciate the value the system brings to their businesses,” he said.

On paper and in the field, Alta Mesa appears destined to be a Midcontinent force. Alta Mesa’s assets include about 130,000 net contiguous acres in the Stack oil window. The company's economics include single-well RORs of 80%, according to a January presentation. Returns exclude transportation fees and assume drilling and completion costs of $3.5 million per well.

In addition to expanding its leasehold since 2017, Alta Mesa’s average production has increased 20% in the past five months, going to 24,000 barrels of oil equivalent per day (boe/d) from 20,000 boe/d in August.

Alta Mesa’s acreage includes delineated Meramec and Osage formation oil with a position that spans Kingfisher, Garfield and Major counties in Oklahoma. From 2012 through 2017, Alta Mesa drilled more than 240 horizontal stack wells.

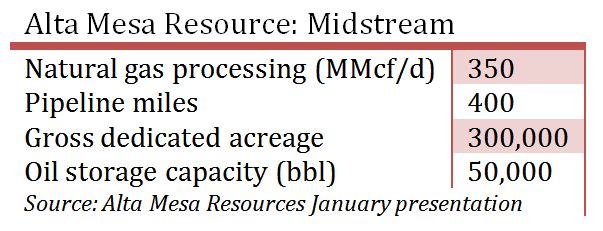

Since August, Kingfisher Midstream—developed alongside Alta Mesa—has also upped its stats. The company’s takeaway capacity mushroomed by 150% to 150 million cubic feet of gas per day (cf/d) from 60 MMcf/d in 2017. Kingfisher Midstream’s gathering system now runs an additional 92 miles, boosting its infrastructure to 413 miles from 321 miles.

A 200 MMcf/d plant expansion is also underway, under budget and anticipated to begin operations in first-quarter 2018, Alta Mesa said in a January presentation.

Following the closing, Riverstone Holdings and Alta Mesa management collectively own 33% of Alta Mesa Resources’ market capitalization. The equity holders of Kingfisher collectively own about 14% of its market capitalization.

The company’s common stock and warrants will be traded on the NASDAQ capital market under the symbols “AMR” and “AMRRW” beginning Feb. 12.

Citigroup Global Markets Inc. acted as capital markets adviser to Silver Run II. Latham & Watkins LLP acted as legal counsel to Riverstone and Silver Run II. Haynes and Boone LLP acted as legal counsel to Alta Mesa.

JP Morgan served as the lead financial adviser, and Barclays acted as co-financial adviser to Kingfisher. Durham Jones & Pinegar served as legal counsel to ARM Energy. Bracewell LLP acted as legal counsel to Kingfisher.

Kirkland & Ellis LLP acted as legal counsel to Bayou City Energy Management LLC, an Alta Mesa joint development partner.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Williams to Invest $1.6B for On-Site Power Project with Mystery Company

2025-03-07 - Williams Cos. did not name the customer or the location of the power project in a regulatory filing.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-03-07 - Baker Hughes said this week's decline puts the total rig count down 30, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.